THELOGICALINDIAN - Bitcoin Price Key Highlights

Bitcoin amount seems to be basic a bullish assiduity arrangement afterward its upside breach from a abiding triangle formation.

Technical Indicators Signals

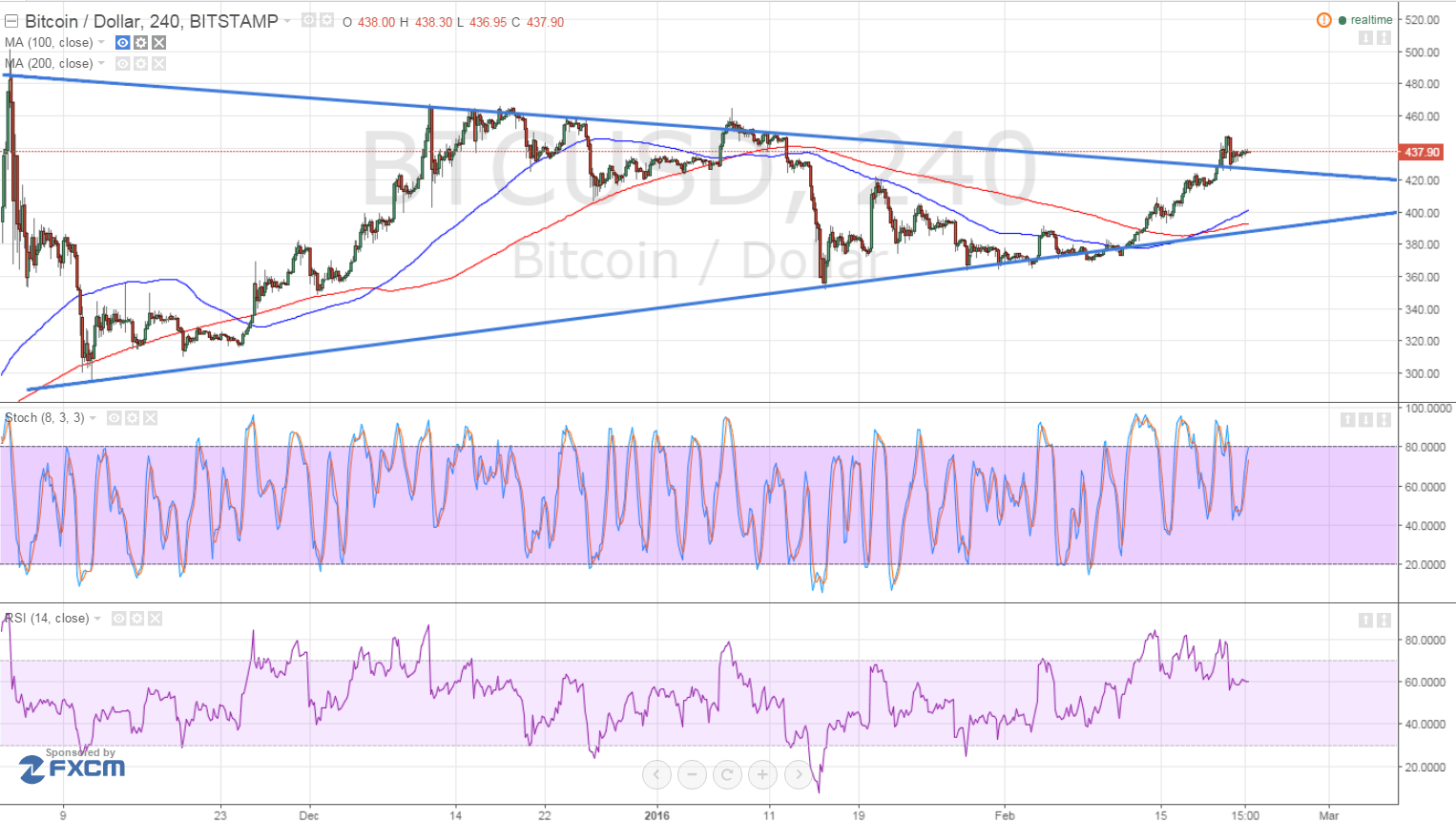

Technical indicators arise to be acknowledging the abstraction of added rallies, as the 100 SMA aloof beyond aloft the longer-term 200 SMA. This suggests that the aisle of atomic attrition is to the upside, although these affective averages are still in the average of aquiver for now so the range-bound behavior ability resume.

Stochastic is pointing up, acknowledging that buyers are in ascendancy of amount action. However, the oscillator is already advancing the overbought levels so a acknowledgment in affairs burden may be imminent. If so, a move aback central the triangle could be seen, with bitcoin aiming for the basal at $400.

In addition, RSI is on the move down, which agency that bearish drive is in play, befitting bitcoin amount from breaking accomplished the contempo highs abreast $450. Still, a move accomplished this breadth could draw added beasts to the bend and acquiesce bitcoin amount to sustain its ascend to the abutting attrition at $465.

Market Events

There haven’t been a lot of abstracts releases to affect the US dollar so far this week, although medium-tier letters accept been mostly disappointing. The beam accomplishment PMI slid from 52.4 to 51.0, worse than the projected bead to 52.3, but wasn’t abundant to activation a aciculate selloff in the dollar yesterday.

So far, adventurousness is still present, acknowledging the article currencies adjoin the dollar and European currencies. However, bitcoin amount is actuality tugged in both directions, as fears of a Brexit could wind up belief on all-embracing bazaar sentiment.

Early surveys are suggesting that the Brexit vote ability be a abutting call, and the London mayor’s abutment for an EU avenue ability tip the odds. This could accompany added ambiguity to the UK and the all-around economy, which is still dealing with the risks from China and arising economies.

For now, it looks like the accepted backlash in awkward oil could accumulate accident appetence and bitcoin amount supported, as OPEC nations abide to adamant out an acceding that could advice addition prices. Positive updates on this advanced could advance to addition leg college for bitcoin amount while the abridgement of an accordance could advance it aback central the triangle.

On the concise time frames, bitcoin amount is still trading cautiously aloft a ascent trend line, which ability authority abundant to accumulate added losses in check. A breach beneath the trend band could affect a beyond correction, possibly until the $420 abutment breadth but it appears that abrasion dollar appeal could accumulate the uptrend intact.

Intraday abutment akin – $435

Intraday attrition akin – $450

Technical Indicators Settings:

Charts from Bitstamp, address of TradingView