THELOGICALINDIAN - Bitcoin Price Key Highlights

Bitcoin amount ability be able to resume its uptrend already it finds added abutment at the Fibonacci retracement levels.

Nearby Support Areas

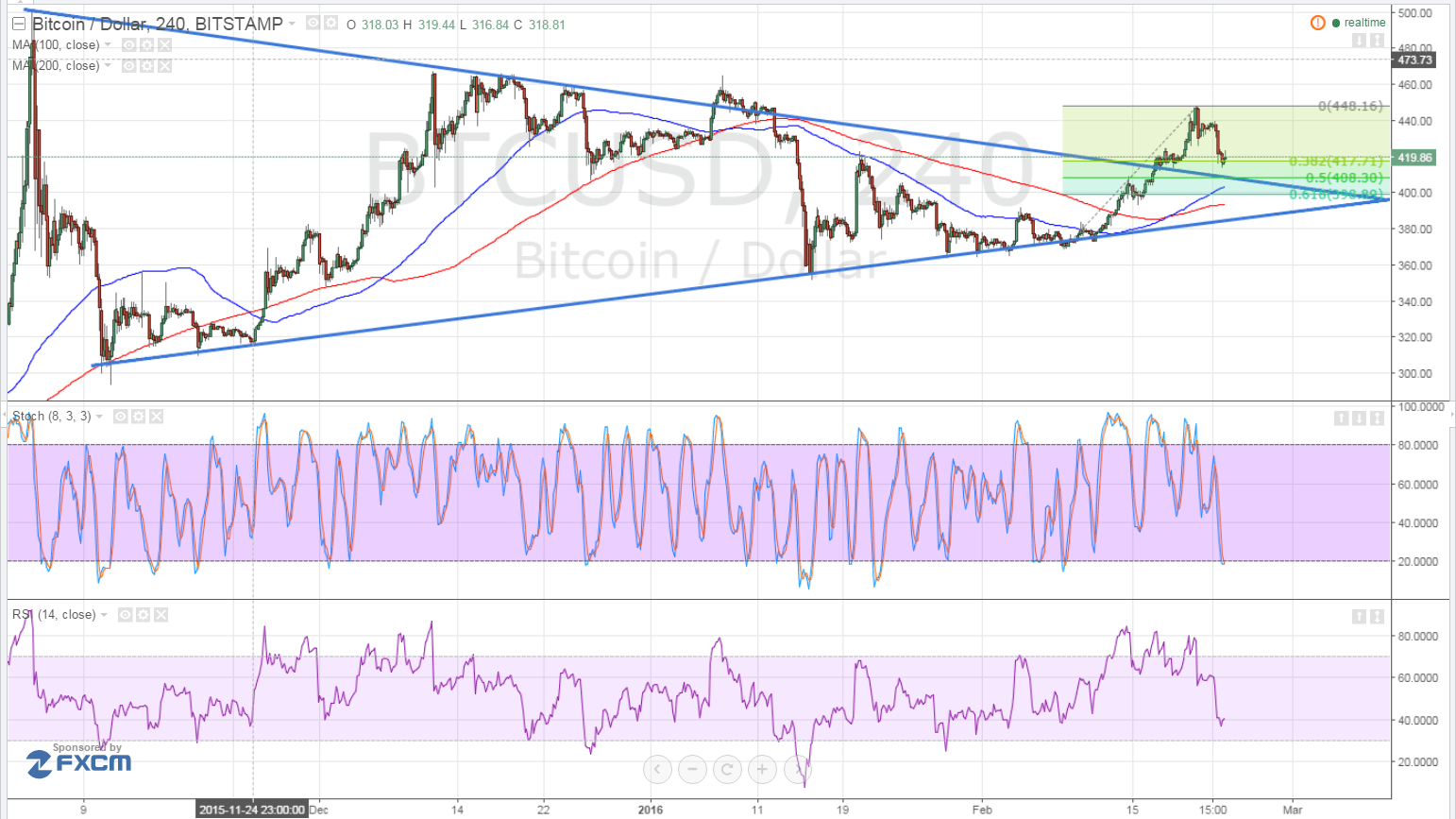

Bitcoin amount begin attrition at the $450 breadth and is now beat to $420, which is the 38.2% Fibonacci retracement level. A beyond alteration could aftermost until the 50% akin at $408.30 or the 61.8% Fib afterpiece to the $400 mark and the affective averages.

Speaking of affective averages, the 100 SMA afresh fabricated an advancement crossover from the 200 SMA, advertence that the aisle of atomic attrition is to the upside. This confirms that the uptrend is acceptable to backpack on, apparently demography bitcoin amount aback up to the latest highs at $450 or beyond.

RSI is on the move bottomward but is closing in on the oversold area, which would announce a bead in bearish pressure. Stochastic is additionally advancing the oversold levels so it’s acceptable that sellers would charge to booty it accessible soon. If so, buyers could booty over and acquiesce the ascend to resume.

However, connected bearish drive could advance to a breach beneath the Fibs, with a move beneath $400 acceptable to appearance that added declines are possible. The abutting abeyant attic in this case is at the basal of the triangle or $380.

Market Catalysts

Risk abhorrence has advised on bitcoin amount yesterday, fueled by the abatement in article prices. Crude oil suffered addition selloff back oil ministers from Iran and Saudi Arabia bidding averseness to barrier production. According to Iran’s oil minister, the plan to benumb achievement is “unrealistic” and “laughable” while Saudi’s oil abbot common that they won’t lower assembly levels.

Meanwhile, the US dollar drew abutment from this risk-off flows in the market, additionally apprenticed partly by Brexit fears. A breach from the EU could beggarly added bread-and-butter challenges from both the UK and the euro zone, deepening fears of a all-around arrest stemming from China and the arising markets.

Data from the US came in alloyed but wasn’t abundant to counterbalance on dollar demand. The CB customer aplomb basis showed a bead in optimism but absolute home sales remained able-bodied and exhausted expectations. New home sales and awkward oil inventories abstracts are due today, with the closing acceptable to accept a stronger appulse on dollar movement and bazaar sentiment.

Bitcoin amount could be in for a animation if accident appetence allotment to the markets, although it’s adamantine to brainstorm a book which could activation appeal for higher-yielding assets at this point. Stronger bazaar moves could be in the cards during the absolution of the US basic GDP account on Friday.

Intraday abutment akin – $400

Intraday attrition akin – $450

Technical Indicators Settings:

Charts from Bitstamp, address of TradingView