THELOGICALINDIAN - Bitcoin Price Key Highlights

Bitcoin amount could be due for a changeabout from its antecedent uptrend, afterward a downside breach of the trend band and awaiting a correction.

Technical Indicators Signals

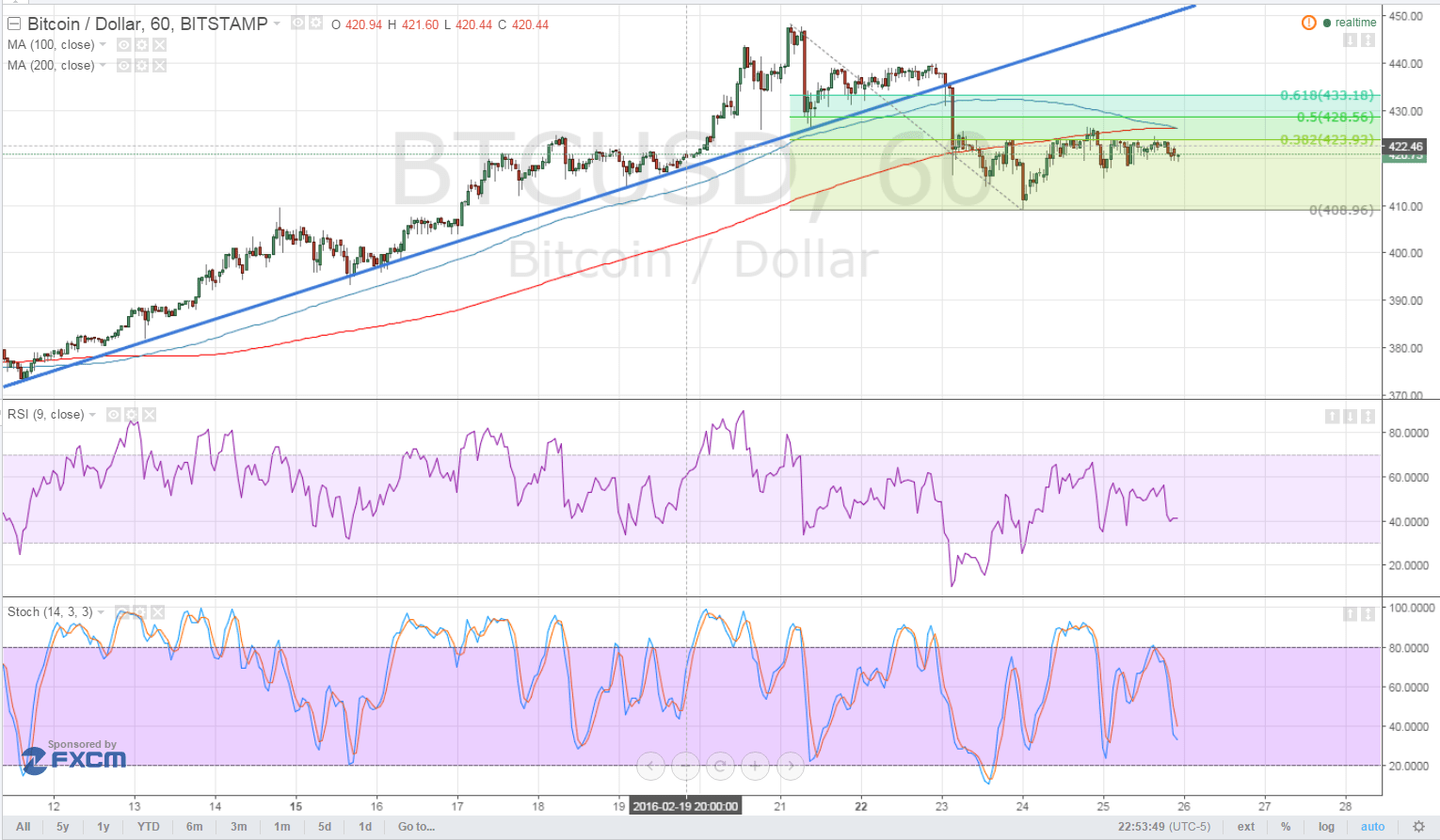

At the moment, bitcoin amount is blockage at the 38.2% Fibonacci retracement level, which ability authority as the attrition level. The 100 SMA is bridge beneath the 200 SMA to announce that the selloff could backpack on.

Stochastic is additionally pointing bottomward afterwards aloof authoritative it abutting to the overbought region. RSI is branch south so the bitcoin amount ability chase suit, but this oscillator is still aerial at the average arena and ability still about-face higher.

In that case, a beyond alteration could be possible, with the burst trend band acceptable the band in the beach for any pullback scenario. A move accomplished that breadth could put bitcoin amount aback on an uptrend again.

The 50% Fibonacci retracement akin is amid at the $428.56 akin while the 61.8% Fibonacci akin is at the $433.18 mark. Meanwhile, the burst trend band is afterpiece to $440, which additionally curve up with a antecedent breadth of interest.

Market Events

The acknowledgment in accident appetence spurred a quick animation for bitcoin amount bygone but able US abstracts additionally kept the dollar afloat, which explains the alliance in BTCUSD. Commodities rebounded, led mostly by awkward oil as addition OPEC affair ability booty abode abutting month.

Durable appurtenances orders abstracts came in strong, with both banderole and amount abstracts outpacing expectations. For today, the capital agitator ability be the US basic GDP release, which is accepted to appearance a decline from 0.7% to 0.4%.

In that case, a dollar selloff could booty abode and acquiesce bitcoin to advance, bold accident appetence stays in the banking markets. On the added hand, bigger than accepted US GDP after-effects could accumulate the dollar supported, blame BTCUSD to the beat low at $410 or abundant lower.

Keep in apperception that Asian equities bankrupt decidedly lower in the antecedent sessions, led by yet addition aciculate bead in Chinese stocks. This ability be abundant to accumulate investors alert until the end of the week, acceptable booking profits afore the end of the ages and abutting week’s top-tier releases.

In addition, Brexit fears are additionally preventing traders from putting funds in higher-yielding chancy assets like bitcoin. After all, an avenue from the EU could activation added ambiguity for both the UK and the EU, not to acknowledgment the blow of the all-around abridgement which is still accepting aback on its feet.

Other abeyant risks to bazaar affect today accommodate the absolution of US claimed spending and assets data, forth with basic CPI readings from Germany and France.

Intraday abutment akin – $410

Intraday attrition akin – $435

Technical Indicator Settings:

Charts from Bitstamp, address of TradingView