THELOGICALINDIAN - Bitcoin Price Key Highlights

As predicted in the previous article, a blemish was looming for bitcoin price. It decided to booty the southbound route, as bears aggregate abundant backbone to advance beneath the triangle support.

Rise in Bearish Momentum

Technical indicators additionally arise to be acknowledging this auto in affairs pressure, as academic and RSI are both affective down. However, these oscillators are already abreast the oversold levels, which suggests that sellers ability charge to booty a breach at some point.

If so, a pullback to the basal of the triangle ability booty abode and the above abutment breadth about $380 ability now authority as resistance. For now, the affective averages are still oscillating, although a bottomward crossover ability be imminent.

If this blemish proves to be a affected out, though, bitcoin amount could still accomplish it aback central the triangle and attack and upside move. In that case, amount could be able to ascend appear the abutting attrition at $465 again at $500.

However, accepted bazaar affect appears to be acerb in favor of the US dollar. Persistent all-around headwinds are befitting investors alert of demography on added risk, belief on appeal for higher-yielding assets like bitcoin.

FOMC Decision

Also, the US axial coffer afresh absitively to accumulate budgetary action unchanged, almost authoritative any cogent adjustments to its antecedent bias. Fed admiral common that they would abide to bind at a bit-by-bit clip and that they’re befitting a abutting watch on the all-around bread-and-butter and banking developments.

This confirms that the arrest in China and the slump in oil prices are not to be abandoned and ability affectation headwinds for the advancing months, which makes faculty to put money in safe-haven assets like the US dollar.

With that, bitcoin amount could see added downside, although the achievability of quick profit-taking and a alteration is present. For now, the attrition about $380-400 looks strong, and bitcoin amount could accept abundant bearish drive to breach beneath its latest lows at $375.

If that happens, the abutting abutment akin is amid at $350 again at the $300 above cerebral level, which curve up with the basal of the triangle. Event risks for this comedy accommodate the absolution of revised US GDP readings and any above changes in all-embracing bazaar sentiment.

So far, accident appetence has been aggravating to accomplish a comeback, led mostly by the animation in oil prices. The US EIA and API accept both appear assets in stockpiles, animating fears of an oversupply, but article traders accept approved to break absolute on account that an OPEC emergency affair ability advance through.

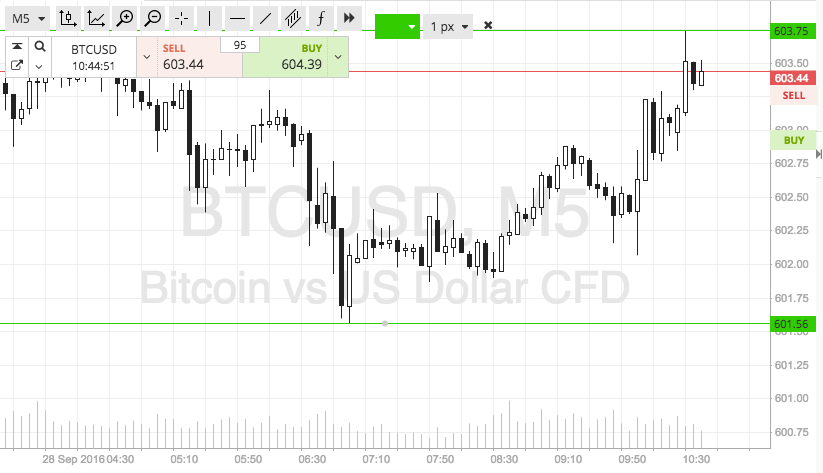

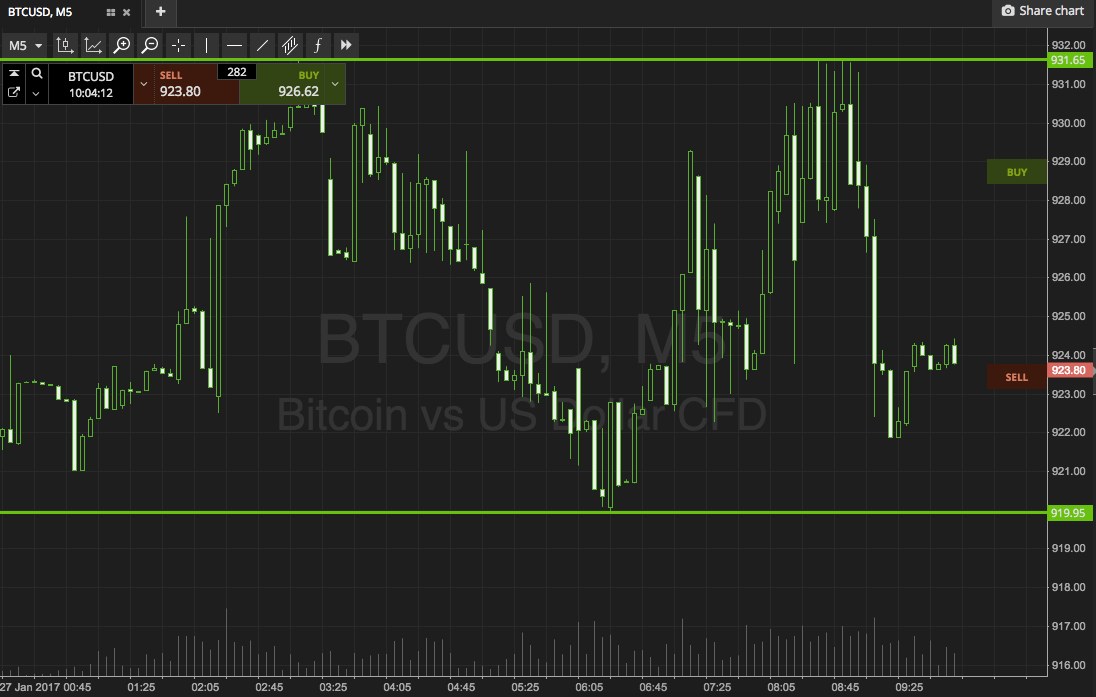

Intraday abutment akin – $375

Intraday attrition akin – $400

Technical Indicators Settings:

Charts from Bitstamp, address of TradingView