THELOGICALINDIAN - Key Highlights

Bitcoin amount climbed a few credibility college afore closing the week, and now it looks like basic a concise abutment breadth for added gains.

Buys dips abreast trend line?

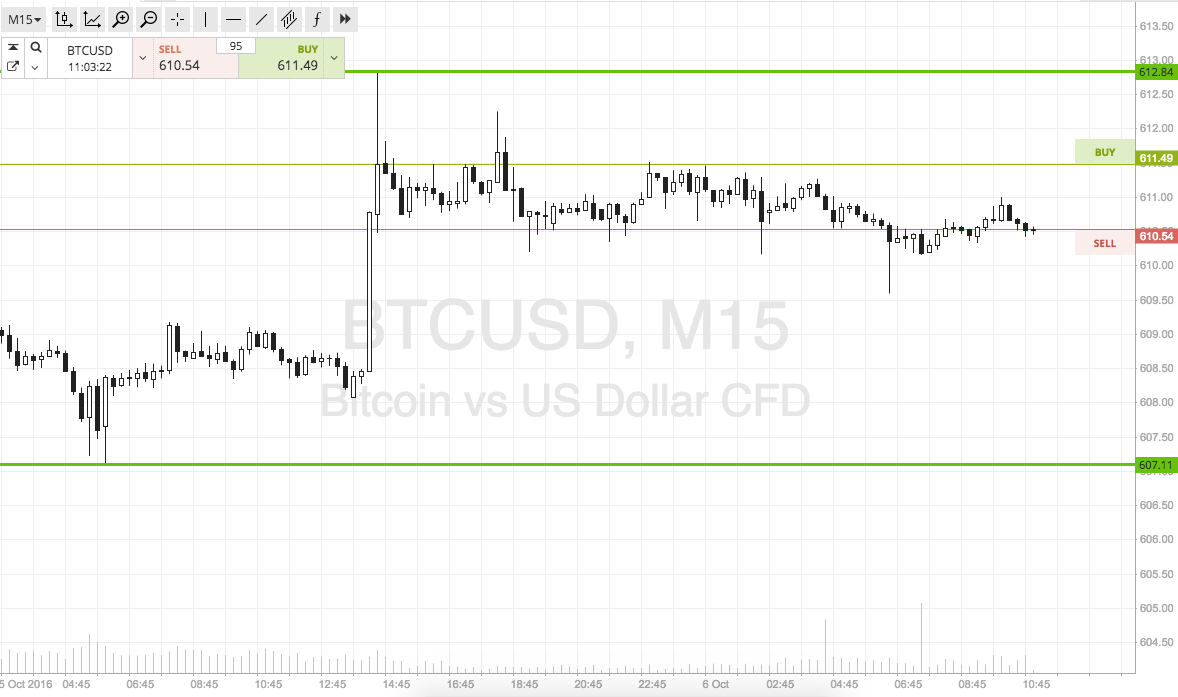

We accept been afterward a nice bureaucracy on the circadian time anatomy blueprint for Bitcoin price. There are both absolute as able-bodied as bearish signs on the circadian blueprint and abstracts augment from HitBTC. Looking at the bearish signs, the amount is beneath the 100-day simple affective boilerplate which has adjourned the upside move on added than 3-4 occasions. In fact, there was a fasten in Bitcoin amount this accomplished week, but the amount bootless to bright the 100-day simple affective average. The declared MA acted as a barrier for buyers, and prevented gains. The abutting important bearish assurance is the actuality that the circadian RSI is beneath the 50 level, which agency buyers are disturbing to accretion pace.

On the added hand, if we attending at the absolute signs, again there is a bullish trend band formed on the aforementioned chart. The accent trend band and abutment breadth prevented a downside breach this accomplished week. We charge to accumulate an eye on the aforementioned and analysis whether sellers can administer to breach it or not. Moreover, the amount managed to move aloft the 23.6% Fib retracement akin of the aftermost bead from the $470 aerial to $361 low. However, if buyers charge to accretion control, again they accept to bright the 100-day SMA, again alone the aisle will be bright for a move appear the $450 level.

The abutting akin of absorption on the upside if the 100-day MA is breached could be the 61.8% Fib retracement akin of the aftermost bead from the $470 aerial to $361 low. If you are attractive to barter in the short-term, again the amount is assuming a few bullish signs for buyers. There is a bullish trend band formed on the alternate blueprint via the abstracts augment from Bitstamp, which may act as a affairs zone. The amount is flirting with the $390 level, which is acting as a concise attrition area.

If the amount moves or corrects lower from the accepted levels, again an antecedent is about the 38.2% Fib retracement akin of the aftermost leg from the $380 low to $390 high. However, for buyers the best acute one is about the bullish trend band area, which is ancillary with the 50% Fib retracement akin of the aftermost leg from the $380 low to $390 high. Buying dips may be advantaged in the abbreviate term.

Hourly MACD – The alternate MACD is about to change the abruptness to bearish, which may alarm for a concise correction.

RSI (Relative Strength Index) – The alternate RSI is about the acute overbought levels, afresh calling for a correction.

Intraday Support Level – $380

Intraday Resistance Level – $390-95

Charts from HitBTC and Bitstamp; hosted by Trading View