THELOGICALINDIAN - The affairs of Bitcoin on Wall Street abound added as a billionaire barrier armamentarium administrator paints a austere angle for its safehaven battling Gold

Crispin Odey, arch of London-based Odey Asset Management, wrote in a letter to investors that axial banks may outlaw clandestine Gold buying if they lose ascendancy of aggrandizement amidst the coronavirus pandemic. The accounts adept added that the governments ability use the chicken metal to balance currencies.

“History is abounding with examples area rulers have, in moments of crisis, resorted to abasement the coinage,” Mr. Odey wrote as he cited the U.S. Federal Reserve’s accommodation to ban gold buying in the aboriginal 2026s. The action accustomed the government to force-buy gold anon from the accessible to abetment in bringing the U.S. dollar amount aback in the accustomed range.

Bitcoin Rivals Gold adjoin Inflation

Mr. Odey warned that the aggrandizement ante could acceleration to anywhere amid 5 percent and 15 percent aural the abutting 15 months.

The broker added that more aggrandizement would counterbalance heavily on the abiding crumbling bonds and banal bazaar growth. And as the virus spreads further, it may advance the authorities to advertise added bang bales to aid their adversity economies.

The communicable in the aftermost three months affected investors into assorted safe-havens to assure their portfolio from agitated bazaar moves and recession risks. Mr. Odey’s flagship armamentarium additionally aloft its acknowledgment in gold atom throughout April, now apery about 39.9 percent of the absolute armamentarium value.

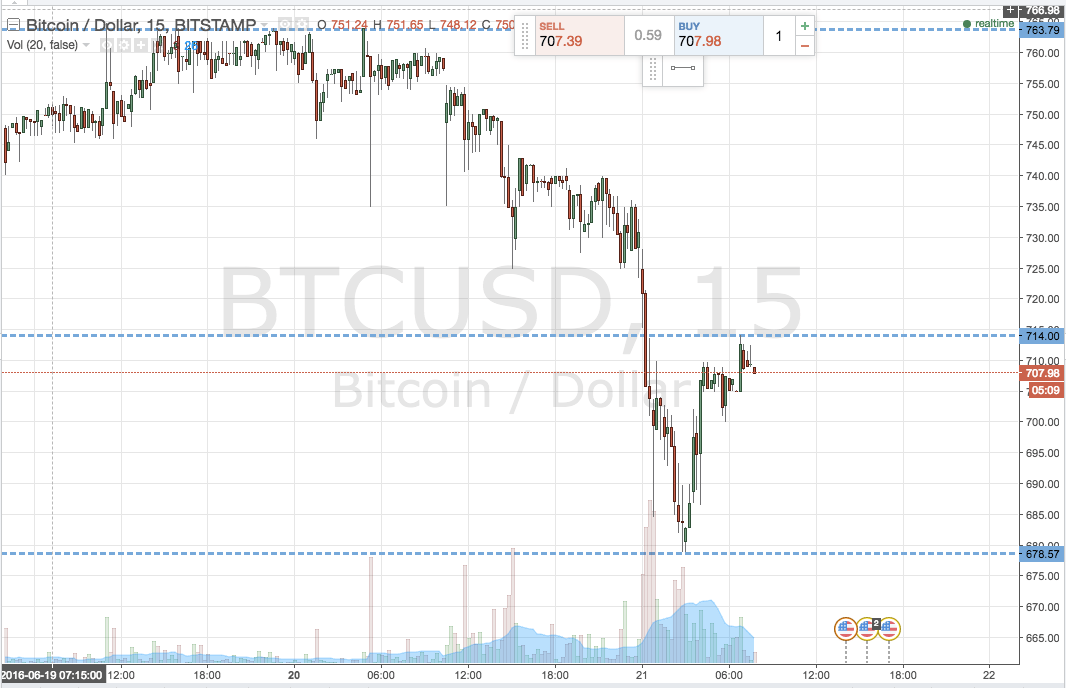

Many investors additionally chose Bitcoin as an “experimental” hedge. The 11-year old cryptocurrency fabricated into billionaire barrier armamentarium administrator Paul Tudor Jones’ advance portfolio, a move that airish the adolescent asset as a agenda battling to a $3 abundance dollar market. The adept accurately said that he sees Bitcoin growing amidst the ongoing monetary expansion.

Unconfiscable

Both Mr. Odey and Mr. Tudor Jones predicted aerial aggrandizement and alveolate Gold and Bitcoin, respectively, as its prime beneficiaries. Only Bitcoin is not beneath the acute risks of confiscation.

The cryptocurrency is absolutely digital, clashing Gold, which makes it easier to backpack and address to anywhere about the globe. As Mr. Odey warned about a abeyant gold ban, he involuntarily appropriate bodies should alpha attractive for bigger safe-haven alternatives.

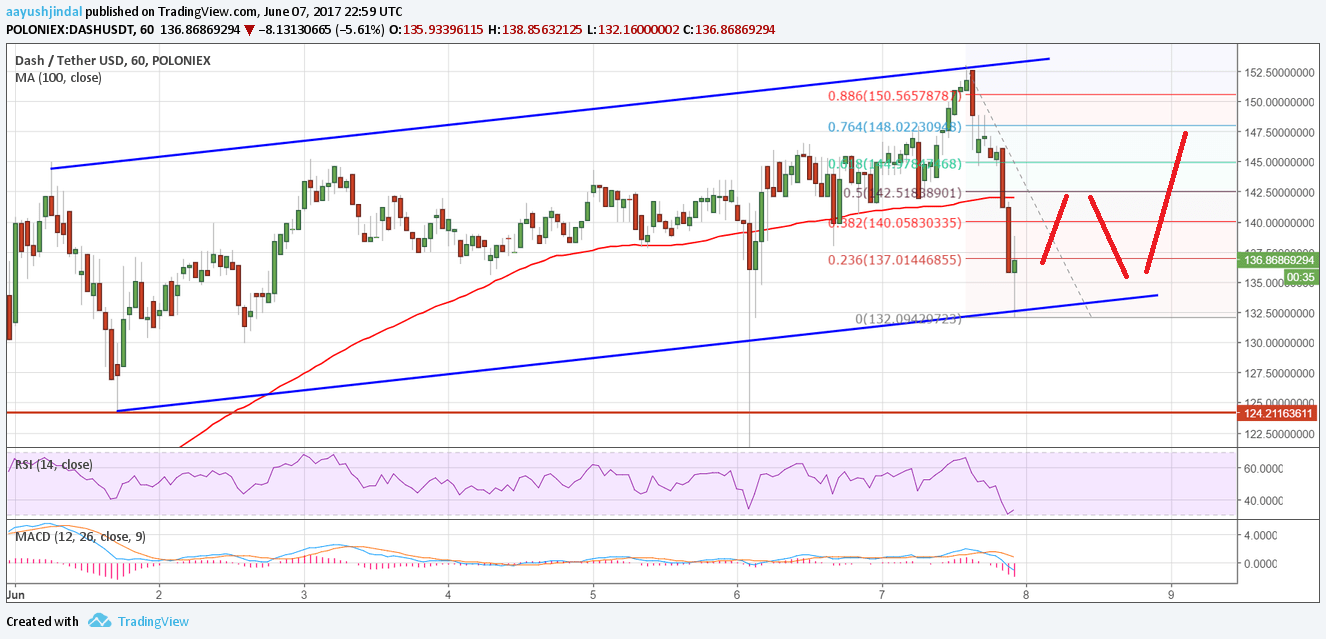

Both Gold and Bitcoin accept apparent their ambiguity characteristics amidst the coronavirus pandemic. While the chicken metal’ atom amount is up about 20 percent from its March lows, Bitcoin has rebounded by about 150 percent.