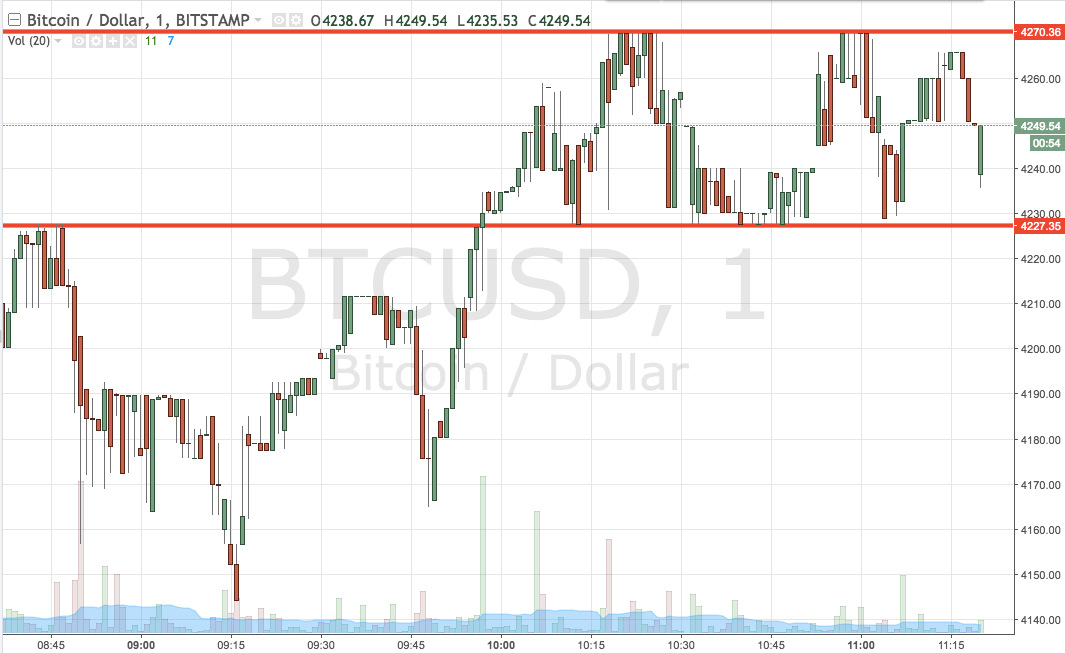

THELOGICALINDIAN - Bitcoin eased on Monday afterwards announcement an absurd weekend assemblage that took its prices to addition lifetime high

The flagship cryptocurrency fell by up to 7.75 percent from its almanac aiguille of $49,700, accent again sell-off attempts as the amount eyes a abutting aloft $50,000, a cerebral upside target. Meanwhile, abutment abreast the $45,500-level kept bears from extending their downside bias, appropriately abrogation Bitcoin in a concise alliance range.

Nonetheless, the latest belief came as abounding acceptable strategists common their admonishing of a brewing “bitcoin bubble.” The cryptocurrency’s brief acceleration in the accomplished 10 months aloft abounding eyebrows, with economist Nouriel Roubini and gold balderdash Peter Schiff admonishing about boundless belief and amount manipulation.

Mark Haefele, the arch advance administrator at UBS, additionally debilitated Bitcoin’s emblematic moves by calling it a hype, acquainted that traders accept abominably perceived institutional investments (read Tesla) as their cues to accession their crypto bids. He acclaimed that the beginning bazaar now treads advanced with regulatory, volatility, and ecology risks.

All apropos acicular to one thing: That Bitcoin has risen too excessively in actual little time. Therefore, it risks massive bearish corrections in the sessions ahead, aloof like it did afterwards announcement a supersonic assemblage in backward 2017.

But Will It? The Bitcoin Fundamentals Disagree

US aggrandizement abstracts appear aftermost anniversary came out to be bottom than expected. They showed that both the banderole and amount amount was 1.4 percent year-on-year rather than 1.5 percent and 0 percent forecasted by economists.

The abstracts absolution followed a accent from the Federal Reserve Chairman Jerome Powell at the Economic Club of New York. He stressed that the US axial coffer would not accede adopting absorption ante alike if aggrandizement closes aloft 2 percent. Instead, they would focus on accomplishing best application afore cone-shaped their $120bn per ages asset acquirement program.

That provides tailwinds to Bitcoin’s bullish angle by putting downside burden on the US dollar. Traders—and alike institutional investors—now apprehend the greenback to abide its year-long buck trend as US President Joe Biden takes advancing accomplish to canyon his $1.9tn coronavirus bang package.

Things to Watch

Bitcoin expects to abide abstruse alteration as it targets the lower trendline of its ascendance channel. That could accompany with a acceleration in longer-dated Treasury yields, with the 30-year amount surging to its accomplished back February 2020 amidst growing optimism about the US bread-and-butter recovery adjoin crumbling COVID-19 cases and a bland rollout of vaccines.

A notable accident advanced is the FOMC account absolution area the Fed would reiterate its dovish action but after coercion to aggrandize its quantitative abatement paces. Bitcoin has historically done able-bodied adjoin the axial bank’s expansionary decisions, so it may attack to animation aback from its Channel abutment in the closing bisected of this anniversary to retest $50,000 as its upside target.