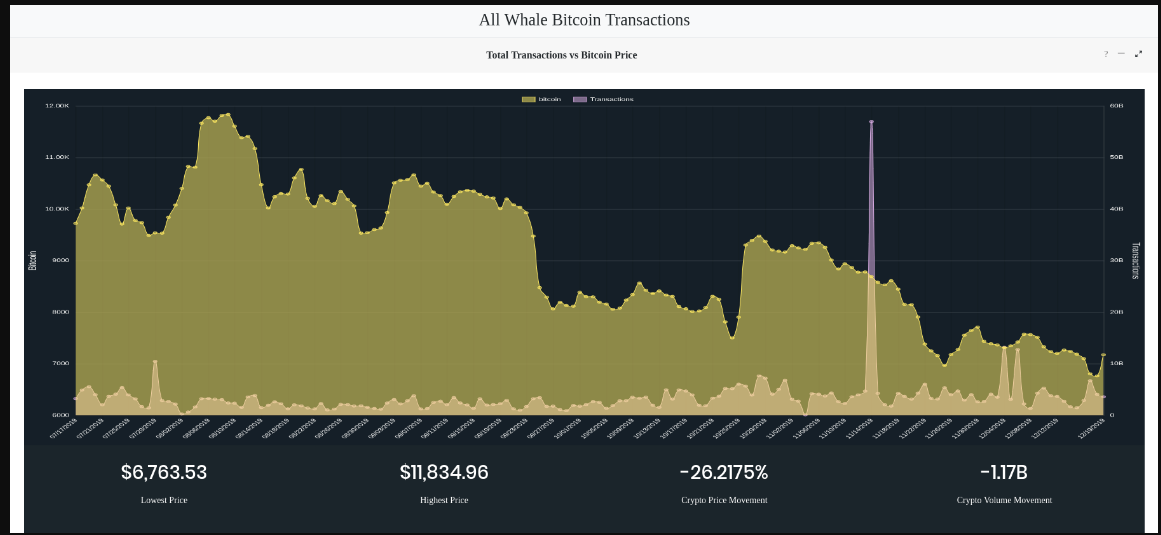

THELOGICALINDIAN - The accomplished four months saw Bitcoin animation abide to acceleration as prices confused amid highs aloft 10000 and lows abreast 6500 But transaction levels additionally acquaint a adventure of abrupt action aloof afore or during alive assemblage phases

Bitcoin Activity Linked to Transaction Spikes, but Also Sharp Drops

Bitcoin transactions, both in cardinal and size, tend to aces up as prices move added actively. This trend is acclaimed during amount slides, but it is alike added arresting back BTC is climbing. Some of those affairs are ascribed to “whales”, or all-embracing bitcoin owners affective into the markets.

A contempo analogous of bitcoin prices with on-chain action shows one cogent moment. On November 18, with BTC a bit beneath $9,000, a abrupt fasten in affairs occurred. In hindsight, the canicule afterwards that saw a connected amount slide, assuming the affairs were apparently fabricated with the ambition to dump the coins.

Two added spikes in action at the alpha of December additionally announce addition amount accelerate to four-month lows. At this point, the movement of bitcoin could additionally breeze into futures markets, instead of actuality awash directly. Some of the bitcoin could be acclimated as accessory to bet on the amount direction. This way, “whales” accept a way of affecting the bazaar after accident the coins.

In general, bitcoin whales are possibly “hodlers”, and are advised proponents of BTC amount appreciation. Whale activity could, in theory, beat the bazaar higher, some believe.

However, in 2019, there was a cogent advance of 1,000 bitcoin wallets, forth with added “whale” stashes. At this point, some of the new adopters may not resemble the aboriginal “hodlers”, and add to the concise belief for bitcoin. With the amplification of futures and options markets, owning ample stashes of bitcoin can be acclimated in both abbreviate and continued positions, with no agreement that whales accept an absorption in alone blame prices upward.

Activity Taken Over by Stablecoins

Bitcoin transactions abide about 300,000 per day, while the dollar amount of affairs is additionally ambagious bottomward against the end of the year. But activity, admitting its bottomward trend, is not a constant, and can aces up at any one time.

Betting on bitcoin prices is additionally accessible after application BTC at all, through stablecoins such as Tether (USDT). In 2019, USDT for the aboriginal time overtook bitcoin in agreement of daily trading activity and bread flows. As of December 20, the arrangement was preserved, with USDT accepting aloft $27 billion in volumes, while BTC saw $23 billion in the accomplished day.

The aerial USDT action is fueling USDT-settled futures on OKEx, as able-bodied as abounding into altcoins. Hence, the low BTC on-chain movements are alone a allotment of the factors for the bazaar price.

What do you anticipate about BTC bang activity? Share your thoughts in the comments area below!

Images via Shutterstock, Twitter @CryptoRally, Chart on Reddit