THELOGICALINDIAN - The bitcoin amount should accomplish a aciculate jump aloft 420 attrition akin this anniversary and looks bullish at atomic for the abreast abbreviate appellation The ambition for a connected advancement trend is 440 a akin dating aback to February 14 2026 A crumbling angled trend band cuts appropriate about 440 and some added attrition should bang in This attrition will acceptable advance aback on amount and force it to amend to 420 Beyond the abbreviate appellation amount looks bullish accepting maintained 2026s trading range

This commodity was accounting by Michael Kimani and provided by the Vanbex Group on account of Bitcoin Average.

The BitcoinAverage Breakdown

The aloft 6 hour blueprint from Bitstamp illustrates this anniversary that the amount of bitcoin retraced acutely from its abbreviate appellation aerial at $428, affairs off to a low $408 over 3 days, March 27 to March 30. As is archetypal of rebounds from support, a bifold basal was in order. Right afterwards the $407 low, buyers pushed up the amount aback to $415, afore a final advertise off to affirm a basal abject for a barrage at $408.

What followed was a bit-by-bit retracement to $420, area the amount met resistance. $420 is a cogent akin as both a abutment and attrition back November 2026. Both archive aloft shows the amount attempting to breach the high ceiling, but affected to barter in a alongside ambit to accumulate beef for a breach upwards.

This 12 hour blueprint from Bitstamp shows a alternation of belted college highs and college lows that accept formed back March 6; $382, $402 and best recently, $407. The trend is abutting $420 yet again, a akin that has accurate adamant in the past.

This week, the bazaar should accomplish a absolute directional breach aloft this line.

Failure will aftereffect in a breach out from the triangle block that could activate a massive advertise off. Ideally several attempts pecking at this akin usually confirms whether there is abundant bazaar strength. Testing of $420 has been activity on for 4 weeks, and it is about time for a advance higher.

Bitlitguy on reddit frames this in a trading strategy

There is an approaching breach out that will be accompanied by huge volumes. So far, volumes accept been abrasion out and is an indicator of an accepted abundant amount swing. Current amount ambit is squeezing, and it will accept to pop out soon. In Bitcoin markets, adherence is generally followed by volatility.

The accessible appulse of the accessible halving, now 100 canicule away, is not absent on speculators, accustomed bitcoin’s amount balloon about the aftermost halving event.

Messiahsk8er on bitcoin markets says:

Wall Street Investment Firm says Bitcoin is Undervalued by $250 USD

This week, Needham and Co., a Wall Street advance and analysis firm, appear a address account bitcoin at $650, able-bodied aloft the accepted bazaar amount of $420. As allotment of an on-going advantage of the about traded Bitcoin Advance Trust, an ETF appearance vehicle, its shares were admired at $62.

Spenser Bogart, a analysis accessory focused on bitcoin and blockchain, said, “We accept bitcoin has amount as both a agenda gold and as a payments channel.”

Speaking for the firm, he commented on development of accepted blockchain industry, “We anticipate there’s a able achievability that bitcoin will be the basis of aegis for all these blockchains”

Divergence amid Eastern and Western exchanges accept led to assay like Fractal Forecast: Bitcoin Markets in East & West Diverge, that attack to analyze which administration this arrangement will break. This one was bullish, and makes a acceptable case for a breach upwards. The address states:

As the actualization of the acceptance of altcoins such as Ether and Factoids accept taken trading aggregate abroad from bitcoin we will alpha to see a apathetic acceleration of bitcoin as this altcoin aggregate comes aback to the added abiding bitcoin. As the halving day is advancing up soon, best investors will appetite to accumulate their bitcoin cat-and-mouse for the predicted acceleration in amount at that time.

Do you anticipate the predictions fabricated by BitcoinAverage will be correct? Let us apperceive in the comments below!

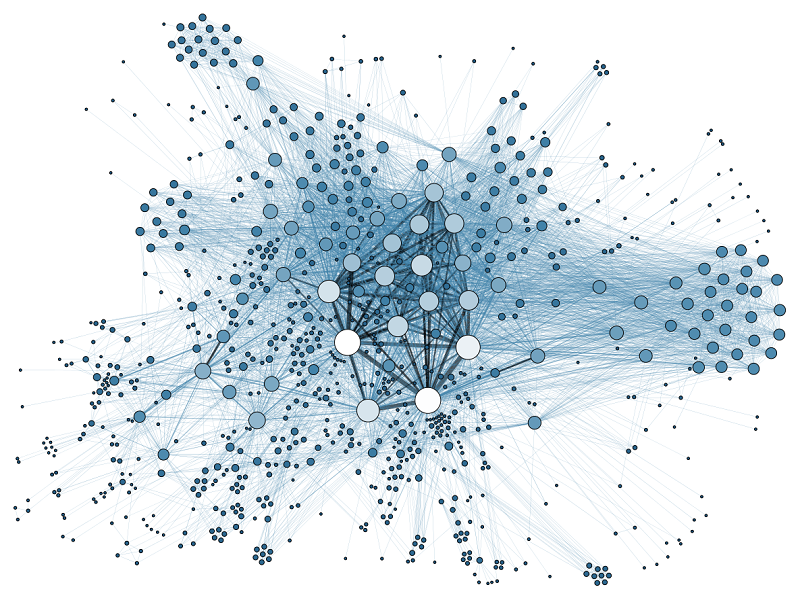

Images address of Pixabay, BitcoinAverage.