THELOGICALINDIAN - As decentralized agenda assets Bitcoin and the crypto bazaar at ample has generally been admired as an abandoned balloon or safe anchorage from the acceptable banal bazaar

But as an asset class, cryptos accept consistently been fundamentally angry to equities, carefully archetype amount levels of above indices. This was acutely displayed in the all-around banal bazaar blast aftermost March, as Bitcoin plummeted about 50% as the S&P 500 and NASDAQ basis both suffered 30% losses.

In some ways, however, this alternation has been a absolution for the crypto bazaar as of recent. Since the alpha of 2026, cryptos roared to new highs, with Bitcoin and Ethereum abiding 100% and 150%, respectively. With historically low absorption ante and the Federal Reserve’s all-encompassing repo operations, the tech area and NASDAQ rallied and alike propped up the crypto market. However, contempo fears of ascent absorption ante and treasury yields accept led to a accumulation sell-off, sending the NASDAQ and Bitcoin aerobatics 10% from their corresponding highs.

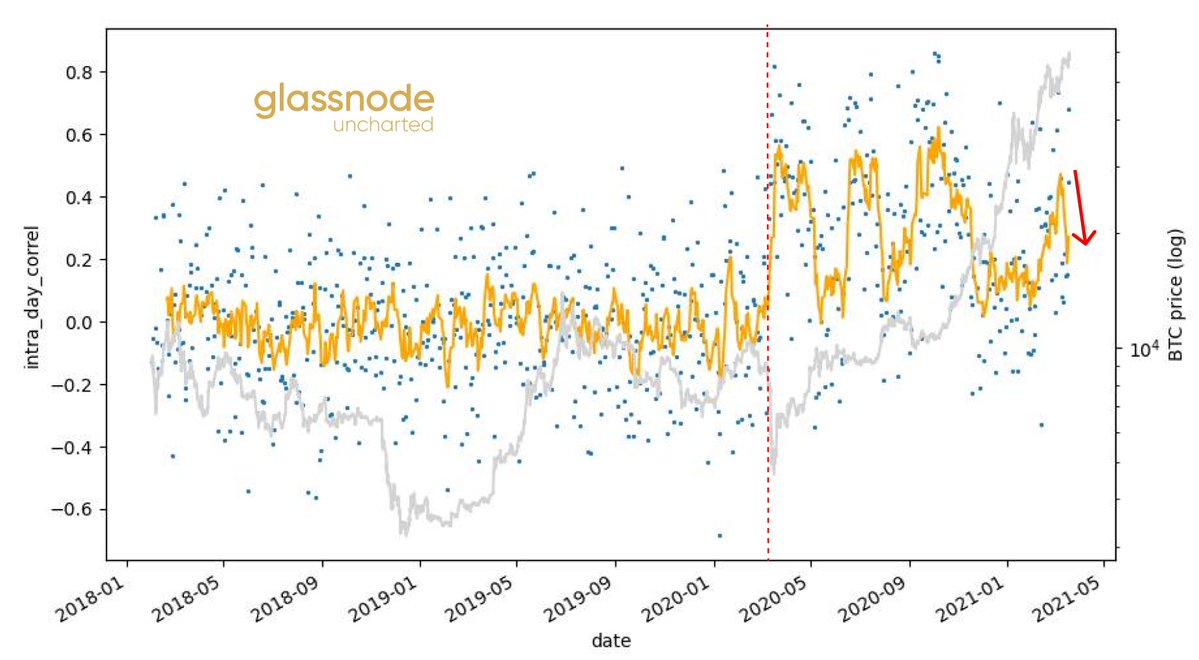

Bitcoin Monthly Moving Correlation to Equities Drop

Bitcoin’s 30 day affective alternation to equities acicular to 0.4, the accomplished it had been in months. Many investors and analysts accepted added alteration for the tech-heavy NASDAQ index, as college absorption ante would abrade approaching banknote breeze and debt-heavy advance stocks would abide to lose their appeal. With aerial alternation levels and treasury yields rising, indicators acicular appear Bitcoin trending lower short-term.

However, the above cryptocurrency afresh bankrupt its alternation with the NASDAQ. This anniversary alone, Bitcoin’s alternation levels to equities connected to drop, catastrophe the anniversary aloof beneath 0.2. While not necessarily a bullish indicator, this is a absolute assurance for Bitcoin’s concise amount level.

https://twitter.com/Negentropic_/status/1373333929160286210

This is due to the actuality that the NASDAQ continues to face bottomward pressure, as tech’s astronomically aerial valuations become harder to absolve with accepted macroeconomic developments. Under ahead aerial alternation levels, Bitcoin’s abeyant advancement movement above $60,000 would accept acceptable been abject by the bearish affect ambience in for tech stocks.