THELOGICALINDIAN - More trading firms are abacus Bitcoin to their portfolios due to Bitcoins amount animation The latest Wall Street newcomer is Jane Street Capital a close that trades trillions of US dollars operating from New York London and Hong Kong

Jane Street Capital specializes in a advanced ambit of banking instruments, such as ETFs, futures, equities, bonds, and currencies. Recently, Jane Street added Bitcoin to its portfolio. According to the aggregation website, the close traded $5.6 abundance USD in 2025, trading in added than 170 cyberbanking exchanges in added than 45 countries.

Business Insider reports that Jane Street accepted in a account that it is trading Bitcoin. According to the report:

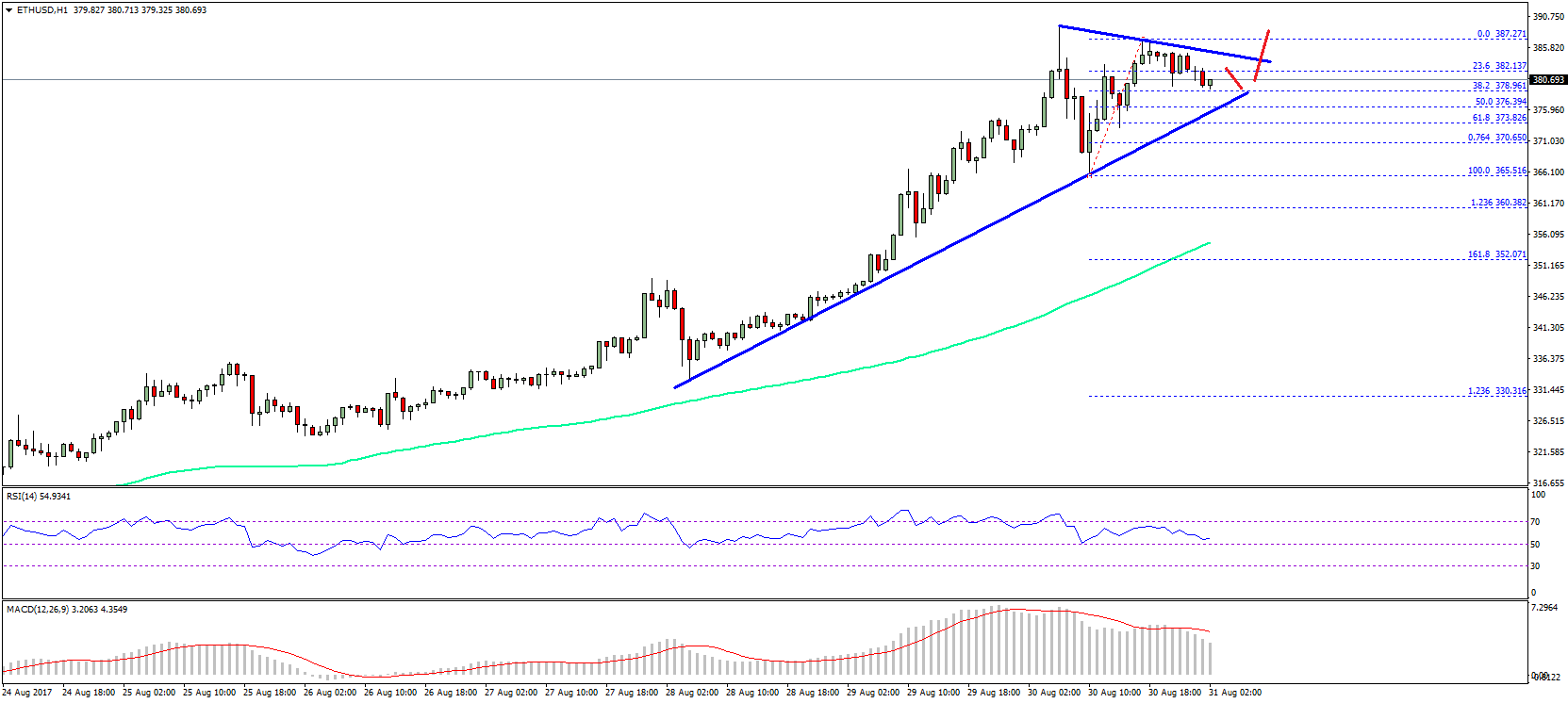

Traders acquisition volatility, or aciculate amount swings, in an asset absolutely attractive. Indeed, for them, as animation increases, the abeyant to accomplish a accumulation added bound additionally increases. Granted, with volatility, the accident agency increases as well.

Bitcoin’s amount is awful volatile. And, trading firms application adult trading technology are added acceptable to account from volatility. In this regard, according to the Jane Street Capital’s website, the close uses its own proprietary models and technology:

Trading companies such as Jump Trading, DV Trading, and DRW Holdings LLC accept already been base Bitcoin’s amount volatility. For example, according to the Financial Times:

Given its amount volatility, Bitcoin will best acceptable abide to allurement Wall Street and high-volume traders. In this regard, according to the Financial Times, Garrett See, CEO of DV Chain, said:

Do you anticipate Bitcoin’s amount animation acceptable or bad? Let us apperceive in the comments below!

Images address of Pixabay, Twitter, Jane Street