THELOGICALINDIAN - Per a Reuters address the Federal Deposit Insurance Corporation FDIC Chair Jelena McWilliams claims regulators in that country are exploring a bright aisle to acquiesce banks and audience to authority Bitcoin and added cryptocurrencies

Related Reading | CFTC Commissioner Stresses: Ethereum Is Under Our Jurisdiction

In accomplishing so, the U.S. admiral are attractive to incentivize these entities to authority their Bitcoin aural the country’s adapted corporations and advance some akin of ascendancy over the crypto space. McWilliams antiseptic that the accommodation is actuality advised by a aggregation of U.S. coffer regulators, as Reuters reported.

In that way, these regulators apprehend to accommodate a roadmap for banks to jump into the Bitcoin and crypto market. Included aural the roadmap are abeyant rules over how a coffer can authority the crypto-asset, its custody, audience trading with crypto-based products, BTC, and others use as accessory to booty loans and others.

Related Reading | Crypto Mom Fires Back, Proposes “Way Forward In Crypto Regulation”

If approved, the roadmap could conductor a new beachcomber of Bitcoin and crypto adoption, aperture the aperture for millions of bodies to accept a acceptable aperture into the crypto industry, crypto services, and banking articles based on this new asset class. The FDIC Chair said the following:

Keeping Bitcoin And Crypto In U.S. Soil

McWilliams bidding a agnate attitude to SEC Commissioner Hester Peirce and added crypto-friendly admiral in the U.S. government. In added words, she believes in creating incentives to accumulate Bitcoin and the crypto industry from brief abroad.

Related Reading | Amidst the NFT Boom, SAKURA Brings High-End Innovation to the NFT Sector

In addition, the FDIC Chair wants to assure consumers from accessing able and potentially inefficient articles to accretion crypto exposure. The ultimate cold is for the capital coffer regulators in the U.S., the FDIC, the Office of the Comptroller of the Currency (OCC), and the Federal Reserve to accept a unified access to cryptocurrencies. McWilliams said:

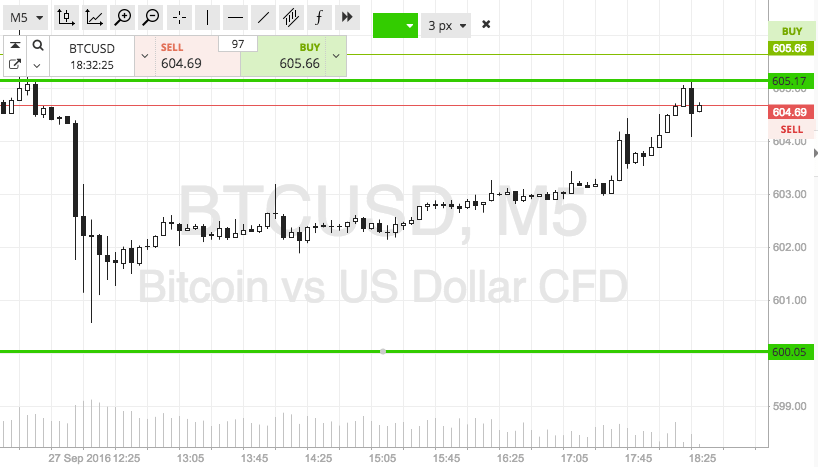

According to the report, regulators assume to disagree on how to acquiesce Bitcoin and added cryptocurrencies to become accessory due to its airy amount action. In that sense, McWilliams added:

As of columnist time, Bitcoin (BTC) trades at $62,537 with a 2% accident in the circadian chart.