THELOGICALINDIAN - Bitcoin has been called the best advance asset of the aftermost decade Arguably a absolute artefact of the banking crisis of 2026 and 2026 BTC represents the adverse of the authorization accepted it is accuracy artlessness admittance and possibly the foundation bean of a new banking arrangement in a apple after bailouts

In agreement of Return on Investment (ROI), Satoshi Nakamoto’s apparatus has burst all records. In 2009, while the acceptable bazaar recover, a $100 investment in Bitcoin could accept bought 1,000 BTC. At the time of writing, this would be account about $33,600,000 million.

The U.S. banal bazaar has additionally apparent new highs back the banking crisis. Data provided by Mati Greenspan, CEO at Quantum Economics, announce that this area recorded a 485% accumulation for that period. In added words, a $100 advance in S&P 500 would be account about $585, at the time of writing.

In Greenspan’s tweet, abounding bodies acicular out that the access could be decidedly less. This is due to the acceleration in the U.S. money accumulation and the aftereffect of aggrandizement on the amount of assets admeasurement with U.S. dollars.

Bitcoin The Record-Breaking Asset For The Next Decade?

In 2021 alone, BTC saw a 63% surged as the cryptocurrency fabricated its way up to new best highs. However, the latest months haven’t been the best for BTC. Financial analyst John Street Capital claimed that the cryptocurrency bankrupt its third after lower ages for the aboriginal back August 2018 and January 2019.

The cryptocurrency has been experiencing a abundant declivity during these months, partially attributed to the BTC miner’s clearing out of China. As the analyst said, there are about 57,000 BTC beneath captivated by miner wallet.

This amount translates into $32,8 actor of BTC awash per day or $2,5 billion back they started selling. However, the analyst claimed that the allotment of BTC captivated by miner’s wallets has accomplished Its Year-to-Date (YTD) average. Thus, affairs burden could balance in the advancing weeks.

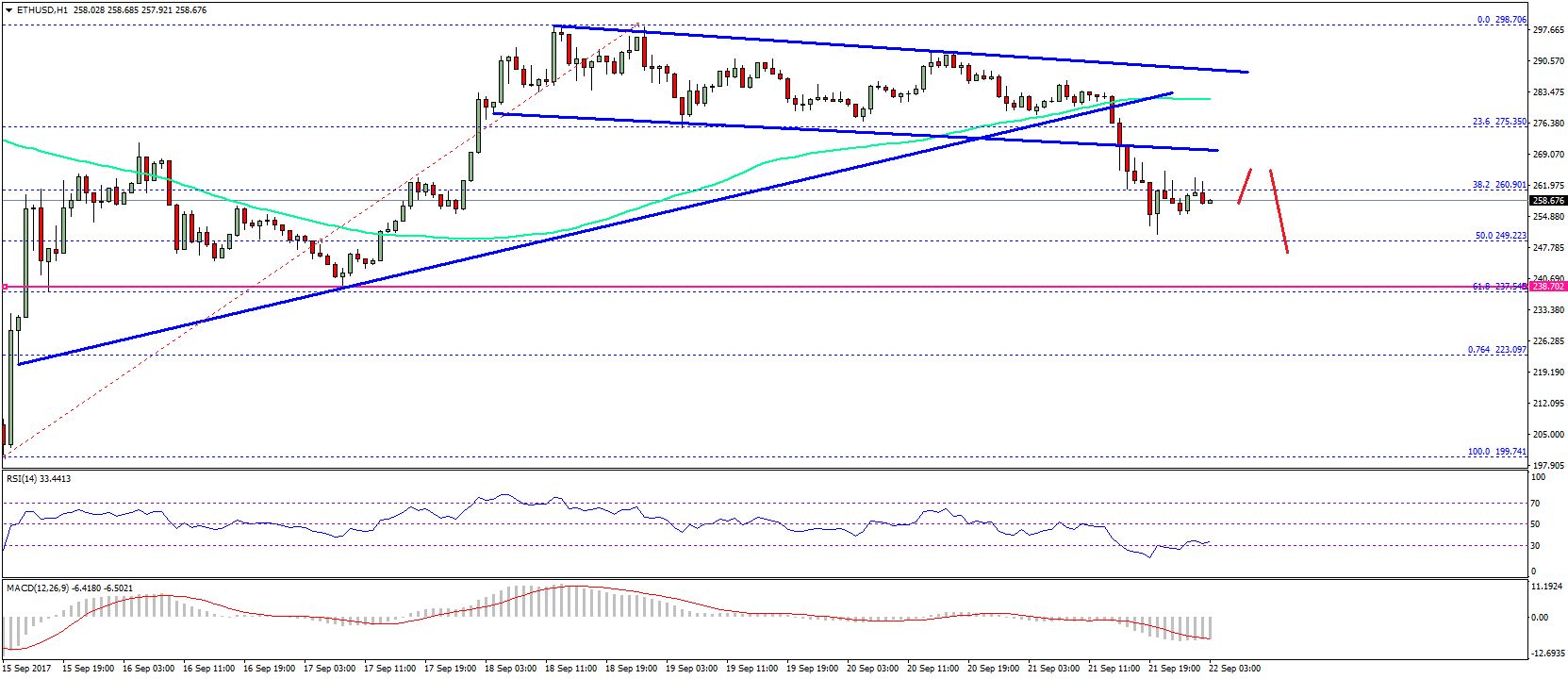

By the numbers, it’s absorbing to agenda that Bitcoin seems to be a bigger advance than the S&P 500 and Ethereum. As the analyst noted, BTC has historically traded at an boilerplate boilerplate exceptional of 79% to 65.3% while ETH annal a 45.3% and 35.1% on average.

As appear by Bitcoinist, Bitcoin is currently at a acute moment in its acceptance curve. The aboriginal cryptocurrency by bazaar cap is growing faster than the internet. Its users abject could be in the billions in the advancing 5 years.

As added bodies access the network, its amount increases. BTC’s amount history of breaking annal could be acceptable in the accountable future. Can the acceptable bazaar accumulate up?

At the time of writing, BTC trades at $33,381 with abstinent losses in the circadian and 7-week charts.