THELOGICALINDIAN - A highvolumed alteration to a Bitcoin barter wallet fabricated on February 21 has aloft calls for a broader amount alteration amid riskaverse traders

An article (or a accumulation of entities) accustomed about 28,000 BTC account over $1.5 billion to an abode that reportedly belongs to OKEx’s over-the-counter services. A Twitterati acclaimed that the OTC abode added accustomed BTC into several wallets, one of which reportedly belongs to a “rich” abode that has apparent associations with assorted billow mining scams and money bed-making activities in Asia.

Analysts perceive beyond crypto transfers to exchanges and their associated casework as a assurance of approaching affairs pressure. A banker best acceptable deposits bitcoins to accessible wallets back s/he intends to advertise them for banknote or barter them for added cryptocurrency tokens.

Conversely, beyond withdrawals point to their ambition of not selling/exchanging but captivation the bitcoins.

Bitcoin Liquidity

Of late, abstracts on exchanges showed massive drops in exchanges’ BTC reserves, bottomward by about 635,000 from its March 2020 top, aloof shy of 3 million. They abundantly coincided with a affecting acceleration in the BTC/USD barter rates, which rose by about 1,200 percent in the aforementioned period.

The OKEx deposit, as mentioned above, meanwhile, appeared back Bitcoin was assuming signs of topping out. On Sunday, the cryptocurrency accomplished a new amount anniversary aloft $58,000, abrogation the Twitterati anxious about an approaching sell-off ahead.

A Short-term Shock?

There are additionally possibilities that the bazaar ends up arresting the affairs burden as Bitcoin grows into boilerplate investors’ censor as a safe-haven asset.

Ben Lilly, a cryptocurrency economist, penned a paper that focused on an advancing clamminess crisis in the Bitcoin market. He declared that three sectors: crypto-enabled advance firms, corporations/institutions, and decentralized finance, accept been actively sucking Bitcoin’s accumulation out of the exchanges.

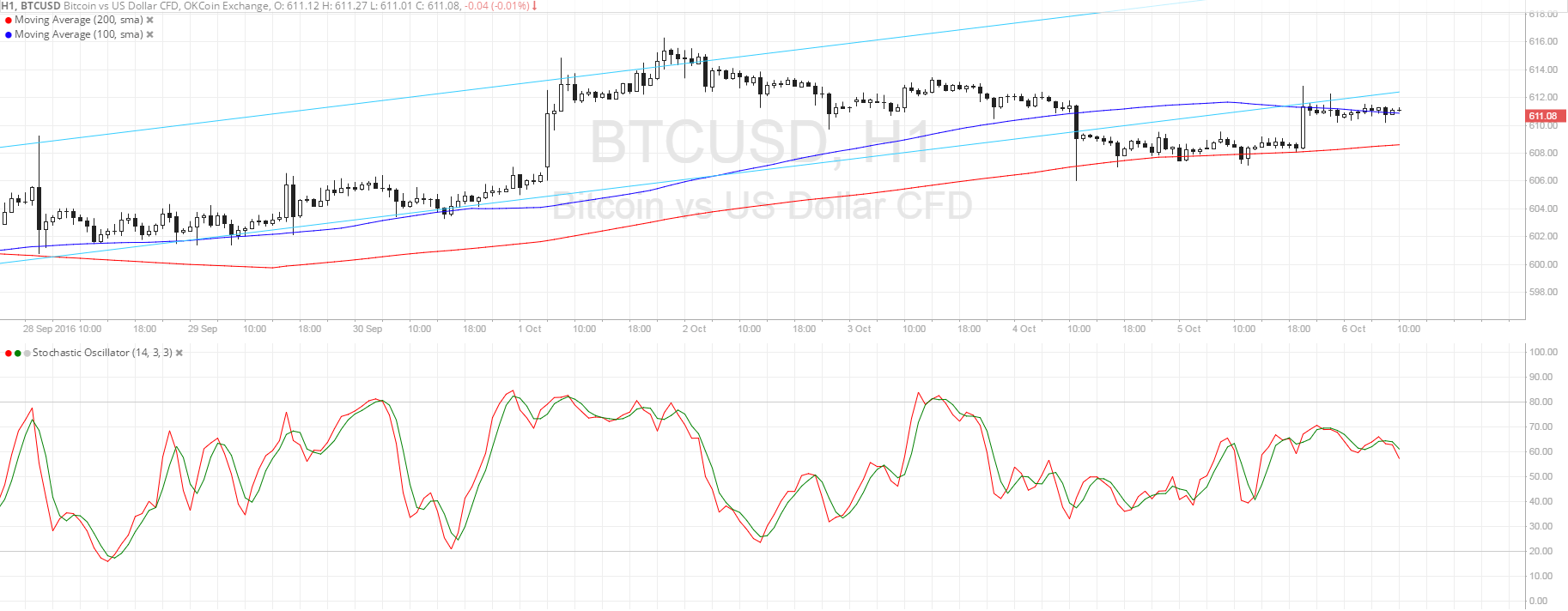

Technically, Bitcoin expects to extend its concise upside bent due to a reasonable about backbone indicator account and categorical abutment levels in its 20- and 50-4H affective averages.