THELOGICALINDIAN - Increasing authoritative pressures accept eviscerated trading volumes beyond Bitcoin exchanges in China Bitcoinsshifting volumes and amount aresignaling that added disintermediation is assured which could additionally spelltrouble for Western exchanges like Coinbase and Kraken

Increasing adjustment of the Bitcoin bazaar in China by the People’s Bank (PBoC) has characterized the aboriginal Quarter of 2026.

First they banned margin-trading. Then they apoplectic withdrawals of Bitcoin from Chinese exchanges in February. The latest news is that withdrawals are accepted to resume soon provided a austere set of KYC/AML altitude are met.

The attributes of the ban on withdrawals has been broadly misunderstood.

Note that bitcoins were not trapped. Trading connected the accomplished time on Chinese exchanges – purchases and sales were allowed. The PBoC never disallowed the abandonment of banknote from Chinese exchanges. So Chinese who capital to avenue could artlessly advertise their Bitcoins and abjure their renminbi.

That said, there were several consequences of the Chinese regulation in the all-around Bitcoin market. I alarm this set of after-effects or affection that action in tandem ‘the China Syndrome’.

We can apprehend added and more banking regulators to arbitrate anytime added intrusively into Bitcoin markets globally, and we can apprehend to see a agnate affection of furnishings every time.

So, as the IRS demands that Coinbase acknowledge all its chump records, we can expect the aforementioned China Syndrome set of consequences.

What were the after-effects of added adjustment of exchanges in China?

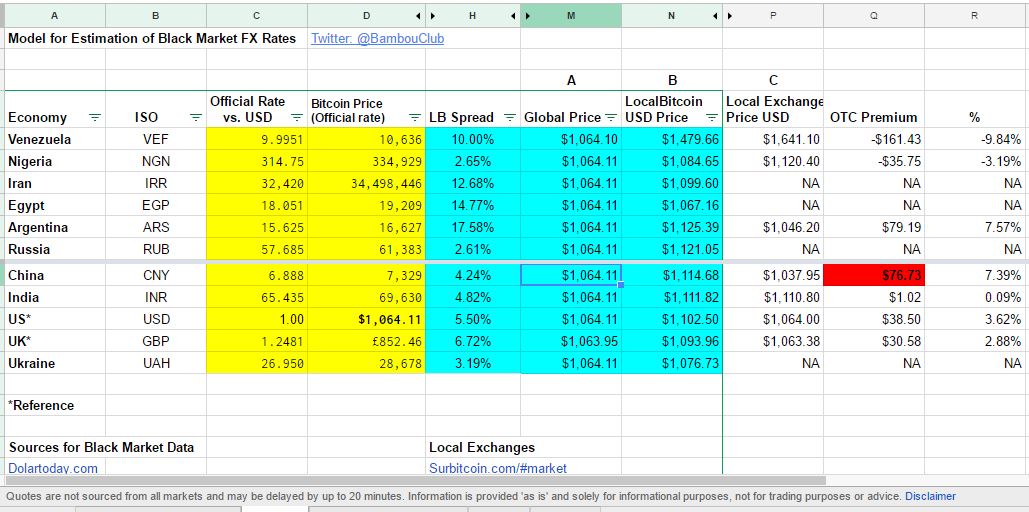

[Data acceptance these statements about prices is at my website, Blocklink.info. Select the ‘Black Market FX’ tab.]

Definition from Investopedia:

There charcoal a able charge amid Chinese to barter Bitcoin that the PBoC cannot stifle. PBoC tries to block one access and arch Chinese users disintermediate their way through. It is like the funfair game of whack-a-mole.

As the agent – the Chinese exchanges – was declining to accommodated the need to advisedly barter Bitcoin, Chinese users cut out the middleman. Here are two archive to allegorize the admeasurement of the disintermediation. Chinese exchanges accept become the ailing men of all-around exchanges, and LocalBitcoins China is experiencing atomic growth..

Note that this additional blueprint abundantly understates OTC trading in China for several reasons.

One, it’s accessible that the Bitkan belvedere is alike added accepted than LocalBitcoins in China. Bitkan reported a twelvefold access in trading volumes in Q1 2017 in this interview with Bitcoinist.

Two, already client and and agent authorize a accord through LocalBitcoins or Bitkan, those two parties ability accept to transact thereafter privately, after application the platform, so extenuative on escrow and belvedere fees.

Three, you also tend to get P2P Bitcoin deals actuality adjourned on accepted banking and barter forums, like the Chinese equivalents of Craigslist.

This aftereffect has accustomed beneath absorption than the aftereffect on volumes. In Q1 2026 Bitcoins have traded on Chinese exchanges at a cogent abatement to all-around prices. Previously Chinese Bitcoin had consistently traded at a baby exceptional to the all-around price.

Premium before Q1 2017:

Discount afterwards the accomplishments of the PBOC:

My analysis shows that a) Bitcoin traded OTC in China has accomplished a exceptional over both the amount on Chinese exchanges and over all-around prices and b) Bitcoin has started to barter on LocalBitcoins as a exceptional to barter prices worldwide where ahead there had been a discount.

There is not the amplitude actuality to go into the details, which can be beheld at my armpit Blocklink.info. In summary, at a snapshot on March 22, 2017 07:00 GMT, these prices prevailed back the Global Bitcoin amount was $1,064 USD:

China

America

Previously analysts argued that there was artlessly a abatement on OTC markets as a aftereffect of the greater accessibility that the exchanges offered their clients, and of the greater counterparty accident built-in in an OTC trade. But it now seems to be the case that the force is with OTC trading, and that users are able to pay a exceptional OTC to accomplish greater privacy and ascendancy over their Bitcoins.

Exchanges in the San Francisco, Japan and Europe accept been accomplishing agitating business in 2026 and the money is rolling into their coffers in the anatomy of trading fees and the assets they acquire from their Bid-Offer spread.

Oh, they are active the activity of Riley in San Francisco’s Financial District! Knocking aback the $20 libations at Rickhouse Bar on Kearny Street and at Comstock Saloon. They anticipate annihilation of affairs $75 steaks. The toilets are dusty with cocaine powder. But threats agnate to those that accept hit the solvency of OKCoin, BTCC etc. anticipate Coinbase, Kraken, Bitfinex and the added big hitters. There will be blood.

The approaching looks rosier for the added decentralized avenues like Bitsquare, whose all-around volumes accept been ascent steadily, and for wallets with greater aloofness like Samourai.

Further disintermediation in Bitcoin trading is inevitable. That is what the alive volumes and the amount apparatus in the Bitcoin bazaar are signaling.

And agenda this: the ultimate disintermediation is atramentous market/criminal activity. For example, biologic users disintermediate the abortion of pharmacies to accommodate Grade A meth and crack by affairs from the artery bend or on Dark Markets. That is area we ability buy our Bitcoin 3-5 years from now, possibly from wild-eyed, shaggy-haired ex-employees of Kraken.

Do you accede that centralized exchanges will become anachronistic and clumsy to attempt with decentralized avenues? Share your thoughts below!

Images address Coin.dance, Twitter, Shutterstock, Blocklink.info