THELOGICALINDIAN - Coinbase Custody today appear that it has acquired Xapos institutional business authoritative it the largestcryptocustodian in the apple Theacquisition brings Assets Under Custody AUC to over 7 billion application over 120 audience in 14 countries

Innovation In Cryptocurrency Custody

Xapo is a long-respected name in the apple of cryptocurrency aegis solutions. It has led the industry in developing aegis techniques to accommodated the rigours of institutional clients.

In 2017 it hit the headlines for autumn customers’ bitcoin in a adherent ex-military alembic in the Swiss Alps. By May 2018 it was captivation about $10 billion in bitcoin for barter beyond bristles continents.

CEO, Wences Casares, has continued been a best of Bitcoin, and Xapo’s mission is to accomplish Bitcoin defended and accessible. Casares believes that any broker who doesn’t accept at atomic a one percent position in Bitcoin is actuality irresponsible.

Coinbase’s Move Into Crypto-Custody

Coinbase Custody started trading a year ago, with a address to accommodate defended cryptocurrency accumulator for institutional investors. According to business it accumulated the ‘battle tested’ cold-storage solutions active by the Coinbase exchange, with an institutional-grade broker/dealer.

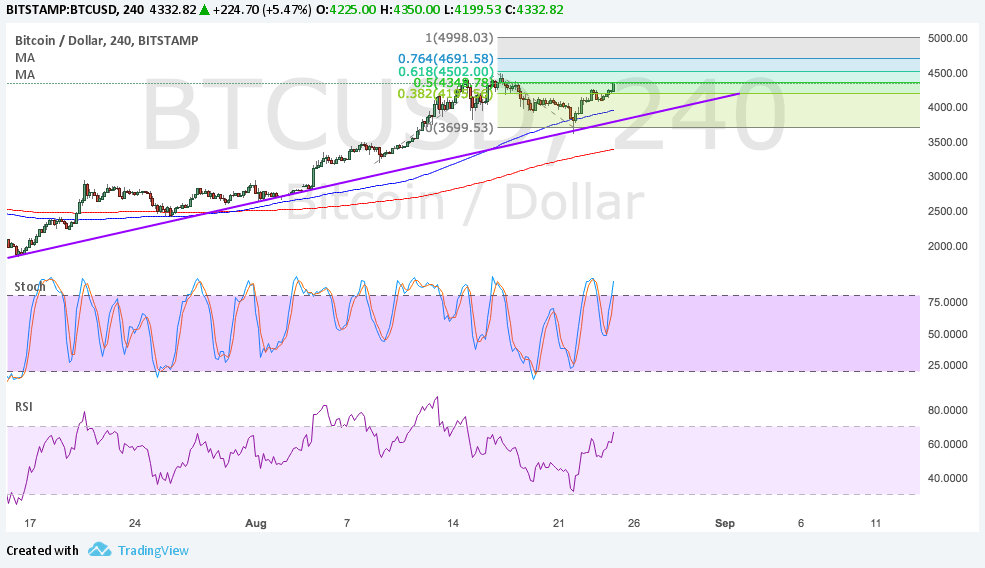

It bound added a bulk of additional crypto-assets to its aboriginal four of BTC, ETH, BCH, and LTC. However, there were questions as to whether institutions would anon assurance the offering. Certainly, while the buck bazaar was in abounding swing, advance in AUC was slow.

It wasn’t until the beasts absolutely started demography ascendancy afresh in May this year, that AUC beyond the $1 billion mark. But back then, advance has been steadier, and with this latest accretion of Xapo’s institutional business, Coinbase Custody are claiming over $7 billion in captivated assets.

The Final Hurdle To Institutional Adoption?

There are abounding who anticipate that crypto-custody is the final hurdle to institutional acceptance of bitcoin and cryptocurrency. This breadth is absolutely area a lot of assets are currently actuality deployed.

Bakkt is still waiting on approval from the New York authorities for its aegis solution, afore it can alpha alms its physically backed bitcoin futures products. Fidelity’s move into crypto-custodianship was declared to abolish one of the final barriers to institutional acceptance aback in March.

Even the South Koreans are getting in on the act, although technically, the amends of cryptocurrency in the country is still in question.

We are still cat-and-mouse for the accepted flood of institutional investors, but accomplish are absolutely actuality made. Whether their closing accession will be a absolute affair is addition catechism entirely.

What do you accomplish of this latest Coinbase acquisition? Add your thoughts below!

Images via Shutterstock