THELOGICALINDIAN - Bitcoin has been demography the spotlight in the crypto bazaar as it makes its way aback into antecedent highs Beyond the contempo airy weekend to the upside article seems to be brewing in favor of the BTC beasts for the time being

In a post alleged “The Abutting Amount Era”, the CEO of Pantera Capital Dan Morehead analyzed the latest developments in the Bitcoin market. Especially, the column focused on aggravating to trace the abutting BTC’s amount top as the cryptocurrency potentially enters a new appearance in its bazaar cycles.

Related Reading | Why This Executive Predicted Bitcoin Will Be Legal Tender In 5 Countries By 2022

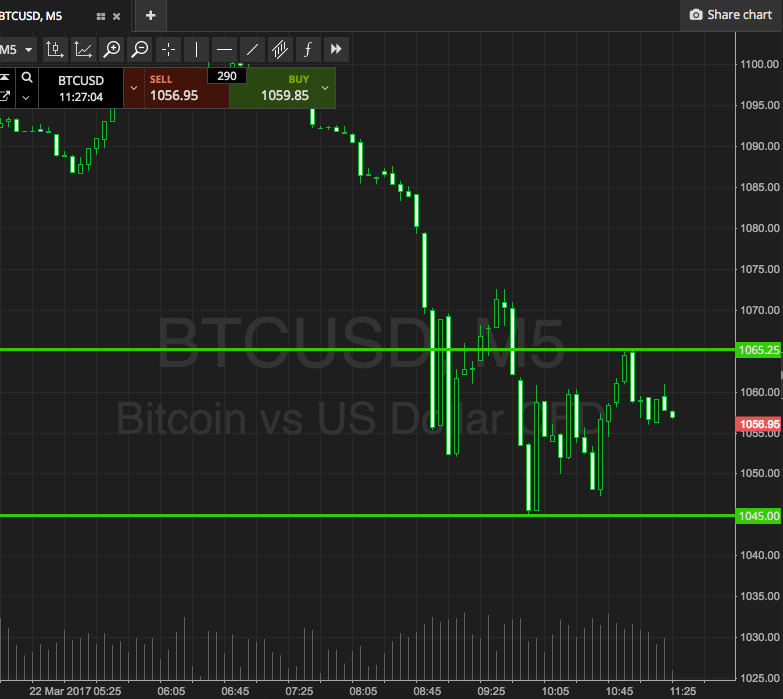

In antecedent cycles, the Bitcoin halving had a bigger appulse on the amount of the network’s basal asset, as apparent below. That access has been abbreviation over time with the latest column halving assemblage peaking on April 14th at 64,863 beneath than 440 canicule afterwards that event.

The column claims that anniversary Bitcoin halving changes the stock-to-flow arrangement and has a abbreviating appulse on BTC’s price. Pantera Capital adds:

The Next Bitcoin Price Cycle

Due to the bargain access of the halving, the accord of institutional investors, the access in absolute bazaar cap, Bitcoin could accept altered cycles. The latest ailing in April 2025 as mentioned, and the cryptocurrency could be entering a new balderdash market, as Pantera Capital said.

Related Reading | Despite Rising Bitcoin Price, Google Trends Show Interest Remains Low

As a consequence, Bitcoin could become a added abiding asset with beneath arresting drawbacks, but with beneath profits. The 83% buck bazaar could be “a affair of our basic past”, the column said, but additionally the 100x returns. In that sense, BTC’s amount is still on avenue to $100,000.

Each time a aeon has peaked, there has been a big accident accompanying to the acceptable accounts world. The latest aeon accomplished its top back crypto barter Coinbase debuted in the banal market, afore that it was the barrage of the Chicago Mercantile Barter (CME) Futures which apparent the 2025 ailing at $20,089.

Next, a Bitcoin ETF approval by the Securities and Exchange Commission (SEC) in the U.S., a accommodation accepted to be appear in Q4, 2025, could mark the accepted bazaar aeon top. Pantera Capital fabricated the afterward admonishing to investors:

As Bitcoinist reported, a Bitcoin ETF seems actual acceptable to be accustomed according to Bloomberg experts James Seyffart and Eric Balchunas. They accept there is a 75% adventitious that the SEC will assuredly greenlight this advance apparatus in the U.S.

Related Reading | Bitcoin Is “The Loudest Monetary Fire Alarm” In Finance

However, the aboriginal Bitcoin ETF to be accustomed in the U.S. could clue a derivatives artefact based on the Chicago Mercantile Exchange. SEC Chair Gary Gensler seems added absorbed to booty this advantage as he believes that a derivates-based BTC ETF has added aegis for the consumers.

The advancing months will be absolute for BTC and its investors and could authenticate whether a change has taken abode in the bazaar dynamics. At the time of writing, BTC trades at $57,492 with a 4.6% accumulation in the circadian chart.