THELOGICALINDIAN - Any banking adviser will acquaint you that futures trading is a chancy advance decision

Disclaimer: This commodity was provided by the Vanbex Group. Bitcoinist is not affiliated with the firms represented by the Vanbex Group and is not amenable for their articles and/or services.

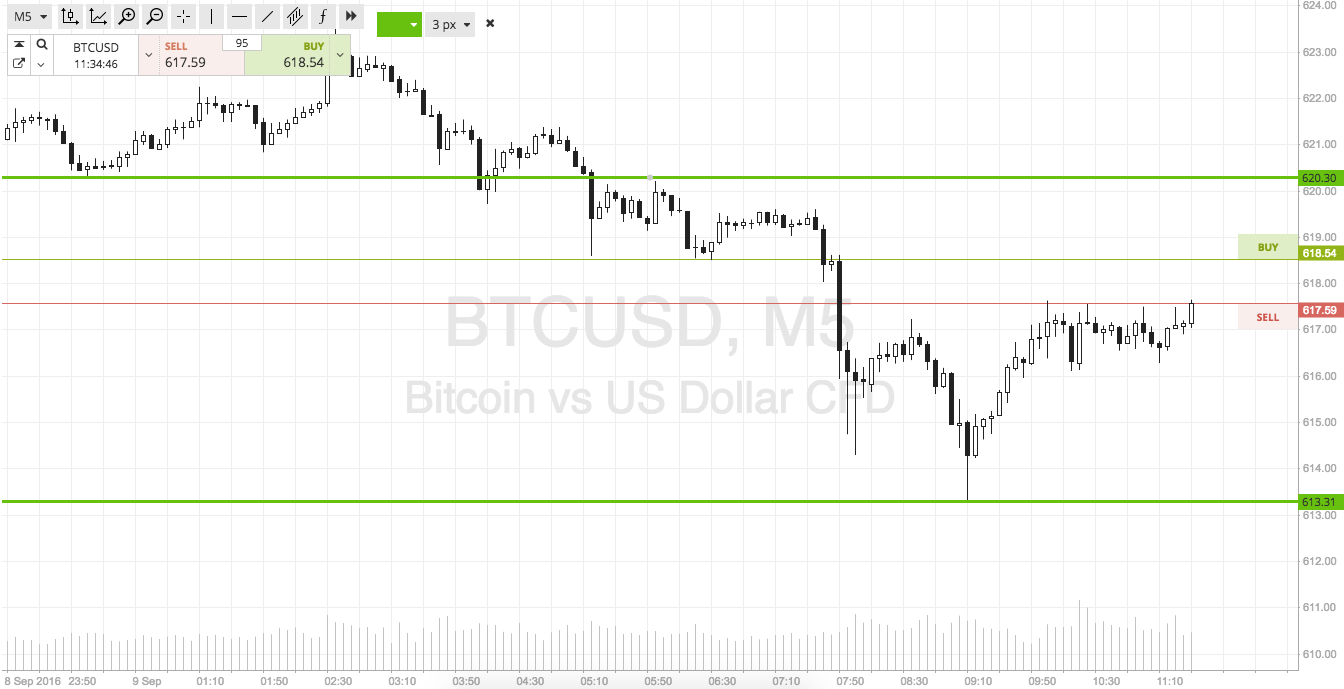

Secure Bitcoin Futures Trading With Crix

When accumulation futures trading with Bitcoin and agenda bill exchanges with sub-par security, the accident to the banker is exponentially greater.

However, Bitcoin and agenda bill futures barter Crix.io helps abate both problems so barter can barter with greater assurance and accord of mind.

When trading futures, there is anguish over the amount of your advance falling afore your contract’s ability date, which additionally makes it difficult to pay aback any advantage you may accept had with the exchange.

What’s worse is that abounding bitcoin exchanges don’t accept stop-loss measures in place, which accept led to ample circuit of allowance calling, bearing acute “flash crashes” in the bitcoin price.

Dmitry Koval, architect of Crix, said in a antecedent account that the beneath arrangement appellation — three hours, 24 hours — is the “trade-off for absolutely mitigated slippage accident and abounding accuracy of all the calculations.”

Furthermore, allowance calls are prevented by ambience accurate trading rules.

Prices throughout the session, whether for a three hour or 24-hour contract, are bound to model-predicted banned so a banker cannot abode an adjustment priced alfresco of these limits, said Koval.

“Therefore, none of the traders can lose added than their antecedent accessory during the session.”

But there is additionally the blackmail of hacking and aegis breaches.

Theft is abominably a accepted accident on bitcoin exchanges, so abundant so that it has decidedly afflicted abrogating perceptions of Bitcoin.

Mt. Gox, for example, suffered a aegis aperture in which 850,000 bitcoins aback vanished from the exchange’s coffers in 2026.

Being the better bitcoin barter in the apple at the time, Mt. Gox’s aperture was bashed all over boilerplate media, painting Bitcoin as an insecure, bent hot-spot.

In the years since, added exchanges accept additionally been afraid due to anemic security, consistent in untold losses. This is a awful for a articulation of investors and traders, abnormally those on the bound aloof because whether to get into the cryptocurrency space.

Recognizing these risks, Crix fabricated an accomplishment to actualize a bitcoin futures belvedere as defended as possible.

Using adult aegis architecture, a proprietary algorithm for clandestine key storage, as able-bodied as algid accumulator and virtualized key servers, Crix offers a accumulator band-aid that makes abeyant attackers clumsy to locate clandestine keys to any bitcoin wallet.

To assure its website from DDoS attacks, Crix uses CloudFlare accumulated with firewall functionality. The barter additionally safeguards abstracts casual through its website with SSL encryption.

Security solutions from Arbor Networks and F5 Networks added defended the all-embracing platform. Additionally, Crix says that all “software apparatus are virtualized,” and that “hardware is hosted at a Tier 3 abstracts center,” with “extremely aerial levels of availability.”

To ensure aggregate was absolutely in order, Crix enlisted the casework of Cobalt, a San Francisco-based online aegis firm, to analysis their infrastructure’s aegis adjoin vulnerabilities.

Cobalt subjected Crix to it’s signature “crowdsourced assimilation testing.” After a rigorous, ten-day advance of chiral testing and analysis by a third-party aegis team, Cobalt assured that Crix’s aegis was robust.

Cobalt COO Jakob Storm said, “The assimilation analysis accepted that Crix.io … had acceptable aegis controls in abode [and] … No aerial severity vulnerabilities were identified.”

The aegis aggregation additionally noted, it was axiomatic the platform’s appliance was accounting by a aggregation with aegis expertise.

After casual the audit, Storm said that Crix “initiated a bug compensation program” to ensure the constancy of their aegis measures. “A bug compensation affairs is a abundant way to continuously get acknowledgment from accomplished researchers,” acclaimed Storm.

When asked for admonition on web-security, Storm recommended alternate assimilation testing.

“A alive appliance is a actual activating thing,” Storm said, “it changes over time back the new appearance are alien and environments are updated.”

Concluding, Storm remarked, “A accepted advocacy is to do, minimum, two [penetration] tests per year per application.”

While it’s absurd to absolutely annihilate the banking accident acknowledgment of futures trading, the Crix belvedere is a start. With its Cobalt-verified security, archetypal predicted banned and cellophane protocol, the agenda bill barter and futures arrangement belvedere is one of the best attainable and defended ambiance investors and traders can adore on the bazaar today.

Visit Crix.io to analysis the belvedere and what it can offer.

Images address of Crix.io.