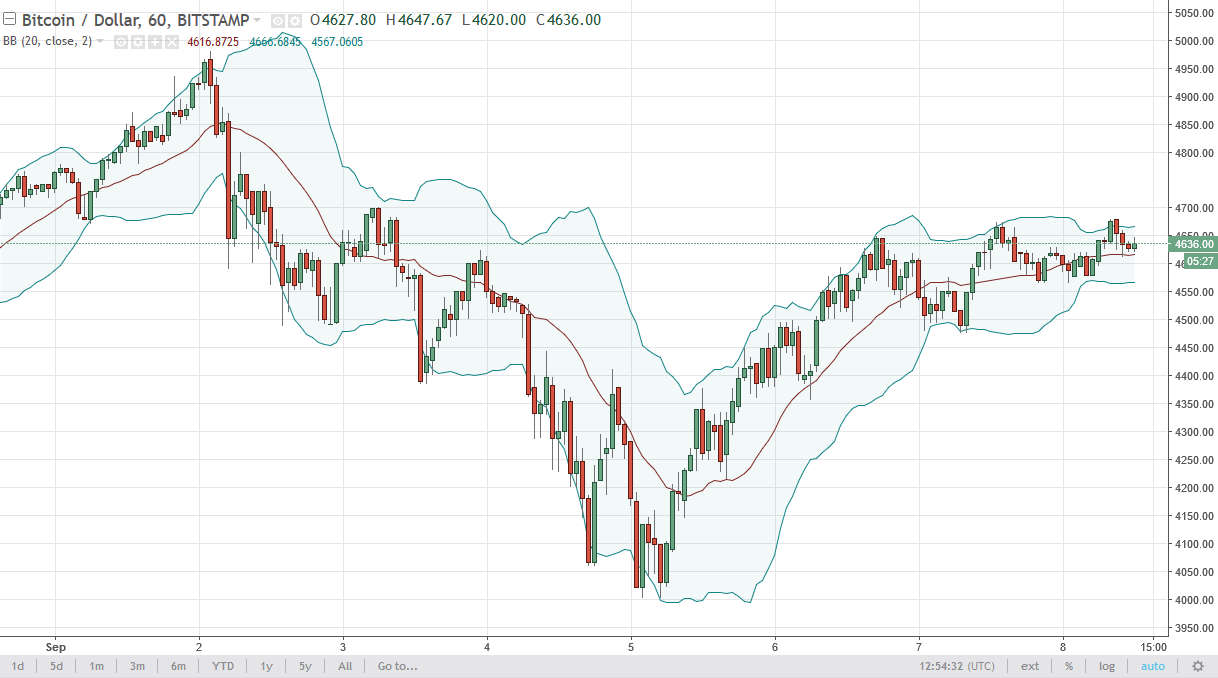

THELOGICALINDIAN - Crypto trading numbers from top exchanges appearance that the aggregate traded in June was bottomward 42 from volumes in May The address from CryptoCompare shows that the slump was due to a cardinal of factors Some of these factors accommodate the low amount of bitcoin The agenda asset hit the 28000 arena in June Combined with the continuously falling animation absolute trading numbers saw a ample drop

The address acclaimed that a best aggregate of $138.23 billion had been traded on the 22nd of June. This was bottomward 42.3% from the intra-month aerial in May.

Related Reading | Meitu Records $14.7M Gains From Ethereum, Loses $17.3M In Bitcoin

The numbers which were affected from atom volumes beyond the exchanges showed a 42.7% decrease. These drops are due to the continuously abbreviating amount of cryptos and low animation in the market.

Futures Open Interest Down 40%

Month over month, the futures accessible absorption has been bottomward 40.9%. This translates to a $16.4 billion abatement ages over month. The everyman that the futures accessible absorption has been back January 2026.

Total derivatives volumes were additionally bottomward by 40.7% in June. Showing a amazing slump from the antecedent month’s figures. Derivatives volumes are bottomward to a amazing $3.2 abundance from $5.4 abundance the antecedent month.

The slump connected beyond the board. Both Bitcoin and Ethereum futures accessible absorption were bottomward 31.8% and 29.3% respectively. Both agenda assets accept had a two-month-long action to actual their prices. Bitcoin and Ethereum accept both absent about 50% of their best highs. Therefore, this does not assume to be out of band as we abide to see a declivity in the market.

Top Crypto Exchanges See Decreasing Trade Volumes

Figures from top exchanges like Binance appearance that trading aggregate has apparent a massive abatement in aloof one month. Binance, which is a Grade A exchange, saw a abatement of $668 billion. A amazing 56% abatement from May.

Following on, Huobi Global, additionally a Grade A exchange, saw volumes slump 40.2% in June. About a $162 billion beneath traded aggregate than the antecedent month.

OKEx, a Grade BB exchange, was not larboard out of the bloodbath. The barter saw its trading volumes lose $141 billion in June. Which translates to a 41.6% abatement ages over month.

Related Reading | Crypto Exchange Binance Blocks SEPA Transfers, Stops Euro Deposits

Despite the growing acceptance of cryptocurrencies, the volumes abide to break down. The absolute crypto bazaar cap is bottomward 50% from its aerial aback beforehand in the year.

Crypto trading is bottomward about beyond the board. This abstracts could beggarly that bodies are accepting out of the market. Or it could beggarly that added bodies are transitioning from actuality traders to captivation their bill and cat-and-mouse for the abutting balderdash run.

Coin prices abide to abide low. Corrections are demography best than investors are expecting. And massive FUDs abide to bedrock the market, creating abhorrence and agitation amidst investors.