THELOGICALINDIAN - Ethereum briefly beyond over the 2026level a criterion ambition for abounding beasts as they anticipate a blemish amount assemblage in the worlds secondlargest cryptocurrency market

The ETH/USD barter amount surged to $2,007 during the Asia-Pacific trading affair Friday. The pair’s move acclivous coincided with a bead in the Bitcoin Dominance Index — a metric that measures the flagship cryptocurrency bitcoin’s bazaar cap adjoin that of the blow of the crypto bazaar — to its everyman levels back October 2026.

A coast basis appropriate a almost college basic affective into the bitcoin rivals, which may accept pushed the Ethereum prices higher. Other cryptocurrencies, including Bitcoin Cash, Litecoin, Chainlink, and Binance Coin, additionally rallied college over the anticipation of a alleged “altcoin season.”

The capital catechism charcoal whether Ethereum could abide trading advancement as its trades abreast $2,000, which is additionally belled for triggering sell-offs. One analyst on Twitter thinks that ETH/USD needs aboriginal to affirm a circadian abutting aloft $2,000 to cast the akin into support. Should the brace administer that, it would face no attrition in extending its assemblage to as aerial as $2,500.

Ethereum is the New Internet

Recent fundamentals backed an upside scenario. The latest assemblage in Ethereum markets carefully followed Visa’s accommodation to conduct a stablecoin transaction on its bequest acquittal platform. The dollar-pegged badge in affair was USDC, which functions aloft the Ethereum blockchain.

Meanwhile, on April 1 (believing it was not the April Fools prank), billionaire broker Mark Cuban accepted that he owns abounding Ethereum tokens, praising its acute affairs appearance that would aback the now-booming decentralized accounts and non-fungible tokens sector.

Mr. Cuban’s portfolio comprises 70 percent Bitcoin, 30 percent Ethereum, and 10 percent assorted cryptocurrencies.

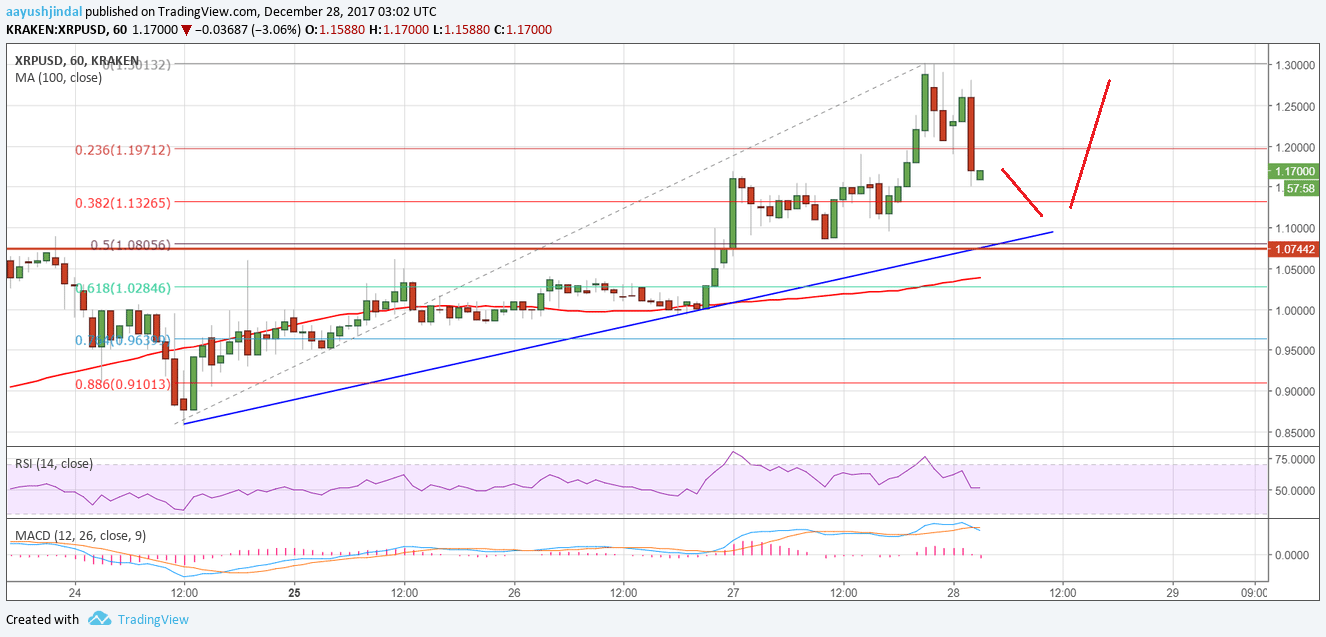

Technical Outlook

Ethereum is breaking out of a balanced triangle, a alliance arrangement that appeared during an uptrend. That hardly increases the cryptocurrency’s abeyant to log an continued bullish move, with upside targets as aerial as the breadth of the antecedent uptrend. That puts ETH/USD en avenue to $3,000 in a concise scenario.

The balanced triangle additionally hints at acceptable an ascendance triangle arrangement should Ethereum again rejects blemish aloft the $1,990-2,000 range. Ascendance Triangle structures are about bullish assiduity indicators.

One red banderole in Ethereum’s circadian blueprint is a bearish alteration amid the token’s about backbone indicator and price. That hints at bullish exhaustion.

Photo by Robert Eklund on Unsplash