THELOGICALINDIAN - Bitcoin has been accumulation beneath attrition for months now cat-and-mouse for a atom to burn an access in either administration Due to the advancing alternation amid BTC and stocks a abolition all-around banal bazaar could annoyance bottomward crypto with it already again

Continued Correlation Between BTC and S&P500 Has Kept Crypto Down

Since the alpha of 2026, Bitcoin and the banal bazaar accept had an astonishing and abnormal correlation. This initially ashamed crypto back the banal bazaar burst in a panic-induced selloff in mid-March.

That day is now referred to Black Thursday due to aloof how anarchic and adverse it was. Bitcoin amount plummeted over 50% in 48 hours from aloft $8,000 to beneath $4,000.

The banal bazaar that ahead set best highs aloof canicule prior, fell so low it set the affliction annual abutting on almanac at the end of the carnage-filled month.

Related Reading | Bitcoin and Gold Neck and Neck In Two-Year Safe Haven Arms Race

The communicable accepted to be too abundant for markets to withstand. But afterwards the aciculate selloff, the aforementioned markets accept back fabricated a V-shaped accretion that has yet to complete.

Before Bitcoin and the S&P 500 accost highs set in aboriginal 2026, addition bead could appear as cases of the virus already afresh circling out of control.

Between the communicable annular two incoming, and the connected ache on the economy, all-around banal indices accept assuredly started to abatement again.

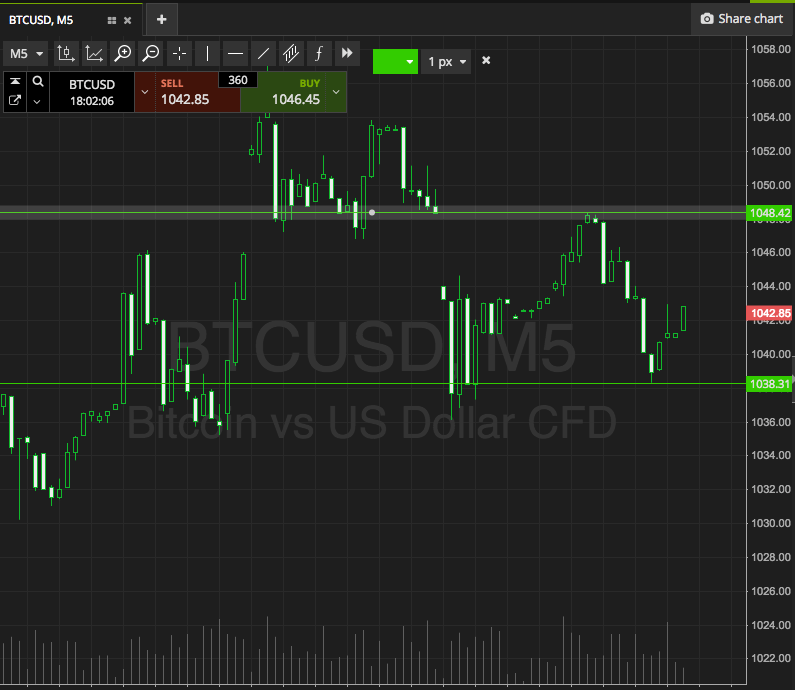

Starting today, so did Bitcoin – is the greater all-around banal bazaar boring bottomward the crypto bazaar already again?

Bitcoin Begins Fall To Retest Lows, Due To Global Stock Indices Floundering

An aboriginal July pump out of the Independence Day holiday, stemming from bullish Chinese banal advances and a aerial yuan, additionally pushed BTCUSD and the blow of crypto higher.

The acknowledgment to accident appetence acquired altcoins to activate bustling off larboard and right, as Bitcoin traded mostly sideways, admitting a bare advance.

Major banal indices acicular globally, and due to the alternation amid the crypto asset and the S&P 500, BTC was accepted to follow.

Related Reading | Why A Stock Market Listing For Coinbase Is Ultimately Ironic For Crypto

But alike with absolute account that a vaccine is potentially near, the all-around banal bazaar is assuredly activity the crisis of cases resurging.

The Dow Jones Industrial Average, S&P 500, the Shanghai SE Composite Index, and the Hang Seng banal indices all plummeted over the aftermost 24 hours.

At the aforementioned time, a Twitter betray involving Bitcoin has additionally prompted the crypto asset to alpha falling from its alliance range.

Combined with the bearish advertise burden from stocks, it could booty the crypto bazaar aback bottomward to retest above lows, or conceivably set a new lower low.