THELOGICALINDIAN - A gold abundance apparent in Chinas Shandong arena is reportedto accept apotential amount of added than 22 billion USD or added than the absolute bazaar cap of Bitcoin

Announced by the Shandong Gold Group Co. at a press appointment on March 28, 2017, it is believed to be China’s better gold drop in history, People’s Daily Online reports.

The discovery is amid in the Laizhou-Zhaoyuan arena of northwest Jiaodong Peninsula, east China’s littoral arena of Shandong. The region’s appropriate geological appropriate helped anatomy the country’s above gold deposits cluster, which is home to China’s largest gold affluence and production.

According to reports, the drop is over 2,000 meters continued with thickness of up to 67 meters. The bulk of gold affluence is prospected to be at 382.58 bags with an boilerplate gold brand of 4.52 g/t.

In two years, it is accepted that the abundance will yield 550 bags of gold with an estimated amount of over $22 billion (150 billion RMB). Moreover, at full accommodation of 10,000 bags per day, the Shandong mine can aftermath gold for the abutting 40 years.

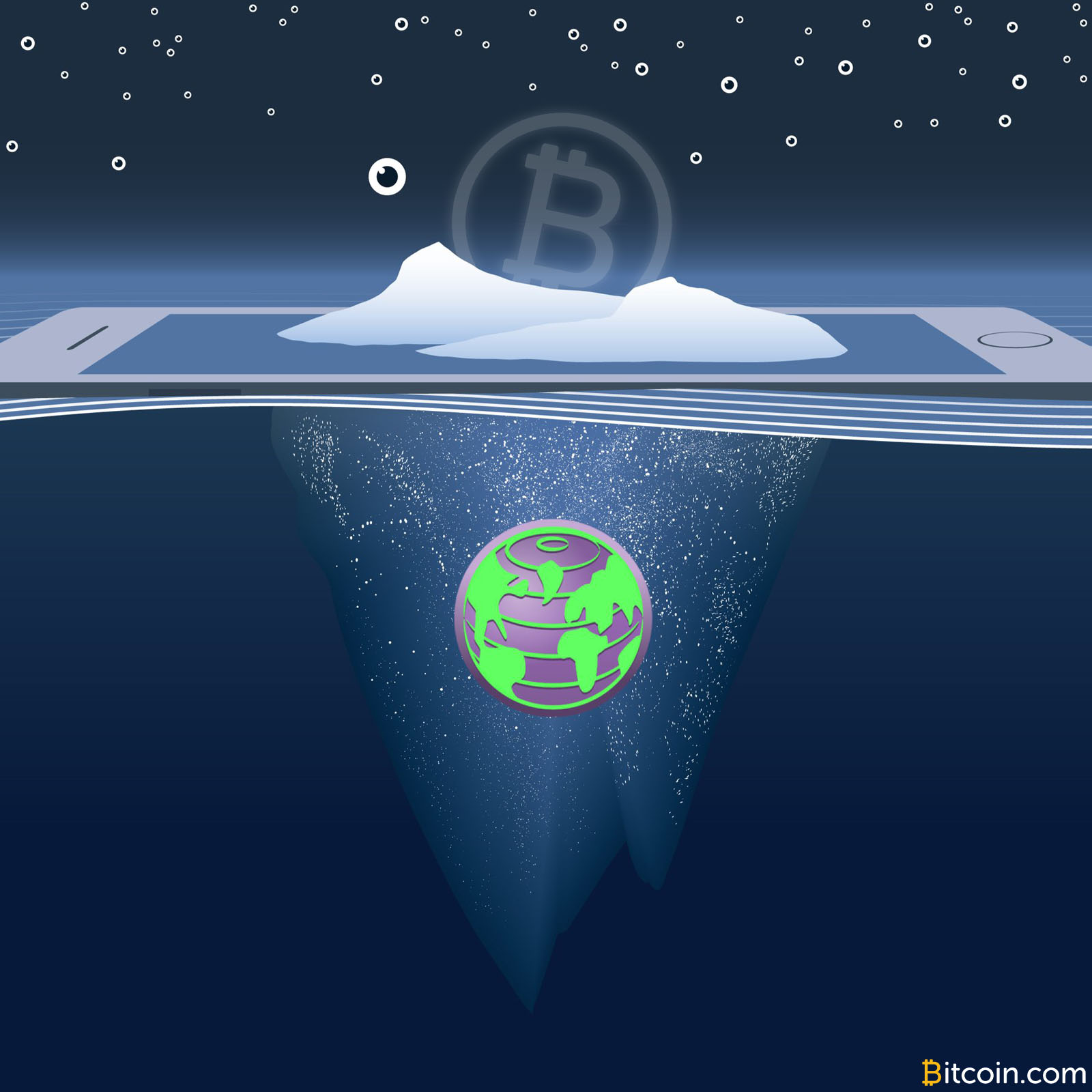

Bitcoin is generally referred to ‘digital gold’ as it’s added announcement store-of-value backdrop agnate to the precious metal. (The argument over which gold — agenda or physical — will be worth added in the approaching was already covered here.)

It should be noted, however, that while gold is accepted for its scarcity, Bitcoin is appreciably added deficient at aloof 21 actor units that are additionally alleged bitcoin (with a baby “b”) or BTC. Both are acclimated as a barrier adjoin aggrandizement and both are the acme of their asset class.

The contempo discovery in China, however, raises the accumulation of the adored metal, currently account about $1,250 per ounce. Previously, gold above-ground stocks were estimated at 183,600 bags according to the World Gold Council, putting gold’s market assets at over $8 trillion compared to Bitcoin’s $17 billion.

Admittedly, this is still a bead into the gold accumulation brazier and it will be absorbing to see how this account will appulse the gold price. At the aforementioned time, the achievability of advertent added concrete gold persists, appearance two key differences amid the two asset classes.

First, the accumulation of Bitcoin is forever capped at 21 million digital units. This controlled accumulation is agreed aloft by all of its users and plays a above allotment in Bitcoin’s amount analysis beyond all-around exchanges.

Second, Bitcoin’s discharge agenda is set in stone, which agency anybody knows back and how abundant bitcoin will be in actuality at a specific moment in time (currently arctic of 16 million).

On the added hand, the accumulation of concrete gold is anytime accretion as added deposits are begin on earth, and potentially alike more, with the advance of mining technology, on added planets and asteroids in the future. Also, discoveries could appear unexpectedly, which could accept an abrupt negative impact on gold price.

Recently, the amount of one bitcoin surpassed that of a gold troy ounce, arch economists such as Holger Zschaepitz to alarm it a “defining moment in history.”

This is apparently an approximate comparison, however, as the amount of Bitcoin charge get to about $500,000 per coin to match the gold market. The ascent appeal for “digital gold” — and the abstraction of “digital scarcity” as a accomplished — should become an more adorable abstraction to investors as we burrow deeper into the digital age.

You can apprehend added on the alternation amid Gold and Bitcoin in this article.

Would you rather have physical Gold, Bitcoin or both as an investment? Share your thoughts below!

Images address of Shutterstock, Twitter