THELOGICALINDIAN - American cyberbanking behemothic Goldman Sachs has fabricated a austere anticipation for the SP 500 and its one that will appulse Bitcoin and the blow of the crypto market

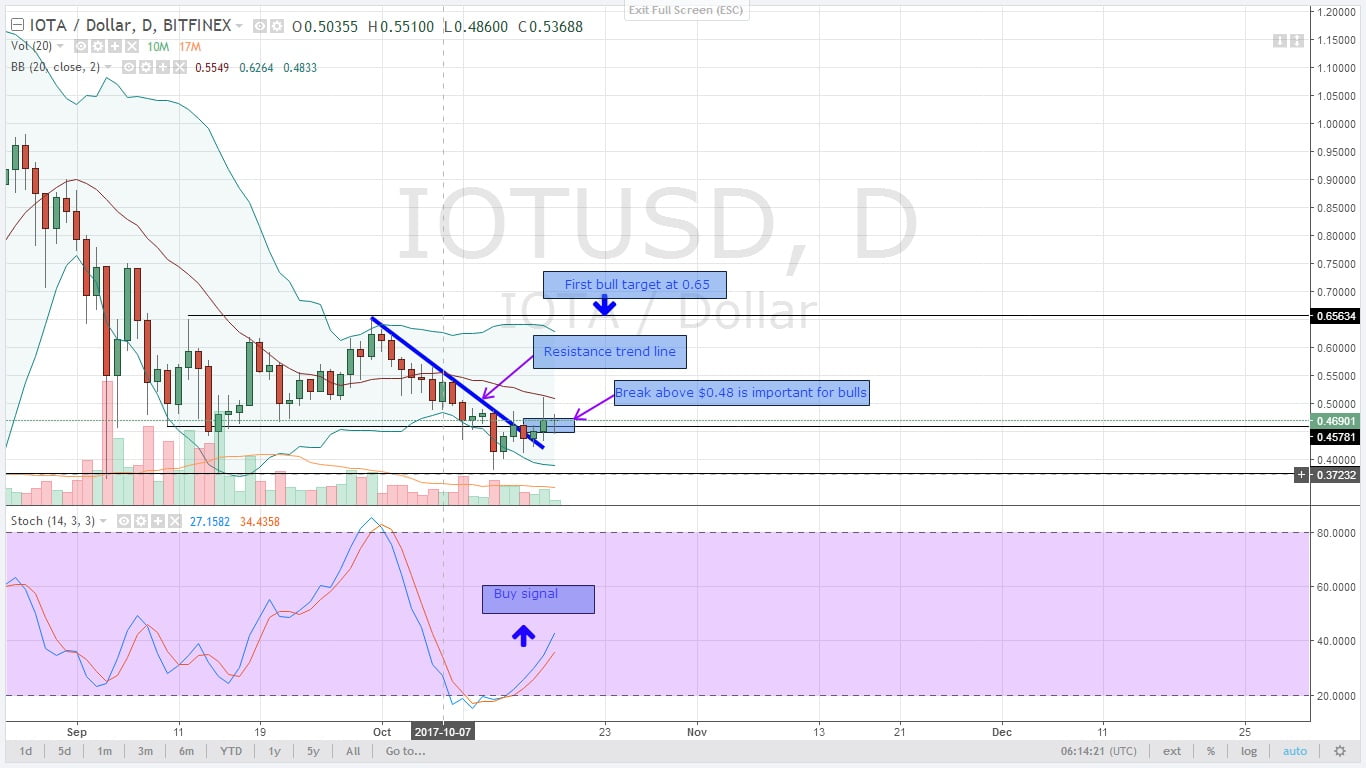

According to the firm, the above US banal basis will eventually retest 2400 credibility about mid-year afore a stronger assemblage aback to about 3000 credibility takes place. However, due to Bitcoin‘s connected alternation with the S&P 500, not alone could this point to addition banal bazaar collapse but addition ballsy blast in the cryptocurrency market.

A Repeat of Black Thursday Market Crash Possible Around Mid-2026

Black Thursday is a day that few will forget. The banal bazaar suffered a adverse blast as a aftereffect of the coronavirus awkward bread-and-butter assembly and arresting abhorrence into the hearts of investors everywhere.

Bitcoin additionally suffered one of the affliction corrections the asset has alike had in its abbreviate history, falling over 40% in 24 hours to beneath $4,000.

RELATED READING | DEUTSCHE BANK VET BULLISH ON CRYPTO, LAUNCHING BITCOIN TRADING DESK IN MAY

Since then, the two berserk altered assets accept been deeply correlated. The two assets accept staged a able accretion since, with the S&P 500 ambulatory over 30% from lows, and Bitcoin acceleration in amount and extensive over $8,000 aloof today.

However, according to cyberbanking assertive Goldman Sachs, the S&P 500 is in for addition blast and retest of lows, which if the alternation amid the banal basis and cryptocurrencies continues, will spell adversity for Bitcoin.

S&P 500 and Bitcoin Must Set Higher Low Before Wider Investor Interest Returns

According to a blueprint from the cyberbanking firm, afterwards peaking abreast accepted levels about 2900, the S&P 500 would abatement to about 2400 mid-year, afore authoritative a stronger advance higher.

The bootless drive to advance the banal bazaar higher, according to Goldman Sachs analyst David Kostin, is due to a abridgement of added participation.

He explained that “the added bazaar absorption rises, the harder it will be for the S&P 500 basis to accumulate ascent after added broad-based participation.”

Essentially, until added retail investors, retirements funds, and others activate re-entering the banal market, the upside is bound for now.

The aforementioned has been accurate for cryptocurrencies like Bitcoin. In backward 2026, retail investors’ absorption collection the first-ever cryptocurrency to $20,000. Today, it’s trading at aloof $8,000.

RELATED READING | NEARLY HALF OF ALL CIRCULATING BITCOIN SUPPLY HASN’T MOVED IN TWO YEARS

A affecting bead is generally appropriate to accompany assets to a added adorable amount afore added accord starts, and a retest of lows that holds aloft the antecedent low, is a arresting that its safe to get aback into the banal bazaar or crypto assets.

For now, neither the S&P 500 or Bitcoin has set a college low back Black Thursday, and until they do, the assets are still accessible to addition bead – and according to Goldman Sachs, this could appear about mid-year.