THELOGICALINDIAN - Bitcoin and the aggregated crypto bazaar saw some calm brief trading afterward the immense animation apparent yesterday

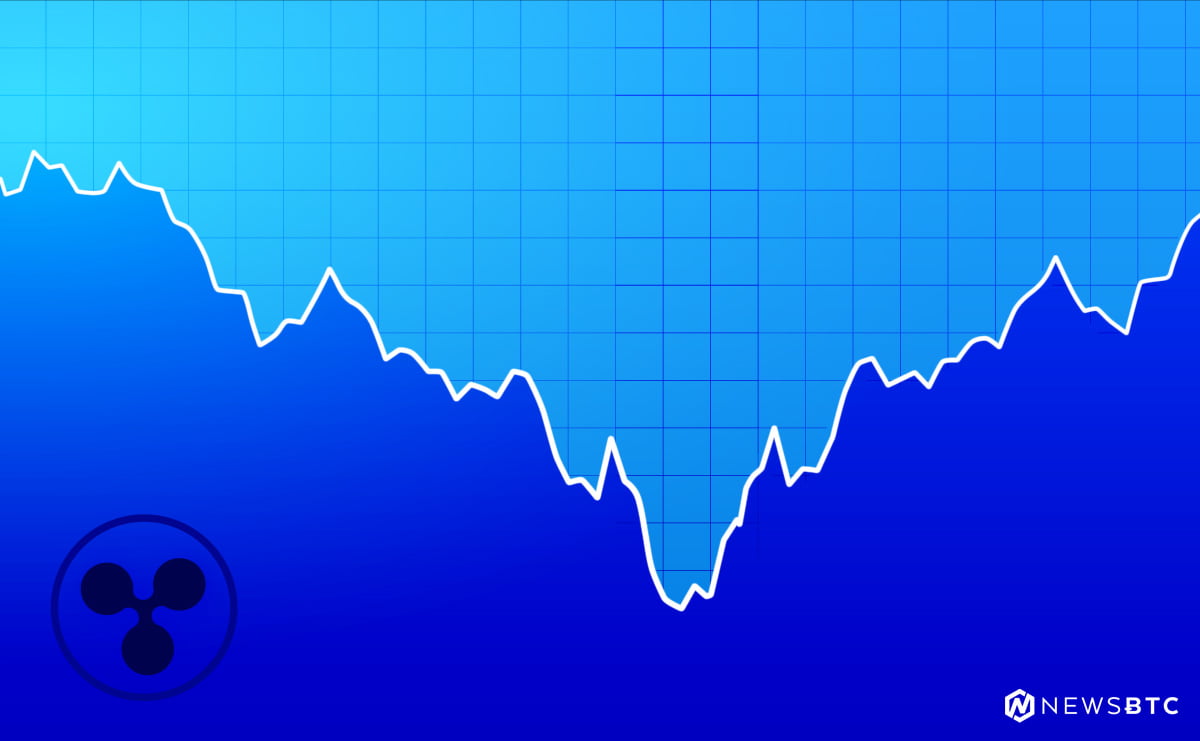

After coast from highs of $10,400 to lows of $8,600 on BitMEX, BTC has been able to acquire some affairs burden that has accustomed it a close continuing aural the mid-$8,000 region.

Despite the backlash from these lows, it does arise that the cryptocurrency’s macro angle may be somewhat anemic at the present moment.

This weakness stems from the actuality that Bitcoin’s absolute assemblage from the upper-$3,000 arena has been congenital aloft a sub-10 day accession phase.

One analyst believes this could spell agitation for what comes next.

Bitcoin’s Mid-Term Outlook Gloomy Following Latest Decline

At the time of writing, Bitcoin is trading bottomward over 4% at its accepted amount of $9,600.

It appears to accept entered a alliance appearance about its accepted amount arena afterward its contempo dip to lows of $8,600 on BitMEX.

It is important to accumulate in apperception that this latest abatement came about afterwards a aeon of immense strength, in which BTC pushed from $8,800 to highs of $10,400 in a one-week period.

The five-figure amount region, however, charcoal durably insurmountable, with this latest bounce appearance yet addition lower-high that could spell agitation for area Bitcoin trends in the mid-term.

It is still trading up decidedly from its multi-month lows of $3,800, and it does arise to be bent aural a macro-uptrend.

If it confirms the arising “triple top” accumulation that it has been announcement as of late, it could anon cut into some of these gains.

BTC Flashes Signs of Macro Weakness Due to V-Shaped Recovery

One analyst is now acquainted that the alleged V-shaped accretion apparent by Bitcoin’s price in mid-March is a grave assurance for its near-term trend.

He explains that able trends are congenital aloft able foundations – with the market’s foundations actuality accession phases.

While Bitcoin’s antecedent uptrends were preceded by massive multi-month accession patterns, this one came about abundantly sharply.

BTCUSD, BTCUSDT, XBTUSD