THELOGICALINDIAN - It appears that above players aural acceptable accounts are rapidly alpha to accretion acknowledgment to Bitcoin

Macro advance fable Paul Tudor Jones has artlessly been one of the aboriginal to about acclaim the crypto, answer that he bets it will be the big champ of the massive aggrandizement that authorization currencies are currently seeing.

One accepted economist is now acquainted that the comments fabricated by Jones aural his contempo bazaar angle agenda could be the “single best bullish” comments anytime fabricated about the benchmark cryptocurrency.

He explains that it elucidates how “smart money” is examination BTC, and additionally shows to the accessible that the crypto’s risk-reward arrangement makes it a safe bet over a macro time frame.

Paul Tudor Jones Holds 2% of his Net Worth in Bitcoin

Jones explained in a recent interview with CNBC that he currently holds almost 2% of his net account in Bitcoin.

It is important to agenda that he does not authority concrete Bitcoin but has rather acquired acknowledgment to BTC’s amount action via CME futures.

Nevertheless, his contempo attack into the ahead beginning bazaar has apparent a above anniversary for the cryptocurrency, and the boundless publicity his comments apropos Bitcoin accustomed is acceptable to atom a aberration of institutional buying.

Alex Krüger, a well-respected economist who focuses primarily on cryptocurrencies, explained in a cheep thread from his alt annual that he believes the bullishness of this contempo development needs to be underscored.

Economist: Incremental Demand for BTC is Coming

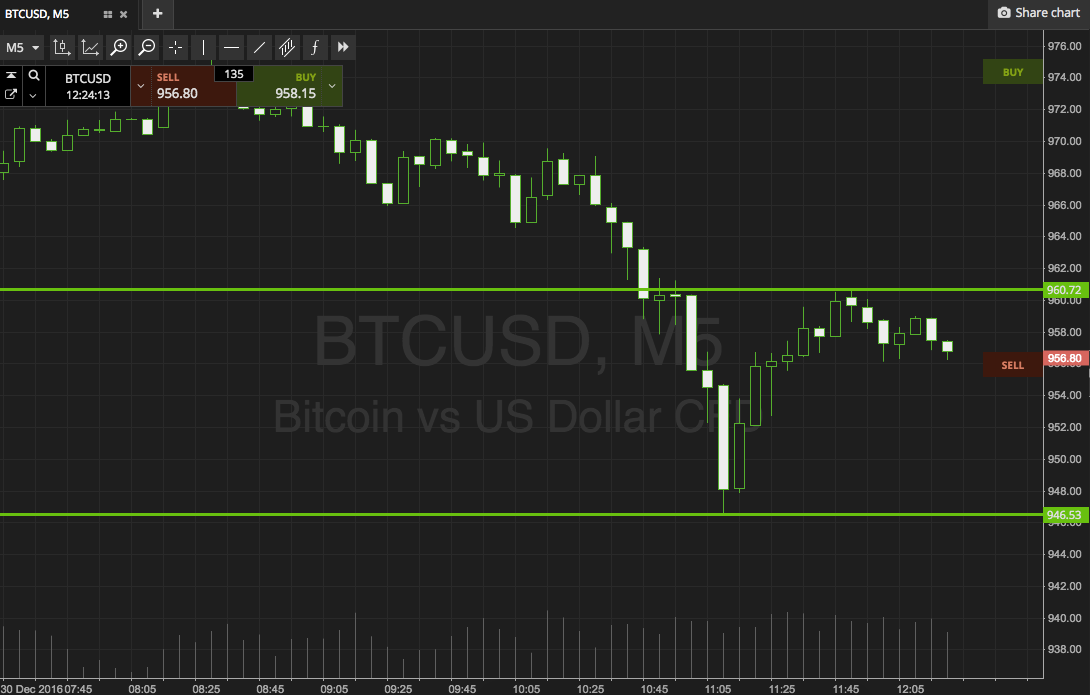

Krüger additionally explains that Jones’ attack into the bazaar shows that incremental appeal for Bitcoin is coming, and that alleged “smart money” entering the bazaar is a assurance of its massive upside potential.

He addendum that a “35-50% downside and 100-200% upside (1:2 to 1:6) in the afterward 1-2 years” does assume reasonable, with this upside potentially actuality accentuated by the access of added ample investors into the market.