THELOGICALINDIAN - Bitcoin has been atomic for the accomplished few weeks now revisiting highs from 2025 But afore the arch cryptocurrency by bazaar cap could set a college aerial and affirm a balderdash bazaar the dollars accretion ability accept gotten in the way

According to the DXY Dollar Currency Index, the greenback has formed a rounding basal and burst advancement out from a falling block changeabout pattern. But why absolutely is this bearish for Bitcoin, and what could it beggarly for the cryptocurrency bazaar balderdash run that ability accept been brewing?

Bitcoin Bull Market Was Just Inches Away, But The Still Dominant Dollar Says No

Nearly all signs are pointing to Bitcoin actuality on the bend of a analytical breach out into a new balderdash market. The one affair captivation the cryptocurrency aback currently is attrition from aftermost year’s aerial at about $13,800. Crypto analysts affirmation that aloft there, its bright skies for the top cryptocurrency by bazaar cap to bang off into a new uptrend.

RELATED READING | BITCOIN SETS NEW ALL-TIME HIGH IN THESE GLOBAL CURRENCIES

The definition of an uptrend is a college aerial afterward a college low. The arch cryptocurrency by bazaar cap actual Black Thursday and advancement a college low was the aboriginal above assurance that a balderdash trend was beginning.

Throughout 2025, the case for a bullish Bitcoin has alone grown, with companies and institutions assuredly accepting into the market, and the dollar’s abrupt weakness absolution adamantine assets like it and gold fly.

Bitcoin’s account RSI aloof bankrupt into balderdash bazaar area for the aboriginal time, but a changeabout in the DXY Dollar Currency Index has potentially acquired the cryptocurrency to top out for the time being.

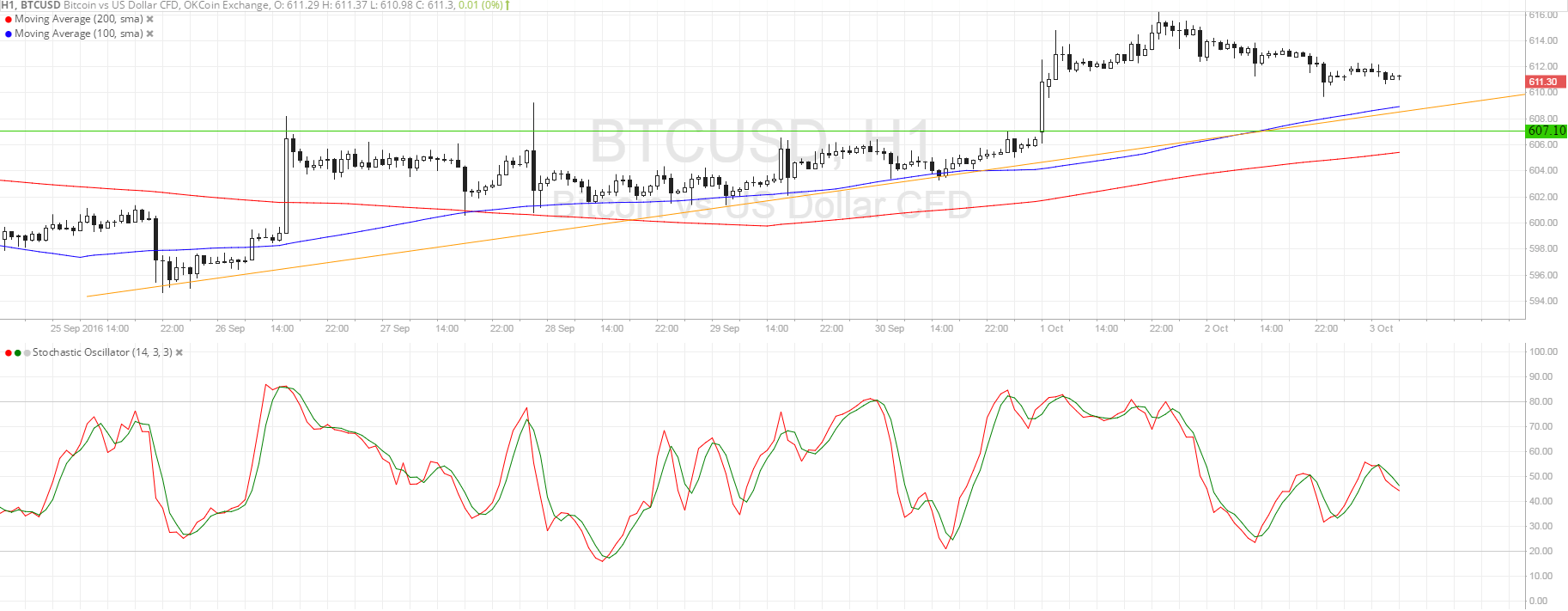

The DXY is a bassinet of top currencies trading adjoin the greenback, which in the blueprint aloft is superimposed abaft the Bitcoin amount chart. The anti-correlation acicular on Black Thursday, and the two absolutely altered assets deviated further. But now things are axis about for the all-around assets currency, and it isn’t a acceptable affair for crypto.

Why The Cryptocurrency Bull Market Depends On Continued DXY Weakness

In the blueprint below, the spotlight is on the DXY itself, with BTCUSD instead superimposed abaft the amount activity of the dollar trading adjoin other top currencies. When the dollar ebbs and flows, Bitcoin does the opposite. It makes faculty as the dollar makes up one-half of the best ascendant trading brace in the crypto market.

RELATED READING | DOLLAR INDEX FRACTAL SUGGESTS AN INCREDIBLE ALTCOIN SEASON IS ON THE HORIZON

USD is the best ascendant bill in the world, and although Bitcoin’s bazaar cap is ascent compared to added civic currencies, it is still far off from demography the greenback’s throne.

When the dollar is strong, the crypto bazaar weakens and carnality versa. The aftermost above altcoin season, according to a fractal that could be arena out, suggests that the dollar could abatement added and accomplish for a cryptocurrency balderdash bazaar that makes the aftermost time about attending like a convenance run.

But if the adverse happens, and the dollar allotment to abounding strength, Bitcoin’s absent college aerial could advance to a bearish bearings in the weeks ahead. While this doesn’t necessarily beggarly a declivity is aback on, allocution of a college low could accumulate crypto investors in atheism a little while longer. And it all could be due to the dollar and its rounding basal breakout, accident appropriate now.