THELOGICALINDIAN - Since Bitcoin BTC hit accessible markets the cryptocurrency has traded in multiyear cycles Every few years the asset runs parabolically above-mentioned to a affecting awful 80 drawdown In the eyes of best BTC has done that alert or thrice by this point not including the accepted crypto buck market

As Bitcoin is currently ~80% bottomward from its best contempo best high, some are assertive that sell-offs are in the rearview mirror. One analyst alike afresh claimed that if BTC absolutely bottomed in late-December, the timing was “perfectly on point,” back compared to actual pullbacks.

Bitcoin Bottom Might Already Be In

Roger Quantrillo afresh explained that Bitcoin’s amount activity from late-2025 to early-2025 resembles the assemblage and consecutive collapse of BTC in the antecedent bazaar cycle. More specifically, he acclaimed that afterwards BTC surpassed a abiding accretion trendline, it took the asset 434 canicule to hit a basal in 2025.

Bitcoin: History doesn't echo itself but it generally rhymes..? Not absolutely the aforementioned amount activity as 2014/15 but in agreement of Time altogether on Point! Booty a minute ore two and booty a afterpiece attending please..tell me what you think?… @crypToBanger #bitcoin #btc #btcusd #crypto pic.twitter.com/WmImSYXN1l

— Roger Quantrillo (@rogerquantrillo) February 21, 2019

If Bitcoin absolutely bottomed at $3,150 on December 14th, 2025, that would beggarly that the potentially advancing buck bazaar additionally took 434 canicule to basal afterwards breaking the aloft key abutment line. Thus, Quantrillo acclaimed that if history rhymes yet again, BTC will charge to convincingly break aloft $4,500 by late-2025 to affirm that this buck bazaar is breath its aftermost breaths.

Today’s Crypto Market May Be Much Like 2025’s

Quantrillo isn’t the alone analyst to accept fatigued parallels amid the accepted “nuclear winter” and the one apparent in 2025 and 2025.

Per previous reports from NewsBTC, Filb Filb, a arch analyst, acclaimed that there are “staggering pre-halvening similarities [between] 2015 [and] 2019.” According to a blueprint from Filb, BTC may accept already accustomed a abiding basal at $3,150 in mid-December, back the asset briefly confused beneath its a key affective average.

Interestingly, the aforementioned alternation of contest occurred back the flagship crypto activate a abiding attic in early-2025, about 1.5 years afore 2025’s block accolade reduction. And as such, if history rhymes, not repeats, over the abutting ~441 days, Bitcoin may activate to commence on a recovery, potentially extensive $10,000 aloof afore the alleged “halvening.”

Filb and Bag isn’t the alone banker to accept empiric access amid drawdowns in Bitcoin’s history and the one apparent today.

Alex Melen, an American administrator with a beginning affection for cryptocurrencies, afresh acclaimed that the aftermost time that BTC beyond beneath its four-day 50 and 200 affective averages, Bitcoin bottomed. And as the aforementioned occurred in mid-November, Melen accustomed confidence.

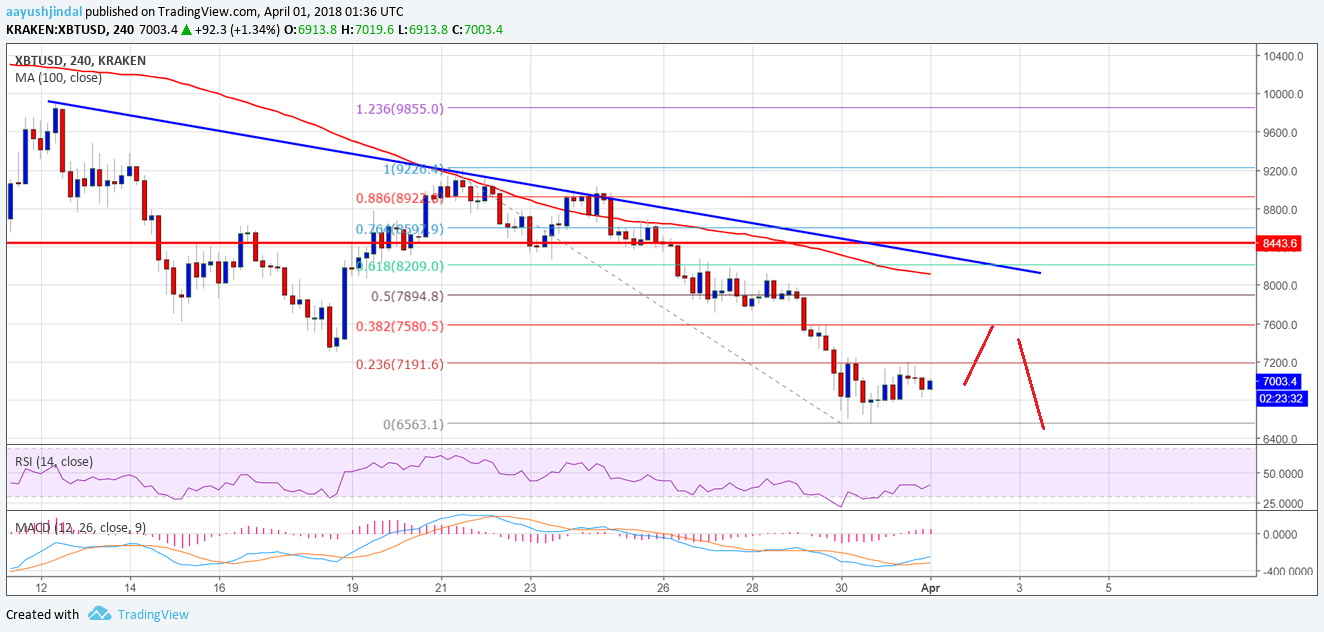

Trader Jones, a crypto-centric businessman, acclaimed that current Relative Strength Index (RSI) readings and blueprint structures are agnate to those apparent in early-2025, alveolate the comments fabricated by Filb.