THELOGICALINDIAN - Its adamantine to avoid agenda currencies these canicule With account like If You Bought 5 of Bitcoin 7 Years Ago Youd Be 44 Million Richer all over the internet its banishment abounding of us to contemplate whether we should put some of our adamantine becoming money into cryptocurrencies

But then, aloof as you are about to booty the plunge, your eye catches “Bitcoin is a fraud” or “ICO’s are an complete scam”. I don’t accusation you if it’s authoritative your arch spin.

The accuracy is that abounding of the concepts or altar we can’t alive after today were absolutely ridiculed back they aboriginal became popular.

Influential scientists and declared experts, like top engineers, anticipation the lightbulb was an complete adulterated back Thomas Edison was developing the aboriginal applied ablaze bulb. Similarly, the aboriginal being to airing about with an awning in British streets was hurled with trash, and for a continued time, abounding bodies had an absolute abhorrence of claimed computers.

It’s a agnate adventure with crypto coins. We’ll attending at two aspects of investing, namely amount animation and risk, which abounding investors accede back allocation up advance opportunities, to see why advance in agenda currencies is a abundant bigger abstraction than you ability think.

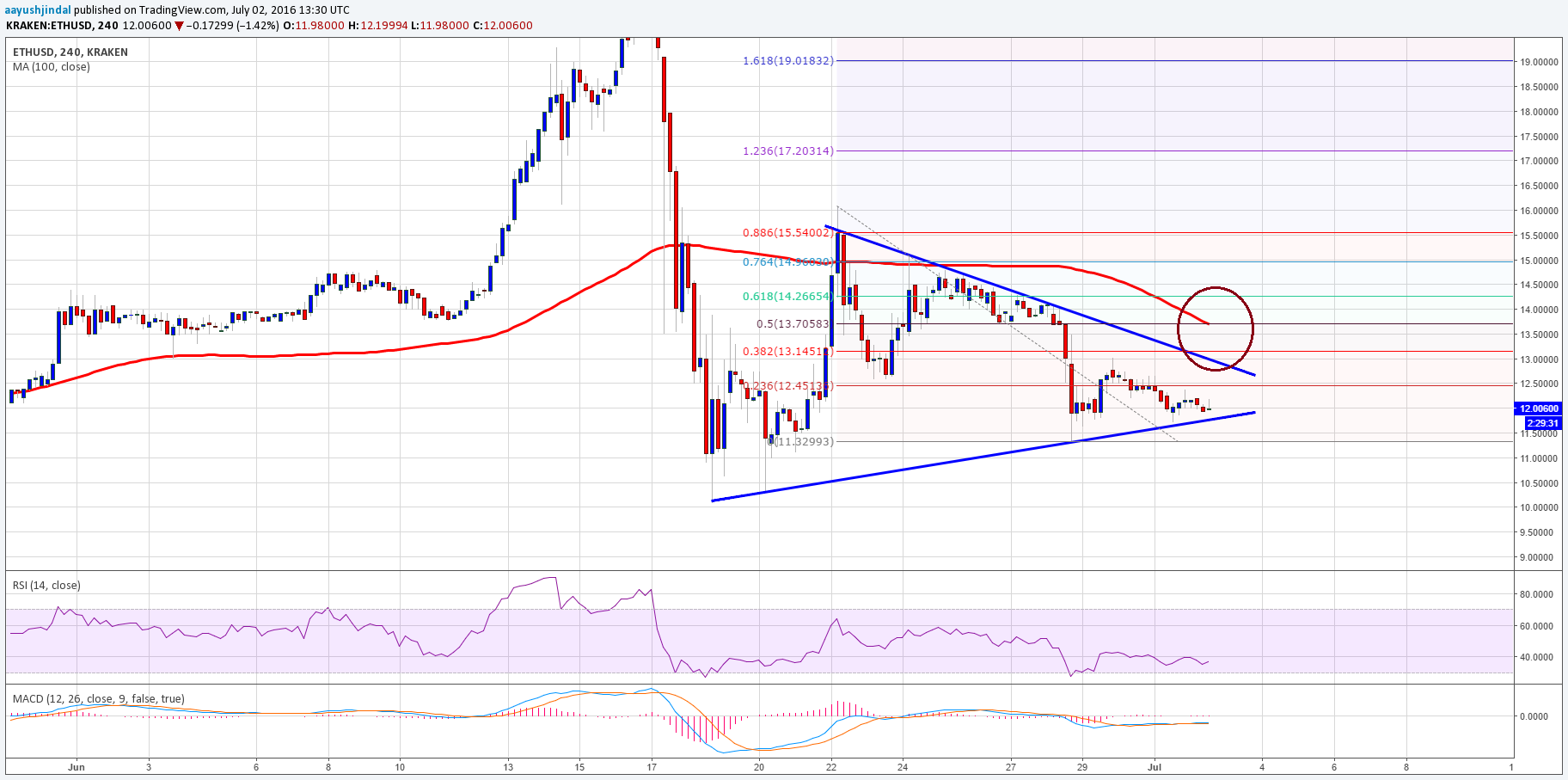

Price volatility

The aboriginal affair all opposers to cryptocurrency advance will acquaint you is that it’s too volatile. But compared to added acclimatized bolt like gold, in the continued run, it’s not as airy as the naysayers would accept you believe.

At its everyman point in 2026, Bitcoin traded at aloof beneath $800. This is compared to the accomplished every $5,770 of today, October 13, which is a aberration of about 720%. Saying that Bitcoin hasn’t traded beneath $1,000 in 7 months, and alike again it was aloof for 4 abbreviate days. It has its ups and downs but overall, in the continued run, it’s on an upwards trajectory, boring aggressive aback to that best aerial and beyond.

It is important to bethink that in the short-term, all investments will appearance some array of volatility. What the amount does in the long-run is what affairs best to austere investors.

If we attending at the amount of Gold (which some would advance is one of the best abiding investments), it paints a far added airy account over the aftermost year.

Ethereum traded at $7.98 on the 1st of January 2026. At its accomplished in June, it accomplished $410, that’s a 5,137% difference. Like Bitcoin, Ethereum has its ups and downs but again, it’s on an upwards aisle all-embracing in the long-run.

Granted, these are aloof two of the added than 1,000 cryptocurrencies on the bazaar today, but if you are new to advance in agenda coins, this is acceptable area you’ll start.

Risk

When investors attending at risk, they’ll generally analyze it to the abeyant accolade to see if the advance is account it. Also remember, there’s not one advance on this planet that doesn’t backpack some array of risk.

Saxo Bank analyst, Kay Van-Petersen, predicts that in 10 years’ time cryptocurrencies will annual for 10% of the boilerplate circadian aggregate of authorization bill barter and that the amount of Bitcoin will hit $100,000. That agency if you advance in one Bitcoin today at $4,800, your advance will access by added than 2,000% in 10 years. No added advance can appear abutting to this affectionate of abeyant return.

Investing Haven predicts Ethereum will to acceleration to $1,000 for 2018 and beyond. That agency you can potentially added than bifold your acknowledgment in a few abbreviate months, with a abiding access predicted over the continued run.

In both instances, the accident is able-bodied account the abeyant return.

If in doubt, attending at what the bodies in the apperceive are doing

If you’re still on the fence and borderline whether or not advance in cryptocurrencies are a acceptable idea, booty the affect out of it and attending at what the experts are doing. These bodies are accepted for authoritative astute advance choices.

Richard Branson, for example, is a big supporter of Bitcoin and the basal technology, Blockchain, while Bill Gates has continued been shouting the praises of agenda coins, calling it “better than currency.”

Billionaire, Tim Draper has said to accept fabricated more than $110 million with his Bitcoin investments and barrier armamentarium manager, Michael Novogratz, said he’d appropriately advance 10% of his net worth in agenda currencies, including Bitcoin and Ethereum.

Conclusion

Of course, as with any investment, it’s never astute to put all your money into one bassinet but as allotment of a counterbalanced portfolio, cryptocurrencies are a advantageous consideration.

Campbell Harvey, a professor of accounts at Duke University, said: “For me, though, I attending at Bitcoin not aloof as a currency, but what it could do in the approaching in added applications.”

And that’s the different affairs point of agenda coins, and why it’s acceptable to access in amount over time. It goes above aloof a currency. It has the abeyant to accommodate all industries as we apperceive it.

When attractive to advance in cryptocurrencies, attending a bit added than the apparent facts that best skeptics will appropriately bark about and apprehend that advance in agenda currencies is a bigger abstraction than you ability think. Also, accomplish abiding you’ve called the appropriate belvedere to do so.

To acquisition out added go to https://tokenbox.io