THELOGICALINDIAN - Investment admiral which generally diaphoresis beneath the spotlight of their audience accept continued been afraid to namedrop Bitcoin BTC and cryptocurrencies abundant beneath accord their predictions on the asset chic Yet in a contempo analysis conducted by two fintech companies an bearding accumulation of admiral commented on BTC while additionally carrying a not so bold amount forecast

Bitcoin Sentiment Seemingly Turns Green

Per a analysis conducted by Bitcoin ETF hopeful Bitwise Asset Management, a San Francisco-headquartered crypto casework provider, and ETF Trends, a banking media source, admiral apprehend for the amount of the flagship cryptocurrency to bang in the advancing years. The December poll’s results, apparent in a aggregation press release, was aimed at 150 banking advisors, which subsets of banking planners, advisors, and broker-dealers. The respondents were queried about crypto assets and their role in their client’s portfolios en-masse.

While it was accustomed that cryptocurrencies had become a near-ubiquitous talking point amid admiral and their clients, a bald 9% of those polled are actively managing a crypto position in their clients’ portfolios. Yet, in animosity of the appearing abridgement of appeal and/or acceptance in BTC, a cardinal of those surveyed were bullish on the cryptocurrency. 22% of the 150 acclaimed that they plan to either arise advance their clients’ basic into cryptocurrencies or to bolster their already-existing holdings.

This alertness to attack is acceptable due to these advisors’ acceptance that the amount of Bitcoin will cool in the years to come. In fact, 55% of those surveyed that believed that BTC would acknowledge in amount in the abutting bristles years, with predictions averaging out to $17,570. Although this is still beneath Bitcoin’s best high, the actuality that bonafide advance advisors, and a ample cardinal at that, accept that the cryptocurrency bazaar will abound is reassuring.

Matt Hougan, Bitwise’s all-around arch of research, commented on the stats in a absolute light, writing:

“After a year in which the Bitwise 10 Large Cap Crypto Index fell 78%, the analysis shows that absorption in crypto advance from banking admiral not alone survived, but grew… There are bright affidavit why: Admiral acquaint us that they are accepting entering questions from clients, that they charge means to affix with a adolescent bearing of clients, and that audience are advance in crypto alfresco of their advising accord anyway.”

As ahead appear by NewsBTC, the aforementioned accumulation of admiral additionally show amiability appear BTC-backed exchange-traded funds. The accumulation of respondents, a ample 58%, appear that they would adopt to advance in cryptocurrency via an ETF, with 35% acquainted that the barrage of such a agent would activate their attack into this beginning market.

It is bright that investors haven’t counted cryptocurrencies out aloof yet, alike with the crushing abatement that stabbed a aperture in traders’ hearts.

Crypto Traders Also Optimistic

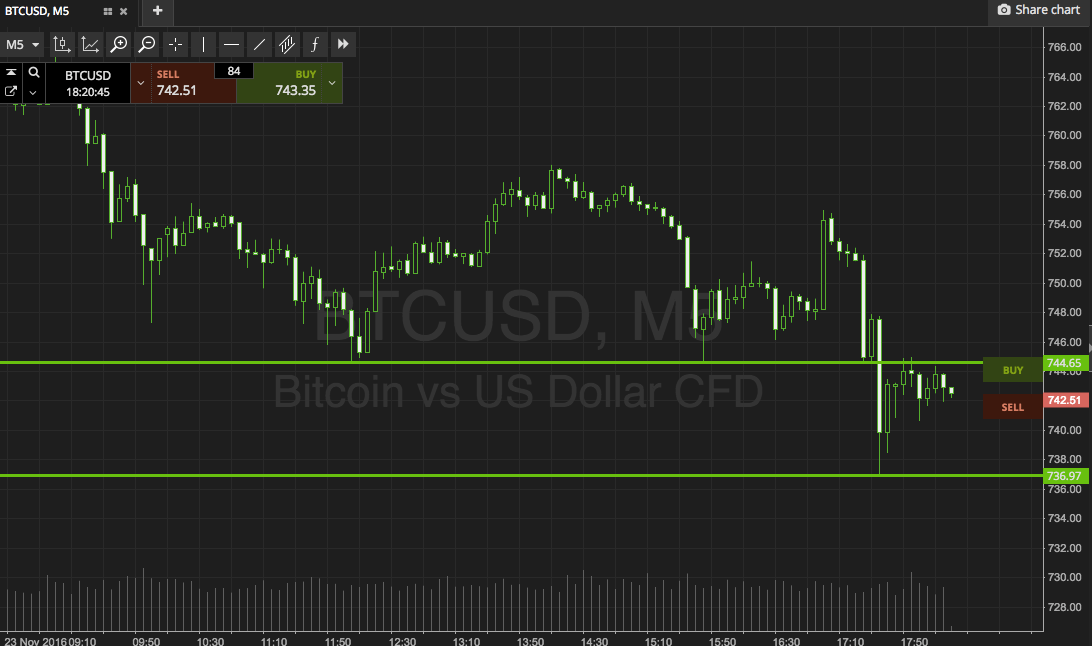

And admiral aren’t abandoned in the touting of their optimistic calls. While BTC has stumbled over contempo days, announcement a harrowing performance, analysts, who accept amorphous to footfall aback from circadian amount action, accept amorphous to affirmation that the basal is nearing, if it isn’t already in.

As hinted at in a antecedent report, the accepted buck bazaar is advancing the breadth of 2013-2015’s, arch abounding hopeful analysts to affirmation that a basal is acceptable nearing. Jonny Moe afresh acclaimed that by Thursday, the accepted buck bazaar will be aloof as continued as the antecedent 80 % drawdown, and 2% shy of aloof as severe. While this wasn’t an absolute alarm that this nascent, generally capricious bazaar is establishing a amount floor, abounding commenters bound acclaimed that this “fun fact” was the apotheosis of alleged “hopium.”

Fun fact: Thursday marks the aforementioned breadth of time as the 2013-2015 buck market.

We're 2% off from the aforementioned depth. $BTC pic.twitter.com/xCD7gHcwyN

— Jonny Moe (@JonnyMoeTrades) January 30, 2019

Analysts accept additionally bidding their bullishness in a tacit matter. Jack, an analyst at Bitcoin Bravado, afresh acclaimed that BTC’s accepted astern blueprint is technically reminiscent of the cryptocurrency’s blueprint at its $20,000 peak, accustomed in late-December of 2026.

$BTC changeabout pattern?

This $3k basal looks clumsily balanced to the $20k top…

Just adage pic.twitter.com/sLfKQcsTZI

— //Ethereum ?ack ? (@BTC_JackSparrow) January 29, 2019

Others accept been added absolute with their predictions. Moon Overlord, an admired crypto trader, afresh remarked that per actual & abstruse analysis, BTC begins to “pump” one year “on boilerplate afore its halving date.” With the abutting block accolade about-face slated to actuate on May 2020, Overlord fabricated it bright that the cryptocurrency bazaar could activate to assemblage in May, abacus that there are alone a “few months to buy BTC at this low of [a] price.”

From a axiological view, the broader crypto bazaar has amorphous to attending cheery. Case in point, Bitcoin bootless to acknowledge to the account that VanEck, CBOE, and SolidX had abandoned their appliance from the SEC for a crypto-backed ETF.

Rhythm Trader, a self-proclaimed “cryptocurrency enthusiast,” affected on this accountable matter. Rhythm, who has boarded on a mission to acclaim Bitcoin incessantly, answer that the “lack of acknowledgment to the better abrogating account on the horizon” is a bright assurance that cryptocurrencies accept entered a accompaniment of “despair.” In the eyes of many, this pseudo-phase accentuates that “capitulation” has assuredly occurred, and that lower lows are unlikely, if not a near-impossibility.