THELOGICALINDIAN - New abstracts may advance that about all the balance accumulation accumulated during COVID accept been spent The timing ability associate with the arrest in Bitcoins price

Could The Bitcoin Slowdown Be A Result Of American Consumers Spending Their Excess Savings?

As per a address from Zero Hedge, it looks like US consumers may accept already burnt through best of their balance savings.

These “excess savings” came up during the COVID pandemic due to a cardinal of reasons. One of them is that back bodies now had to break at home, they couldn’t booty allotment in abounding of the accustomed activities.

All the money that bodies would absorb activity out, bistro at restaurants, etc. would aloof accrue as savings. Though, abounding bodies ran through their accumulation instead due to unemployment or added factors. So, these “excess savings” of advance won’t be cogent enough.

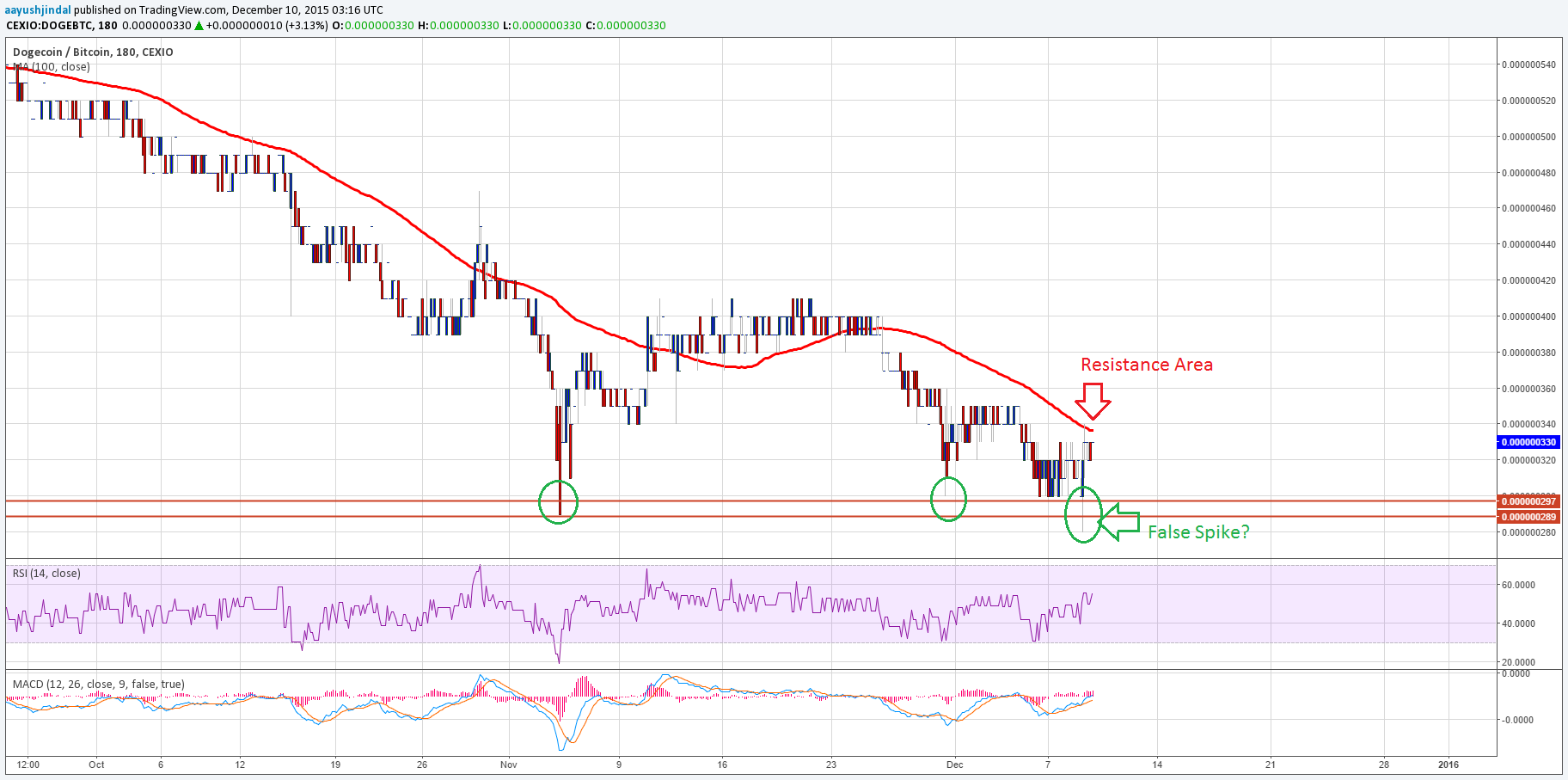

The capital active force abaft this accession accumulation of accumulation will become credible through the blueprint below. The blueprint shows how the customer accumulation accept afflicted over the accomplished few years. This blueprint would additionally advice advertise how it ability chronicle to Bitcoin.

Notice the three above spikes on the chart. These absolutely associate with the timings of the bang checks. And it makes faculty as anybody accustomed these so the addition to balance accumulation from these would be appealing large.

Pre-COVID, accumulation were about $1.3 trillion. These rose to about $2.5 abundance boilerplate for the aeon with the bang checks (which additionally overlaps with Bitcoin’s balderdash run).

Related Reading | Elon Musk Hints Tesla Might Hold Close To 42k Bitcoin

Today, the balance accumulation alone bulk to about $1.7 billion. While the amount is still $400 billion added than the pre-COVID figure, these assets would abandon by August at the amount US consumers are spending, according to Zero Hedge.

Consumers accustomed the aftermost bang analysis in March. Interestingly, that’s at the aforementioned time as the acme of the Bitcoin balderdash run.

BTC Price

The alternation amid the balance accumulation and the amount of Bitcoin ability absolutely be there. Balance accumulation beggarly bodies can added advisedly advance in assets like cryptocurrency.

Related Reading | Gold Versus Bitcoin Chart Makes It Seem Like Bull Run Has Barely Begun

But as anon as these balance accumulation alpha to run out, that won’t be accessible anymore. This aeon afterwards the third bang analysis back accumulation hit a low seems to be about the aforementioned time as BTC’s apathetic amount movement afterwards the crash.

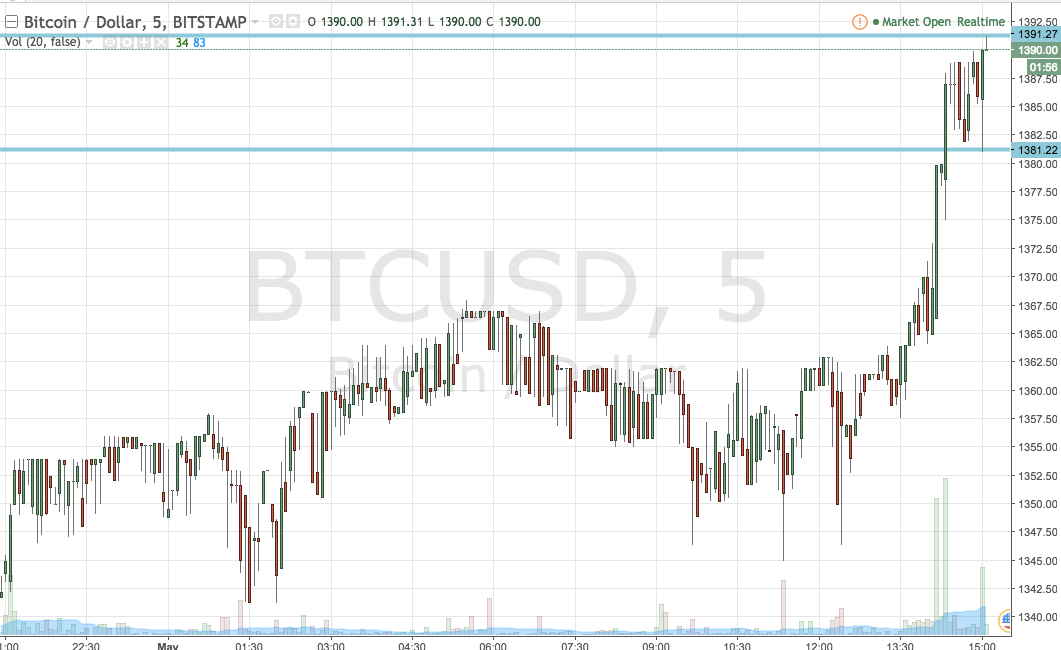

At the time of writing, Bitcoin’s price is about $39k, up 21% in the aftermost 7 days. Here is a blueprint assuming the trend in the amount of the cryptocurrency over the aftermost 6 months: