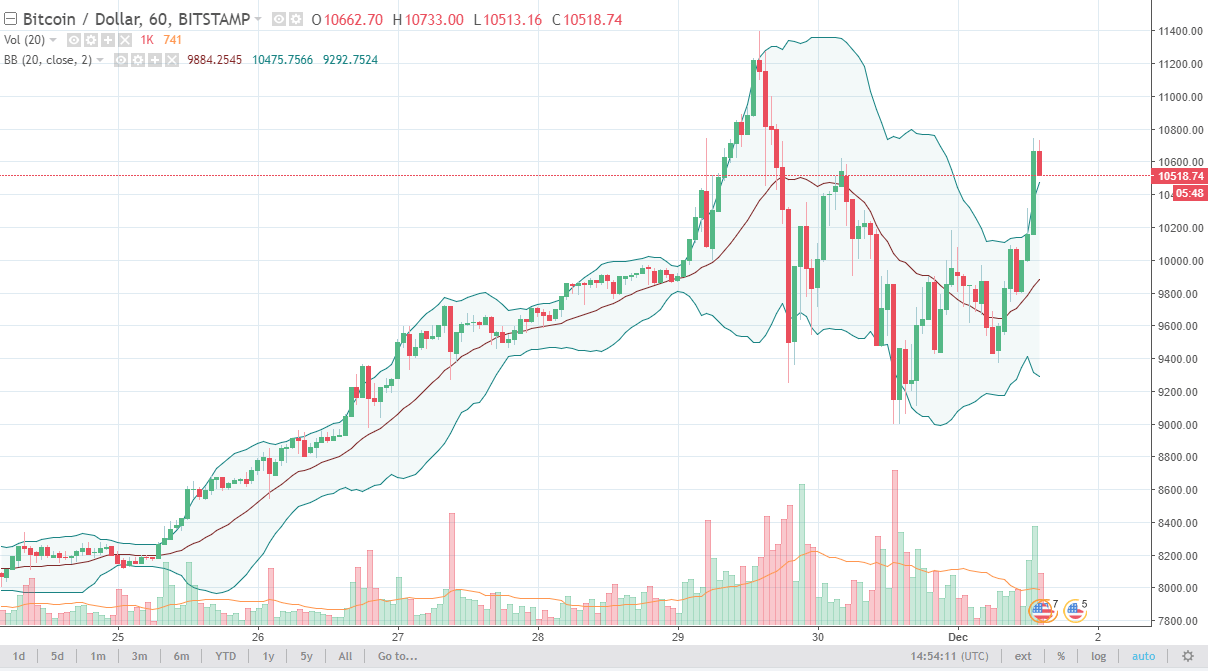

THELOGICALINDIAN - JP Morgan and Goldman Sachs are advising their audience adjoin purchasing Bitcoin a different asset whose US dollarrate has surged 8000 percent back 2026

Digital Asset Investment Management (DAIM), a California-based agenda asset abundance manager, declared that it risked accident a basic applicant aloft the action of the two banking moguls. The close claimed that it has an institutional amateur who was accessible to advance in bitcoin but afflicted his apperception afterwards speaking to his admiral at JP Morgan and Goldman Sachs.

Trust Gap

The case follows a continued history of growing distrust amid the accustomed cyberbanking and the arising cryptocurrency sector. Bitcoin’s peer-to-peer cyberbanking arrangement allows bodies to transact amount anywhere in the apple at the cheapest rates. The cryptocurrency artlessly poses a competitional blackmail to a abundant added big-ticket cyberbanking sector.

That serves allotment of the acumen why banks abhorrence Bitcoin. In 2017, JP Morgan’s arch Jamie Dimon marked the cryptocurrency as “fraud,” while activity as far as admonishing his agents with the sack if they traded bitcoin. Two years later, Bank of America accepted that bitcoin could abate its revenues in the long-term.

But the cryptocurrency has back become beneath a acquittal technology and added an anti-fiat movement. A area of investors treats it as a barrier adjoin the booming aggrandizement – aforementioned as boomers accede Gold is their safe-haven. The cryptocurrency so far has delivered amazing after-effects to its abiding investors.

DAIM, for the actual aforementioned reasons, helps audience advance Bitcoin anon in their allowance and tax-advantaged retirement accounts. On the added hand, retirement advance solutions accessible at JP Morgan and Goldman Sachs focus on bonds, securities, and agnate acceptable asset classes that are beneath airy and riskier than Bitcoin.

That somewhat explains why admiral at both the advance banks recommended the DAIM applicant to abstain Bitcoin altogether.

Diversifying With Bitcoin

As bankers connected antisocial on Bitcoin, top crypto professionals recommended their audience on demography a counterbalanced access appear the cryptocurrency. One arch analyst said that admiral in big banks should acclaim audience to put alone 3-5 percent of their net portfolio in bitcoin.

Jeff Dorman, the arch advance administrator at California-based asset administration firm, Arca, added acclaimed that owning bitcoin is alone a way to move alfresco the crisis-laden system.

Photo by Jason Pofahl on Unsplash