THELOGICALINDIAN - True to anatomy JPMorgan strategists accept been admonishing investors off Bitcoin admitting the accepted bullmarket According to a contempo broker agenda Bitcoin has surged advanced of its built-in amount apery 2026s bang afore 2026s slump

Naturally JPMorgan Wants To Rain On Bitcoin’s Parade

Bitcoin amount [coin_price] has undergone a ballsy allegation back the alpha of April, signalling the end of the about 18-month crypto-winter. However, the BTC-phobic strategists of JPMorgan, will consistently acquisition some acumen to dissuade any absorbed barter from buying.

For JPMorgan, cryptocurrency amount assets beggarly alone one affair – the overpricing of assets. In adjustment to accord the FUD an air of science, they are alike able to put a amount on it – the ‘intrinsic price.’ Which, according to JPMorgan, derives from alleviative Bitcoin as a article and artful its ‘cost of production.’

According to the strategists:

Of course, JPMorgan omits that Bitcoin does not behave like a article as its accumulation is not alone hard-capped, but its achievement is anticipated and connected behindhand of bazaar demand.

Between The Slump And The Rally, Surely There Was A Buy Signal?

Not annihilation that JPMorgan could acknowledge. Although logically, yes, there charge accept been some point that bitcoin was a buy. It seems the experts at JPMorgan absent that.

In fact, they were singing the exact aforementioned tune aback in February, back BTC was aerial at about the $4000. Aback then, JPMorgan’s ‘intrinsic value’ was just $2400, based on the ‘average banknote cost of a bargain Chinese miner’.

However, all that is absolutely actuality charted actuality is a asperous account of miner’s accumulation margins.

Still, afore that the association at JPMorgan were determined that Bitcoin had no ‘intrinsic value’ at all, added than conceivably in a dystopian approaching scenario.

“Great to see JPM assuredly acceptance that Bitcoin has built-in value,” commented EToro chief bazaar analyst, Mati Greenspan. “Now delay till they accept that miners who run a surplus tend to activate hoarding.”

JPMorgan Disclaimer: We Don’t Really ‘Know’ Anything

Many in the mining association accept argued that the actual abstraction of a ‘marginal cost’ or ‘break-even point’ is flawed. With a bound supply, miners can alone accept a bigger allotment of that about to added miners.

JPMorgan alludes to the ‘challenge’ of defining a ‘fair value’ for BTC in a admonition to its strategist’s note.

So… ‘Based on our, absolutely somewhat arbitrary, valuation, don’t buy bitcoin’. Is this what passes for able banking admonition these days?

Do you accede with JPMorgan’s appraisal of bitcoin’s accepted value? Share your thoughts below!

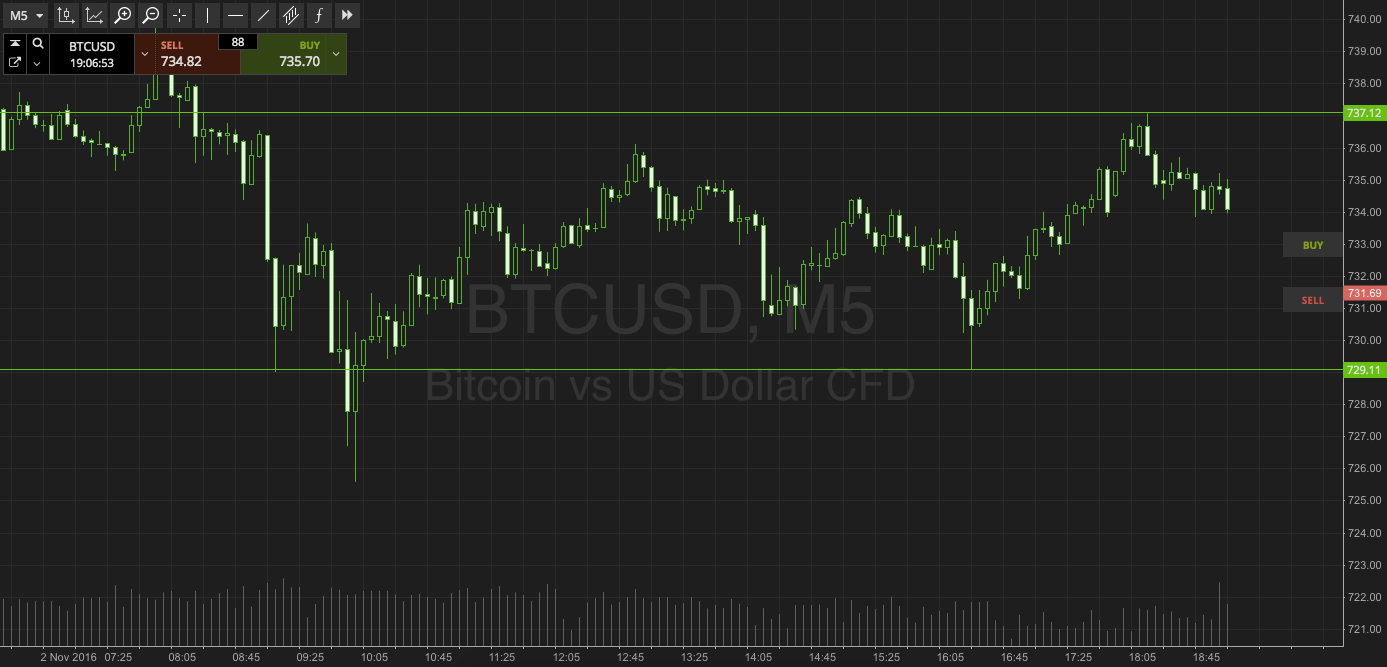

Images via Shutterstock, JPMorgan/Bitfinfocharts.com