THELOGICALINDIAN - Its been an atomic accomplished 24 hours for Bitcoin and the cryptocurrency market

After architecture bullish drive for the accomplished seven weeks, BTC finally bankrupt accomplished $10,000 today, announcement a added than 170% accretion back the $3,700 lows of March. While this move was abate than BTC’s 20% achievement in two canicule apparent aftermost week, analysts say it is technically important.

One top macro analyst, in fact, said that the affairs Bitcoin sees “vastly college prices” has aloof “risen dramatically.” And in adage “vastly college prices,” this analyst is talking about hundreds of bags of dollars per coin.

BTC Could Soon Go Parabolic… Again: Top Analyst

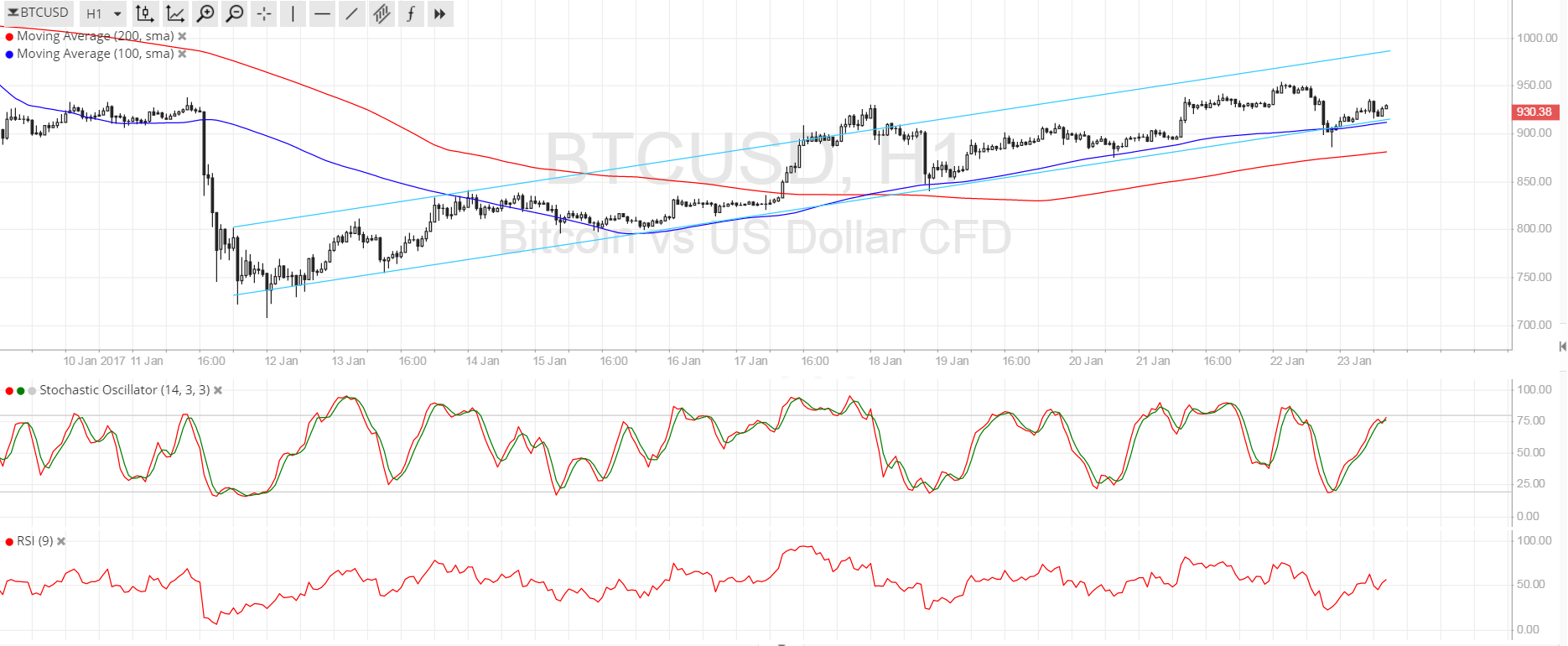

Referencing the blueprint below, Raoul Pal — CEO of Real Vision and a above Goldman Sachs controlling — said that Bitcoin’s move today was a “KEY abstruse break” which agency the “probability of awfully college prices has risen dramatically.”

The investor’s blueprint beneath illustrates this point well: the balanced triangle arrangement that Bitcoin was trading in back early-2026 has assuredly burst to the upside, creating a absolute blemish pattern. The blueprint predicts a $40,000 Bitcoin price, according to Pal.

Add to this a assemblage of bullish fundamentals, namely the approaching halving and axial coffer money-printing, and you accept a compound for success, the broker explained. Concluding his thoughts, Pal wrote:

Wall Street Veteran Throws Weight Behind Bitcoin

It isn’t alone Pal who has been signaling abutment for Bitcoin amid the Wall Street adept class.

As appear by Bitcoinist, billionaire macro broker Paul Tudor Jones aloof threw his weight abaft the top cryptocurrency. Jones is a adept macro broker that is account over $5 billion, accepting fabricated arresting calls over the advance of his multi-decade career.

In a bazaar analysis agenda alleged “The Great Monetary Inflation,” the barrier armamentarium administrator said that he is allocating some of his fund’s basic to Bitcoin futures.

As to why, he aboriginal remarked that the advancing amount activity in Bitcoin and the macro accomplishments reminds him of the mid-2026s, above-mentioned to a massive billow in the amount of gold. After bottoming out in 1976-97, the amount of gold added than quadrupled in the abutting three years, assault its antecedent high. The aforementioned accident to BTC could aftereffect in a new best high.

Bitcoin is additionally adorable to Jones because he sees it as a potential abundance of value in a apple area axial banks are abasement authorization money. He, in fact, alleged it the “fastest horse in the race,” referencing how it has the adeptness to outdistance added asset classes in the years ahead: