THELOGICALINDIAN - MicroStrategy has accepted it is not slowing bottomward anytime anon back it comes to affairs bitcoin Not continued afterwards account bankrupt that the close had taken a 200 actor accommodation to acquirement bitcoin it has fabricated its aboriginal advertisement that it has purchased BTC apparently application the accommodation it had anchored beforehand This latest acquirement is one in a continued band of purchases that accept been activity on for added than a year putting the aggregation durably in the advance with its BTC holdings

MicroStrategy Buys 4,167 BTC

In a contempo tweet, CEO of MicroStrategy Michael Saylor fabricated the company’s bitcoin acquirement public. The cheep explained that the acquirement had been fabricated as of Sunday, 4th, April, and had added addition 4,167 BTC to its holdings. In total, MicroStrategy had purchased about $190.5 actor account of BTC at the time, advancing out to an boilerplate of $45,714 for anniversary BTC.

Related Reading | The Blockchain Is The Future Of Hollywood, Departing WarnerMedia CEO Says

This acquirement had bumped up the backing of the close already more. Already the about traded aggregation with the better bitcoin holdings, MicroStrategy now holds about 129,218 BTC in total. These BTC accept been purchased for about $3.97 billion, putting the boilerplate amount of anniversary bitcoin at $30,700 apiece. This agency that the aggregation charcoal durably in accumulation from its bitcoin backing authoritative this a acceptable comedy for MicroStrategy over time.

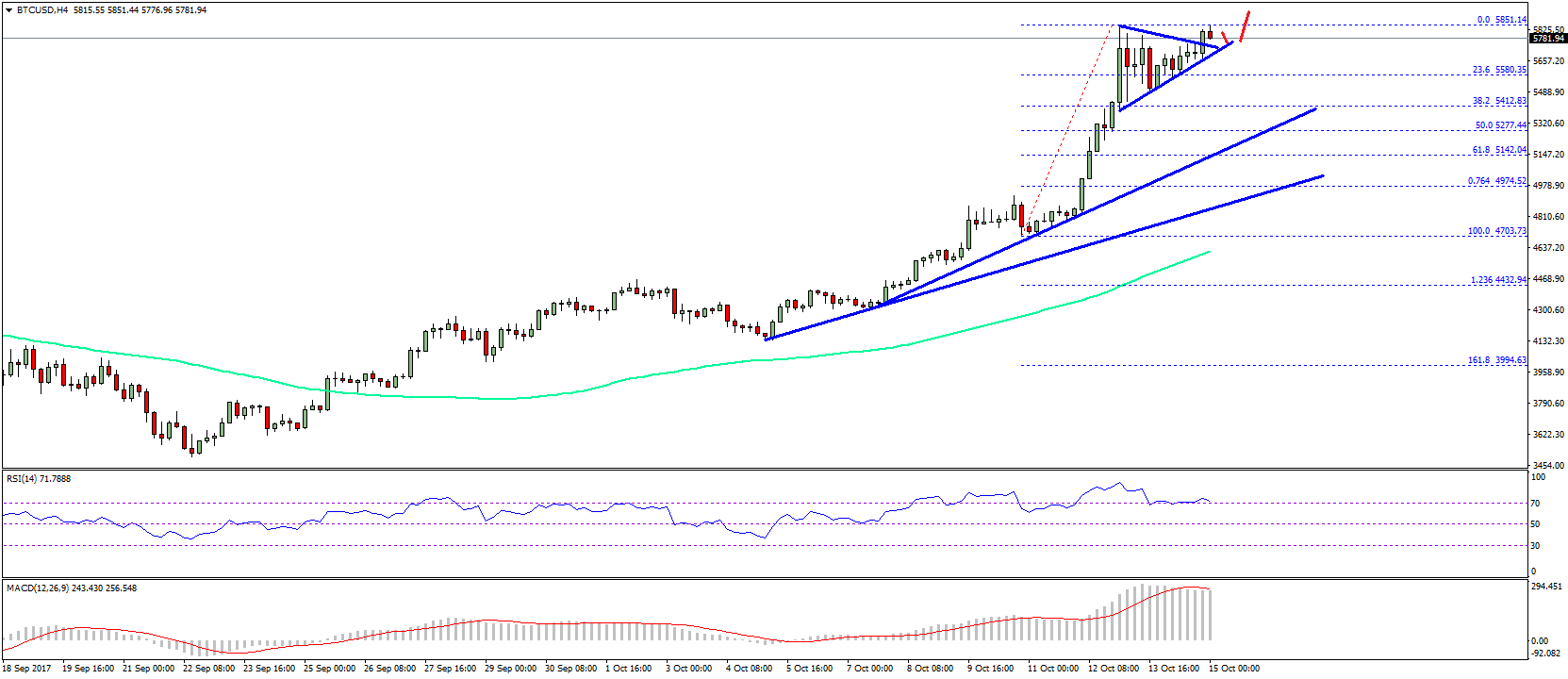

At accepted prices, the absolute amount of the MicroStrategy BTC backing stands at a little over $5.8 billion. This puts the close in accumulation to the tune of about $2 billion total. Additionally, the aggregation now holds 0.615% of the absolute BTC supply.

Why Hold Bitcoin?

MicroStrategy’s Bitcoin action has been a acceptable action for the company. Putting bitcoin on its antithesis area has been assisting so far alike through the dips. It has far outperformed arch stocks in the accounts market, abiding assets at an accelerated rate.

For MicroStrategy, its accommodation to acquirement bitcoin has been no agnosticism acceptable for its stock. Since the aggregation holds a ample bulk of debt-financed BTC, it has fabricated its allotment amount carefully activated with the agenda asset’s price. This agency that with BTC in profit, the MicroStrategy banal tends to do well.

Related Reading | The ‘Merge’ Will Drive More Interest In Ethereum, Says Bloomberg Analysts

MicroStrategy is not the alone publicly-traded aggregation to own bitcoin though. Others like Tesla, Square Inc, and Galaxy Digital all own bitcoin. It is fast acceptable an asset that companies appetite to put on their antithesis sheets.