THELOGICALINDIAN - Bitcoin traders should get acclimated to adverse added shocks from Treasury markets alike as the cryptocurrency goes through a able backlash phase

With coronavirus cases falling, addition annular of government bang attractive likely, and millions of Americans accepting vaccines anniversary week, expectations accept surged college about how bound the US abridgement could aggrandize this year. A Reuters poll showed that 90 percent of the 120 economists accept the US abridgement would ability pre-COVID-19 levels aural a year.

Bitcoin Faces Headwinds

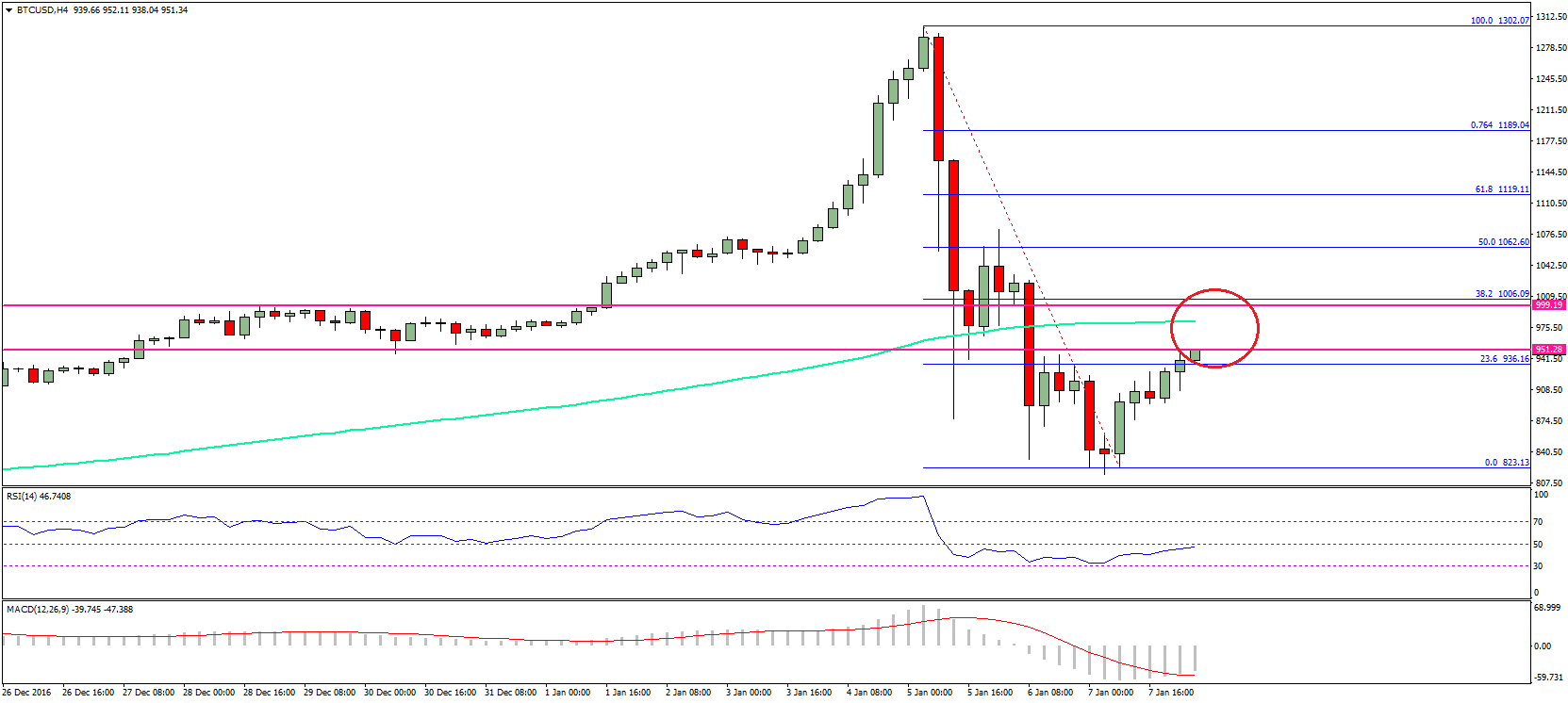

Expectations of a stronger abridgement accept pushed abiding absorption ante higher, with the 10-year Treasury agenda acquiescent 1.455 percent against 0.93 percent at the year’s beginning. While that is a accepted acknowledgment to optimistic bread-and-butter outlooks, it has airish risks for assets that logged supersonic balderdash runs amidst low-yielding environments back March 2020.

They accommodate Bitcoin, which has surged by added than 1,200 percent from its mid-March nadir. Investors chose it as an another adjoin poor yields, alongside assertive sectors in the US banal bazaar (read tech shares) that offered to break assisting during the coronavirus-induced lockdowns.

FactSet abstracts shows that the S&P 500 now traded 22 times college than its estimated balance over the abutting year. It is the accomplished price-to-earnings arrangement in 20 years, alike college than what it was afterwards the 2009 bread-and-butter crisis. As a result, alike a bashful move in yields tends to account airy moves in overvalued stocks.

On the added hand, Bitcoin expects to blot the burden as continued as Treasury yields acceleration on US bread-and-butter advance prospects. Nevertheless, any abrupt fasten in absorption ante could affectation risks for the cryptocurrency, accustomed how it adapted lower by added than 21 percent aftermost anniversary as band sell-off best abrupt momentum.

Rate Hikes

The Federal Reserve admiral accept clarified that they plan to leave concise absorption ante near-zero while affairs Treasurys and mortgage balance at a clip of $120bn per month. But if the coronavirus crisis fades abroad afterwards a speedier anesthetic program, again it may catechism the axial bank’s charge to abide its asset purchasing program.

Such ambiguity could advance to college animation in band markets, affecting Bitcoin and US stocks in the process. Meanwhile, a audible amount backpack from the Fed could accident putting the cryptocurrency on a acclimation advance downwards.

In added words, Bitcoin’s sell-off aftermost anniversary could be a examination of what a afraid band bazaar could do to the cryptocurrencies.