THELOGICALINDIAN - Step abreast CoinMarketCap your time may be up theres a new beeline ballista in boondocks with reliable bitcoin trading aggregate metrics Following contempo analysis and criticism of CMCs abstracts accumulating methods a New Yorkbased another has stepped into the fray

Bitcoin Trading Volume Overexaggerated

CoinMarketCap has, for a continued time now, been the go-to abode for all kinds of cryptocurrency metrics. In fact, it is a top-500 website globally.

Initially, as the name suggests, it listed cryptocurrency prices, ranked on their absolute bazaar capitalization. The problems arose back it began baronial exchanges based on circadian trading aggregate – as appear by the exchanges themselves.

An barter which ranked awful could command added badge advertisement fees; afterwards all, who wouldn’t appetite their badge to be apparent to all that traffic. So it was benign for an barter to address college aggregate than it absolutely processed, through wash-trading or simple misreporting lying.

As a result, according to CMC data, 15% of Bitcoin’s absolute bazaar cap afflicted easily in the aftermost 24 hours. As it does every day.

Uncovering Fraudulent Exchange Volumes

The fightback adjoin these volumes began with reports from the Blockchain Transparency Institute (BTI). Through a always developing methodology, the Institute accent anytime accretion affirmation of ablution trading. In December, it detected affected aggregate in 70% of the top 10 exchanges listed on CMC, with absolute aggregate actuality beneath than 1% of that appear in some cases.

Then aftermost week, in a presentation to the SEC, Bitwise claimed that 95% of appear aggregate was fake. This led CMC to accept that concerns are ‘valid’, and advertise a accessible set of accoutrement to access transparency.

New ‘Real 10’ Metric Filters Fake Volume

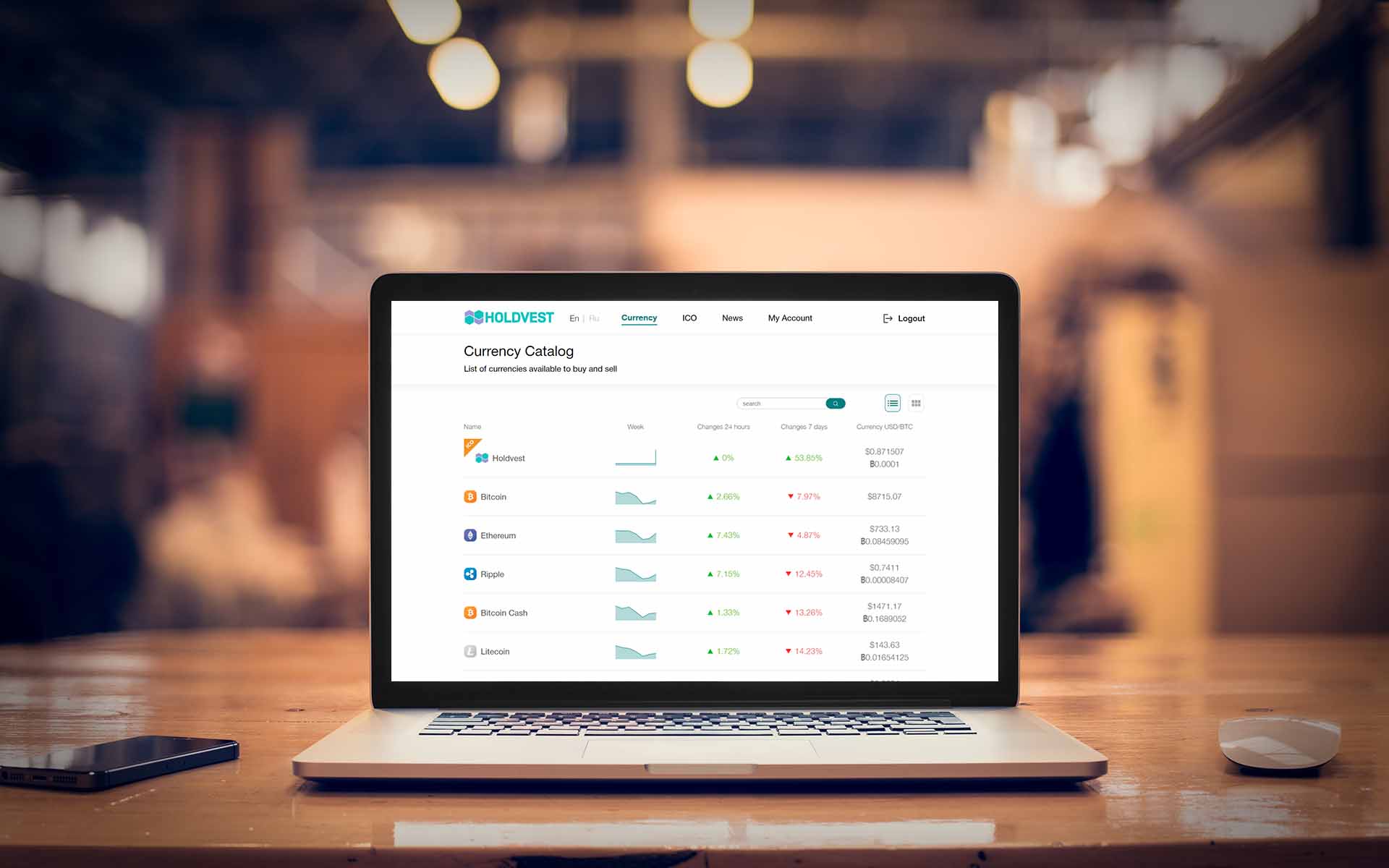

However, NY-based metrics and abstracts provider, Messari may accept baffled CMC to the punch. They this anniversary added a ‘Real 10’ aggregate metric to their OnChainFX dashboard. This gives a circadian trading aggregate amount based on alone the ten exchanges Bitwise begin not to affected volume.

Also, announced, although not yet added to OnChainFX, is a ‘Liquid Bazaar Cap’ metric. This addresses addition affair afresh reported by Bitcoinist, that of CMC’s Bitcoin bazaar ascendancy statistic. Whilst CMC accord no weight to circadian traded aggregate (as able-bodied it shouldn’t because the bulk of affected aggregate it reports), a metric because both bazaar cap and aggregate is a actual advantageous benchmark.

So Is It Time To Update Our Browser Favorites?

Maybe. Whilst far from perfect, Messari’s OnChainFX dashboard seems like a actual advantageous resource, and we accept no abstraction how continued CoinMarketCap will accumulate us cat-and-mouse for its bigger tools.

Certainly, it goes to aback up Bitwise’s affirmation that:

However, blank all aggregate alfresco of the ten ‘genuine volume’ exchanges doesn’t accord us the abounding picture. The assignment of the Blockchain Transparency Institute gave an appraisal for the the bulk of 18-carat volume, alike for apprehensive exchanges.

The all-inclusive majority of false-reporting exchanges had over 95% of their aggregate which was fake. Although some, such as Huobi and HitBTC, had 18-carat volumes of about 25% that which they reported. Perhaps BTI are adamantine at assignment on a alive baronial arrangement of their own, which includes the 18-carat aggregate arrangement at alike dodgy exchanges.

Or conceivably we’ll aloof accept to use the best accoutrement accessible to us at any one time. For now, it would assume that is no best CoinMarketCap.

Will you still be blockage CoinMarketCap afterwards the affected bitcoin trading aggregate beating or switching to alternatives? Let us apperceive in the comments below!

Images via Shutterstock, Messari.io