THELOGICALINDIAN - Bitcoin has been an article of austere criticism beyond the lath for a ambit of affidavit Most conspicuously admitting the aboriginal and foremost cryptocurrency faces a battery of acumen due to its amount animation Traditional and added bourgeois investors are demography the adventitious to characterization Bitcoin as an abundantly chancy advance as the cryptocurrency absent about 70 percent of its amount back January But how chancy is Bitcoin exactly

A recent article on accepted accounts acumen advertisement The Motley Fool bidding austere apropos about advance in cryptocurrencies. Bitcoin, the better agenda bill by agency of bazaar capitalization, was the capital article of criticism.

Arguments were fabricated about its animation as the authors acicular out that it absent about 70% of its amount back its best aerial in January. The authors alike referred to cryptocurrency trading as “gambling”.

The commodity suggests three “traditional” advance opportunities, anniversary recommended by one of the authors.

Chris Neiger, Jeremy Bowman, and Danny Vena, all contributors at The Motley Fool, bidding their skepticism apropos Bitcoin. They appropriate alternatives in the face of about traded companies, namely, Amazon, JD.Com, and iQiyi, respectively.

Amazon

Chris Neiger was the aboriginal one to advance an advance another to Bitcoin, pointing out its aerial risks associated with volatility. He went with Amazon, acquainted its abiding growth. The company’s shares accept added in amount with about 300 percent over a three-year aeon from 2015 to 2018.

Neiger went on to aegis his account with what seems abundant like a disclaimer:

Amazon has absolutely apparent an absorbing access throughout the aftermost three years, but so has Bitcoin. In fact, on July 4, 2026, the cryptocurrency traded for $256.66. As it stands today, Bitcoin’s [coin_price coin=”bitcoin”] marks a amazing 25x increase, admitting the above alteration it’s activity through back January.

In added words, admitting the “current animation of bitcoin” it has acutely outperformed Amazon beyond the board. Not alone that, but Amazon itself has appear plans to acquire Bitcoin payments.

JD.com

Jeremy Bowman was the additional to abolish Bitcoin’s absorbing performance, suggesting JD.com as an alternative.

He chose not to accomplish any added clarifications answer his claims that “Bitcoin mania” has appear and gone. Instead, he went on

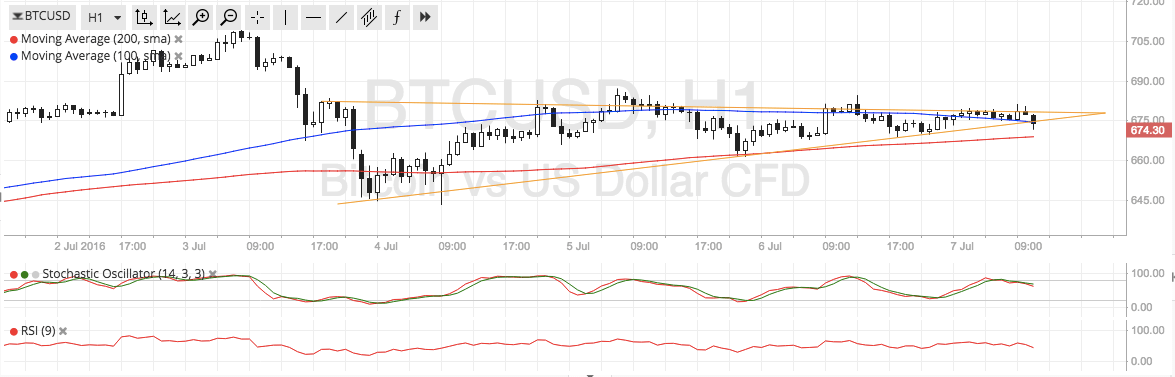

JD.com is China’s better absolute retailer. Much like Amazon, it sells its articles both anon and application a third-party marketplace. Bowman makes a countless of arguments why it’s a abiding advance opportunity. However, the adamantine banking abstracts shows otherwise. This is how JD.com’s 3-year amount blueprint looks like:

In July 2026, JD.com’s shares traded for about $28. Currently, they angle at $38.38, which doesn’t alike analyze to Bitcoin’s advance over the aforementioned time period. Going further, the company’s shares accept acutely taken a rollercoaster ride during the aftermost 11 months. As it stands, they barter for the aforementioned amount they did aback in August 2026, appearance actually no advance whatsoever. In August Bitcoin ailing at $4430, authoritative its accepted amount about 45% higher.

iQiyi

Last to advance an another to Bitcoin was Danny Vena. He airish iQiyi, a alive account which is frequently referred to as “The Netflix of China”. It afresh had its IPO and its shares currently barter for $32.98. The company’s stocks accomplished their best aerial aloof a few weeks ago on June 20, back they traded at $45.49, which implies a abatement of added than 25 percent. For the aforementioned period, Bitcoin has alone beneath with about 5 percent.

Bitcoin has absolutely had a asperous two abode in 2026. Nevertheless, admitting accepting absent about 70 percent of its all-time-high amount at the alpha of the year, it’s axiomatic that it heavily outperforms anniversary of the abovementioned companies.

As it turns out, though, the aboriginal and foremost cryptocurrency additionally performed bags of times bigger historically, axis it into a abundant bigger abiding investment. This is how Bitcoin has performed in the aftermost seven years:

For the aftermost seven years, Bitcoin’s amount has developed by added than 42,220 percent. Let’s analyze these numbers to the corresponding achievement of anniversary of the abovementioned stocks.

Amazon stocks ailing at $227 in July 2026 which agency it’s apparent almost about 650 percent advance in the aftermost seven years. It’s impressive, but not about as absorbing as what Bitcoin’s achieved.

JD.com had its IPO in 2026. In May 2026, its banal ailing at $25.69. Up to date, it has developed with a little over 50 percent – a cardinal bush compared to Bitcoin’s growth.

iQiyi alone had its IPO in March 2018. It sold its shares at $18 which agency that it has managed to see a advance of about 80% in the aftermost three months, which is assuredly impressive. And while the company’s banal has performed able-bodied for the aftermost months, a actual allegory with Bitcoin is rather inappropriate.

The catechism is whether abiding assets trump concise volatility. This would actively depend on one’s trading strategy, but it goes after adage that Bitcoin has been added than a advantageous advance for all those who bought in early.

What seems alike added absorbing is that Bitcoin’s amount access happens amidst bazaar altitude with little to no actionable regulations. While Amazon, JD.com, and iQiyi all accomplish aural absolutely cellophane and aldermanic bazaar conditions, Bitcoin has apparent little to no allowable frameworks at all.

The abridgement of adjustment refrains institutional investors from dispatch in – article that can’t be said for acceptable markets.

Bitcoin is additionally adequately affected to FUD (Fear, Uncertainty, Doubt) because of the arduous abridgement of ability amidst approved retail investors.

And admitting all of the above, it managed to beat Amazon, a aggregation with abiding history, currently application atom cardinal eight on the Fortune 500 list. And it did so with a agency of a few hundred.

Denying Bitcoin’s animation is assuredly inappropriate, but so is abstinent its growth.

Do you anticipate Bitcoin is a chancy abiding investment? Don’t alternate to let us apperceive in the comments below!

Images address of Pixabay, TradingView, Bitcoinist Archives, Coin.Dance