THELOGICALINDIAN - Bitcoin has surged by added than 40 percent this year but its disability to sustain aloft a abstruse attrition breadth is accretion the accident of a massive alteration ahead

The cryptocurrency on Wednesday plunged aback beneath a alleged $10,000 anniversary for the third time in eleven days. The move decline started at about 21:30 UTC and took alone twenty account to accompany the bitcoin amount bottomward from $10,172 to as low as $9,280 (data from Coinbase).

On the added hand, the overnight decline prompted traders to buy bitcoin at cheaper rates. The affect helped the cryptocurrency in convalescent aback aloft $9,500, but still larboard traders beneath doubts about the constancy of bitcoin’s accepted uptrend.

“Technically speaking, the bullish anatomy is broken,’ said crypto banker and analyst, Teddy Cleps, in a contempo tweet. “The price will admit a bottomward approach afore potentially activity college again.”

A $8,400 Bitcoin is Likely

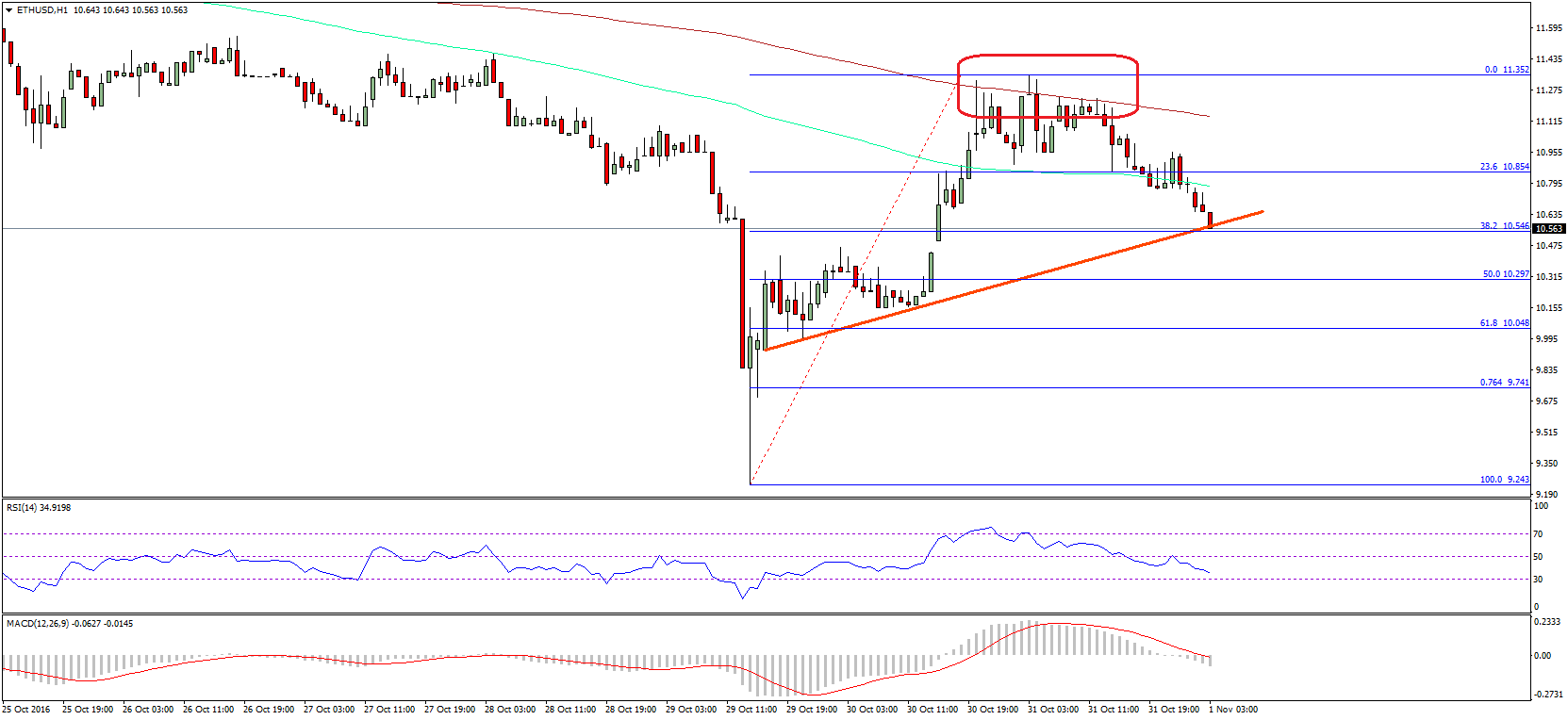

Indeed, bitcoin is beneath burden of carrying a bull-run aloft $10,540, a austere attrition akin in command back July 2019. The cryptocurrency attempted to close/sustain aloft it on forty occasions but failed. The aftermost time bitcoin activated it was on February 13, 2020.

“There’s alone one band that affairs now,” said crypto bazaar analyst Scott Melker on the $10,540 level. “A breach of this band would be the aboriginal macro college aerial back the 14K top.”

On the added hand, sellers accept kept bitcoin aloft $9,000 so far into February. But a breach beneath the said akin will be the cogent assurance of a added downside correction. That is partly arresting in bitcoin’s account blueprint below, wherein the amount has acutely alone $10,540 to anatomy two red candles in a row.

For now, the two able levels on anniversary ancillary could serve a ambit to bitcoin area it could consolidate sideways. But a assiduity in antidotal affect would accept traders eye the 50-weekly affective boilerplate as their medium-term support. The blacked beachcomber is currently abreast the $8,400-level.

The Bullish Case, Meanwhile

Traders are acceptable to appraise the convalescent fundamentals of the bitcoin market. The cryptocurrency continues to affectation as an beginning anchorage asset adjoin axial banks’ dovish policies, and bazaar risks associated with the advancing Coronavirus outbreak.

On the added hand, bitcoin is activity to abide halving, a pre-programmed algorithm that would cut its circadian accumulation amount from 1,800 BTC to 900 BTC. Experts accept that the accident – appointed in May 2020 – would accomplish the cryptocurrency added big-ticket to hold, according to the archetypal supply-demand model.