THELOGICALINDIAN - Bitcoin and the aggregated crypto bazaar accept flashed some signs of weakness over the accomplished 24hours with the criterion agenda asset addled bottomward to the lower abuttals of its longheld trading ambit in a aciculate brief movement

This latest animation comes as assorted factors activate stacking up in seller’s favor.

One such agency is the improvement of the PlusToken Ponzi Scheme bond its massive cryptocurrency holdings. This is a assurance that the now-defunct Chinese-based betray is attractive to offload added of their holdings.

In the past, PlusToken has been active as actuality the antecedent of abundant BTC and market-wide selloffs throughout 2019. It is accessible that they will abode some immense downwards burden on Bitcoin in the weeks and months ahead.

Another agency that could stop the criterion cryptocurrency from aggressive any added is massive outflows from miners – a assurance that they are additionally planning to offload their crypto backing in the near-future.

Bitcoin Bears Rejoice as PlusToken Transfers $458M Worth of Crypto

PlusToken affective account throughout 2026. The Ponzi arrangement blanket billions of dollars’ account of cryptocurrency from biting victims, and none of these funds were anytime bedeviled or alternate to investors.

Some investors do accept that the betray – which tends to dump their crypto holdings into able bazaar altitude – will abide agreement immense burden on the cryptocurrency bazaar in the years ahead.

This could arrest any abeyant emblematic rallies that beasts attack to atom in the months and alike years ahead.

Earlier today, Spencer Noon – the arch of DTC Capital – spoke about the latest accumulation of PlusToken-related transactions, acquainted that the amount of the crypto they accept confused this anniversary totals at about $500 million.

Most of this is broadcast amid Bitcoin and Ethereum.

“This anniversary the afterward #PlusToken funds accept been on the move to exchanges and new addresses for mixing: – 22k BTC ($203m USD) – 789k ETH ($183m) – 26m EOS ($68m) – 20m XRP ($4m). The big question: can the crypto markets blot this aggregate or are we headed lower?”

Miner Outflows Strike a Blow to Bitcoin’s Bull Case

PlusToken isn’t the alone abeyant antecedent of affairs burden that may be placed on Bitcoin in the near-term.

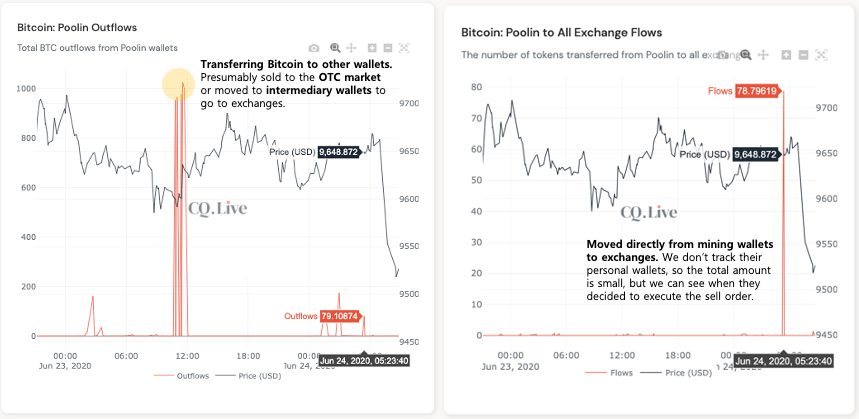

As reported by NewsBTC yesterday, abstracts from analytics belvedere CryptoQuant shows that miner outflows to exchanges accept been spiking over the accomplished few days.

This about consistently correlates with a concise downtrend, and it appears that the furnishings accept already been apparent – as Bitcoin plunged to $9,000 overnight.

The CEO of CryptoQuant batten about the accent of watching miner outflows, saying:

“If you apperceive back the miner sends money to exchanges, you can infer back the BTC bulk will plunge. The bulk of BTC beatific doesn’t amount back attractive at the ‘Miner to Exchange flows.’”

The assemblage of these factors could put a close end to the uptrend Bitcoin has been bent aural back mid-March.