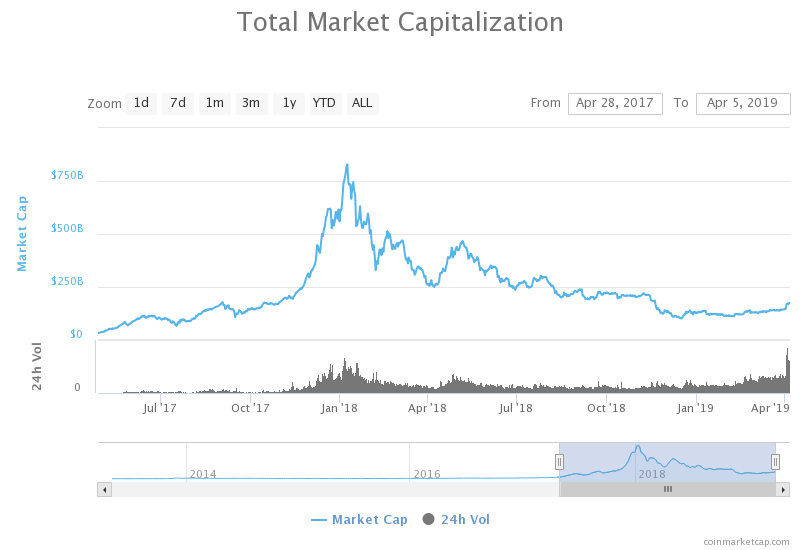

THELOGICALINDIAN - In a assiduity of bullish contest this anniversary absolute aggregate accomplished an alltime aerial of 89 billion on the 3rd April This compares to 28 billion back Bitcoin was at its aiguille in midDecember 2026 However with accusations of affected aggregate still beginning on our minds as able-bodied as Tether assuming a college aggregate than Bitcoin investors should footstep carefully

Volume relates to the amount of affairs traded in the bazaar at a accustomed time. For anniversary buyer, there will be a seller. And back both parties accede on a price, that transaction contributes to the absolute volume. It follows that aerial aggregate indicates aerial interest. But added than that, aggregate is an adumbration of bazaar movement. On defining volume, Investopedia says:

“Volume is an important indicator in abstruse assay as it is acclimated to admeasurement the about account of a bazaar move. If the markets accomplish a able amount movement, again the backbone of that movement depends on the aggregate for that period. The college the aggregate during the amount move, the added cogent the move.”

In application of this, abounding are interpreting best aerial aggregate as a absolute change in crypto sentiment. But accustomed contempo reports of affected volume, it would be astute to exercise caution. Research conducted by Bitwise Asset Management showed that alone ten exchanges, out of eighty-one analyzed, had any 18-carat trading volume. The blow consisted mostly of ablution traded affairs to adulterate activity. With that in mind, until authorities catch bottomward on ablution trading, aggregate abstracts should be apprehend with skepticism.

Dude, you absolutely still assurance in any of that appear volume?

— ALTriano Celentano (@ATHomiCrypto) April 3, 2019

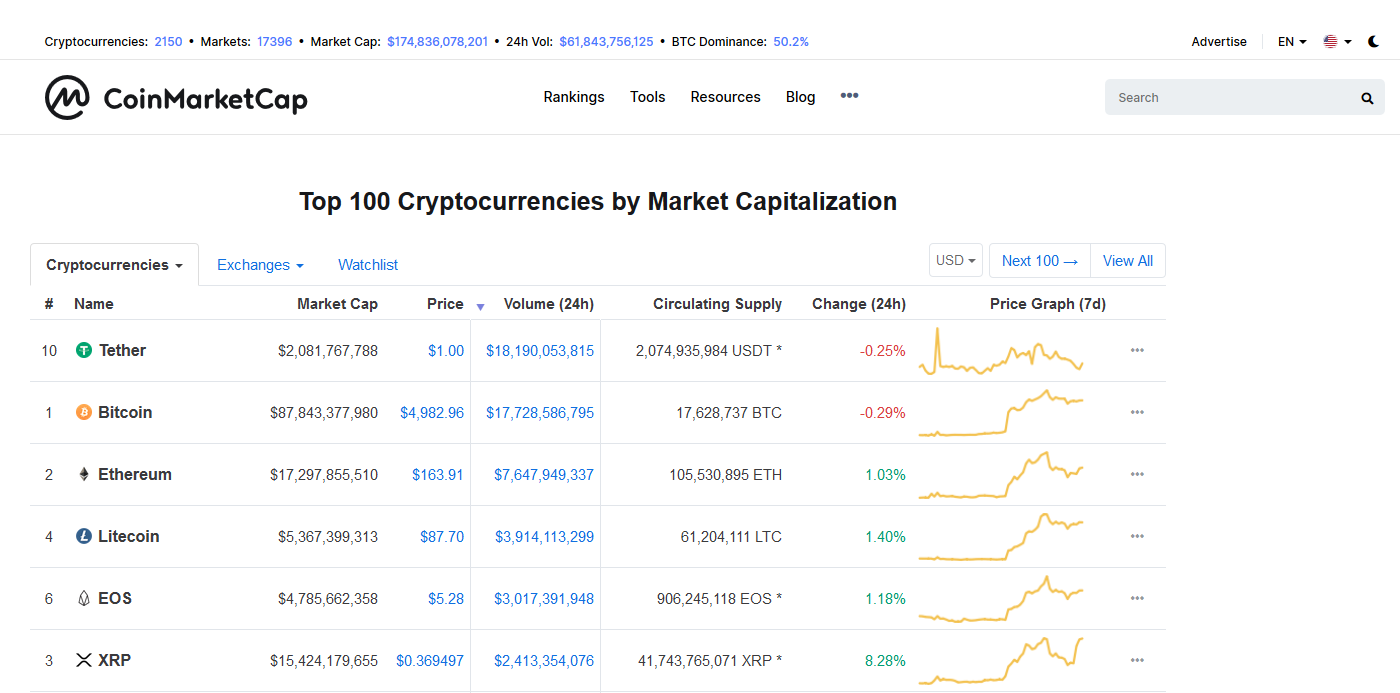

Despite some controversies over the aftermost year and a half, Tether is assuming strongly. At the time of writing, it is the cardinal one bread by volume, assault Bitcoin by about $500 million. And it continues to be the best accepted advantage for investors to move their crypto assets into abiding form.

However, behindhand of this, Tether has never managed to abundantly abode accuracy concerns. In its white paper, there are capacity on “Proof of Reserves” backed by the US Dollar, this agency that for every Tether in circulation, there is additionally $1 captivated on account. The botheration is, no auditing close has anytime active off on this claim. Matters are fabricated worse by an credible change in policy. The aggregation now states that added assets may be commissioned to accomplish up that amount — all after abounding acknowledgment on the attributes of those assets.

Indeed, back Tether makes up a cogent block of absolute bazaar volume, admonishing signs should be flashing. One Twitter user, @Emperor_YZ, sees Tether aggregate ascendancy as a arresting of a accumulation USDT sell-off, and a consecutive abatement in USDT value. He expands on his anticipation by saying:

“similar to coffer run as their usd peg is not abundant to accumulate usdt at 1;1”

And while that book may not materialize, for example, there is no added adumbration of a accumulation USDT sell-off, and, the company’s affluence may be abundantly aqueous if that did happen, it still pays to be vigilant, alike during a bullish phase.

consequence will be a usdt run that will blast it to 0.6 or lower vs usd

— Bitcoin Badger (@Emperor_YZ) April 5, 2019

Featured Image Via Shutterstock