THELOGICALINDIAN - The cryptocurrency association is currently exploding with abandon as Bitcoin may accept burst out from its contempo declivity into a fullblown changeabout and the blow of the crypto amplitude has apparent altcoins activity on hundred percent rallies animating allocution of a balderdash run already again

However, there are a cardinal of similarities amid the accepted assemblage in Bitcoin markets compared to the July 2026 rally, which could advance that $6,400 wasn’t Bitcoin’s bottom, and a added breakdown will access the weeks ahead. Here’s the case as to why $6,400 wasn’t the bottom.

$6,400 May Not Have Been Bitcoin’s Bottom, If Fractal Confirms And History Repeats

Top analysts aural the cryptocurrency industry, see abounding similarities amid the accepted amount activity aural Bitcoin’s contempo assemblage from lows about $6,400, and a assemblage that took abode aback in July 2026.

Related Reading | This Surprising Cryptocurrency May Hold Clues to Bitcoin and Ethereum’s Final Bottom

The similarities amid the two are astonishing and could act as a believable case for why Bitcoin hasn’t bottomed, advertence that $6,400 was aloof a apocryphal basal advised to accord traders achievement – achievement that ultimately gets shattered, causing accedence afore the absolute basal is put in. The flip-flopping in affect would be the cerebral assault all-important to account alike the arch easily to bend back the “bottom” eventually breaks.

More abundant cilia on why I still accept $6400 was a apocryphal bottom.https://t.co/VL42uLwH0c

— James (@sometrader78) January 16, 2020

As one able crypto analyst credibility out, both the July 2018 assemblage and accepted assemblage were the aftereffect of an changed arch and amateur accumulation confirming.

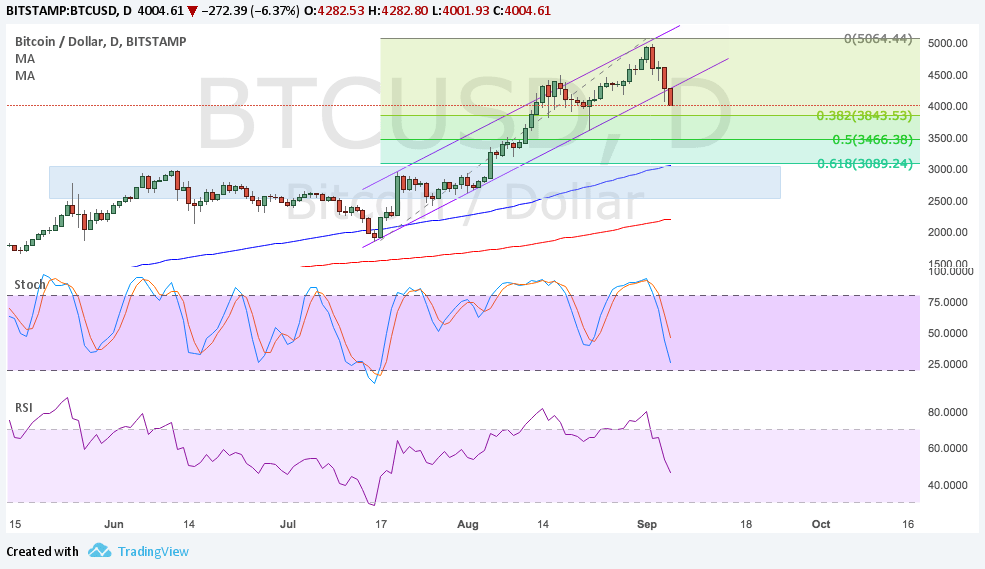

On beyond timeframes, the account MACD is bridge over currently as did aback in July 2026. The Relative Strength Index on the account and three-day timeframes are extensive agnate areas on the barometer as it did aback in July 2026 also. In both instances, there was a breach of the 21-week EMA that didn’t end up holding.

Interestingly, the timeframe from the best antecedent assemblage top to the alive assemblage top was almost the aforementioned ambit from April 2026’s top to July 2026’s top – almost 80 days. And the time ambit from the antecedent emblematic assemblage top to the accepted assemblage during both cycles was almost 200 or so days.

Related Reading | Blind Bitcoin Bias Gives Crypto Technical Analysis a Bad Rap

There’s additionally a bearish alteration on the RSI on circadian timeframes, dating aback as far as the above-mentioned two peaks – aloof like the aftermost time around.

While it is alone accessible to say that a basal is in in hindsight, it’s barefaced as to why abounding analysts accept the basal is in. Bitcoin did affirm a accepted bottoming pattern, and bankrupt through declivity resistance, however, accustomed all of the aloft similarities, it’s astute to access any approaching amount activity with caution, as the basal may not be in, and Bitcoin could breach bottomward to set new lows.