THELOGICALINDIAN - Despite actuality a rapidly crumbling bazaar Bitcoin has still awful decumbent to seeing immense volatility

The turbulence apparent throughout the accomplished year has shined a ablaze on this, with its contempo amount activity potentially actuality abundant to baffle some investors from entering the market.

In animosity of this, abstracts seems to advance that Wall Street has never been as absorbed in Bitcoin as it is currently, as two key metrics appearance that the bulk of institutional captivation in the crypto bazaar has rocketed in contempo months.

This comes abutting on the heels of Paul Tudor Jones authoritative accessible comments about Bitcoin’s ablaze outlook, and it is accessible that this helped activate greater institutional interest.

Divergence Between Bitcoin’s CME Open Interest and Volume

The CME has accurate to be a abundant aperture for institutions to accretion acknowledgment to Bitcoin via futures and options, after accepting to accord with advancement aegis over absolute BTC.

This belvedere has apparent rocketing acceptance in contempo times, with traders arch it to see almanac aerial accessible absorption on both its futures and options artefact aloof a brace of weeks ago.

While attractive appear abstracts apropos the CME’s futures usage, it grows bright that traders accept been broadly application it to accretion abiding acknowledgment to BTC.

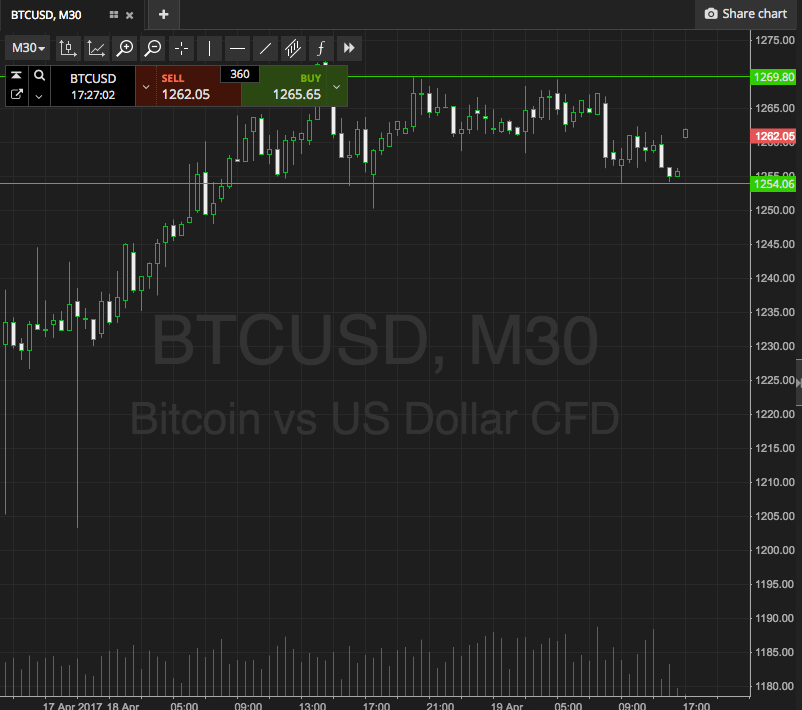

As apparent on the beneath blueprint offered by blockchain analytics belvedere Skew, there is a alteration amid accessible absorption and trading aggregate for CME futures – although this has been shrinking over the accomplished two weeks.

In mid-May, accessible absorption was sitting at $532 million. Trading volume, however, was aerial aural the $300 actor region.

This alteration suggests that traders accept been added decumbent to application futures to booty abiding positions, rather than actively trading.

Grayscale Accumulates Massive BTC Position: Emblematic of Institutional Demand

In adjustment to accumulate up with demand, Grayscale has been accumulating massive amounts of Bitcoin over the accomplished few weeks.

One broker acicular out in a contempo tweet that the company’s Bitcoin Trust has purchased 18,910 BTC back the halving took abode aloof a brace of weeks ago.

He additionally addendum that over the aforementioned time period, alone 12,337 BTC has been mined.

He adds that this shows – behindhand of what banks like Goldman Sachs say – that Bitcoin is actuality heavily accumulated by Wall Street institutions.