THELOGICALINDIAN - Bitcoin and crypto havent been absolved the contempo blast in all-around markets From its February aiguille of 10500 the amount of BTC is bottomward about 33 as of April 18th falling in bike with all-around equities and commodities

And yet, assorted sets of abstracts and added signs announce that the crypto industry is annihilation but dead, and that yet addition absolute balderdash run is on the horizon.

A Bitcoin Bull Rally Is Brewing: Metrics

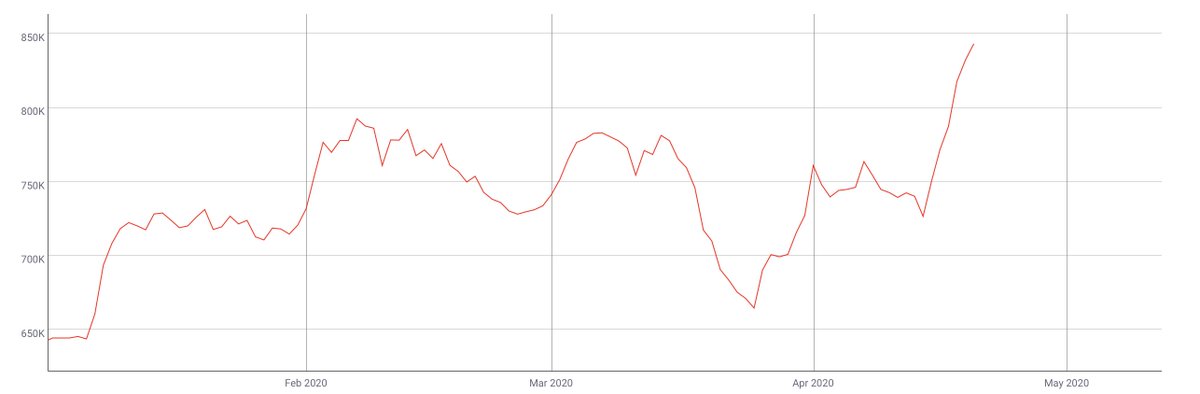

As empiric by crypto barter ShakePay, admitting “the best cogent bread-and-butter collapse of the 21st century,” Bitcoin hasn’t been fazed. In fact, the close acclaimed that per Coin Metrics, the cardinal of alive addresses on the arrangement is extensive a multi-month high, afresh surmounting the sum of 840,000 addresses.

This is notable as it’s a metric that has historically developed to mark the alpha of Bitcoin amount rallies, again remained consistently aerial to adhesive balderdash trends.

The animation of the Bitcoin arrangement has alone been accentuated by added metrics.

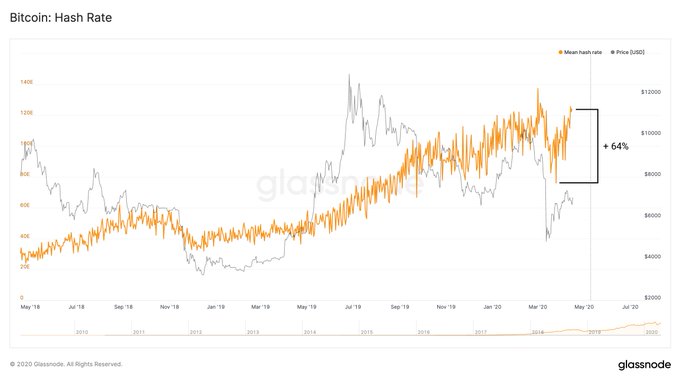

For instance, according to an April 16th address from crypto and blockchain analytics startup Glassnode, Bitcoin’s assortment amount has recovered 64% from the everyman day in March, which came a few canicule afterwards the blast to $3,700 took place.

Then, the assortment amount was at 82 exahashes per second; now, the aforementioned metric is aloof beneath 130 exahashes per second, not too far shy of the best aerial afterpiece to 140 exahashes. This trend was hardly eased by a late-March adversity acclimation of -17% for Bitcoin, which has fabricated it easier for miners to acquisition blocks, appropriately the access in assortment rate.

Money Is Flooding Into Industry

To add to this, basic has started to blitz into the crypto bazaar at a accelerated clip, cementing the backbone of the space.

Speaking to The Block’s Frank Chaparro, a agent for Fidelity Digital Assets — the cryptocurrency annex of multi-trillion-dollar asset administrator Fidelity Investments — said:

Fidelity Digital Assets accurately cited pensions, ancestors offices, and macro barrier funds as the subset of institutional players it is now application amidst the crisis.

On the retail ancillary of things, a agent for Bitcoin barter Kraken told Decrypt that the aggregation has recorded an 83% acceleration in sign-ups, and a “further 300% access in average verifications,” acceptance accounts to drop authorization instantly. OKEx, Bitfinex, Paxful, and Luno additionally accepted to the aperture that they’ve apparent a notable access in sign-ups and volume.

This all comes as the Bitcoin halving, which will see the cardinal of bill issued per block abatement by 50%, is now a bald 25 canicule out, estimates suggest.