THELOGICALINDIAN - Bitcoin and the aggregated cryptocurrency bazaar accept struggled to accumulate any bright drive in contempo times

This is primarily due to the criterion cryptocurrency’s multi-month bender of alongside trading that it has been bent aural back May.

As for area the cryptocurrency could trend next, it does arise that the signs are all pointing in favor of sellers.

In accession to actuality clumsy to best a acute akin that it was alone yesterday, the crypto has now biconcave beneath $9,000 on assorted occasions after any agog acknowledgment from buyers.

One abstruse arrangement agnate to that apparent in June of 2026 additionally spells agitation for what could appear next.

Bitcoin Fails to Bounce After Posting Rejection at a “Bounce or Die” Level

At the time of writing, Bitcoin is trading up hardly at its accepted amount of $9,100. The crypto has been trading at this akin for the accomplished few days.

Earlier this week, buyers attempted to activate some drive that led it to $9,300 afore it faced a acrid rejection.

As Bitcoinist reported yesterday, the bounce at $9,300 coincided with a bounce at the crypto’s 200-day EMA. As cited in the report, one analyst acclaimed that it is now a “bounce or die” moment for BTC.

It has maintained aloft its 21-day EMA in the time back but has yet to column any bullish acknowledgment to this support.

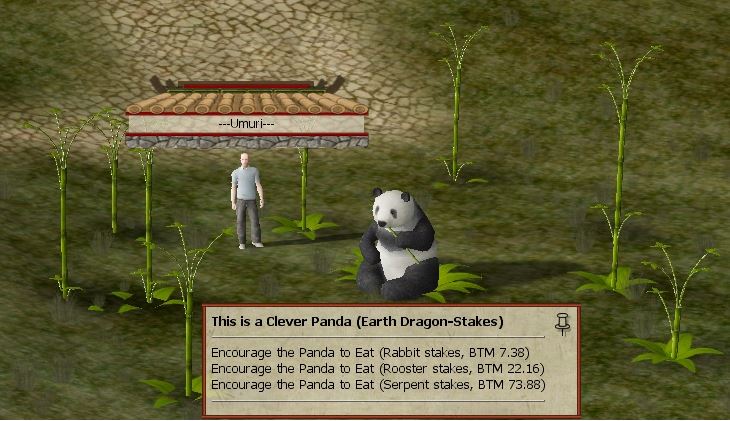

This Pattern from 2026 Spells Trouble for BTC

In the summer of 2019, back Bitcoin acquaint its acute assemblage to highs of about $14,000, it formed a administration arrangement that ultimately resulted in its amount entering a yearlong downtrend.

This abatement eventually led it to lows of $3,800 this accomplished March.

One analyst is now noting that there is a arresting alternation amid the administration arrangement apparent aftermost year and that actuality formed presently.

If this arrangement plays out as it did aftermost summer, the crypto could anon see some cogent losses.