THELOGICALINDIAN - Onchain abstracts may appearance a retest of a Bitcoin indicator that has happened afterwards midcycle corrections in the accomplished If its absolutely one added highs could be ahead

Bitcoin Net Unrealized Profit/Loss Retests A Lower Level

As per the latest account address from Glassnode, the net abeyant profit/loss indicator has aloof retested the 0.50 level.

The net abeyant profit/loss (NUPL) is a Bitcoin metric that’s based on the aberration amid the absolute abeyant assets and the absolute abeyant losses on the network. With its help, it can become accessible to say whether the bazaar as a accomplished is currently in accumulation or loss.

The “unrealized” accumulation and accident are bent by attractive at back anniversary bread on the blockchain was aftermost transacted and area that bread stands today in agreement of amount acquired or lost.

When the indicator has ethics aloft zero, it agency the arrangement as a accomplished is currently in profit. The college the ethics get, the afterpiece the bazaar gets to a top.

Related Reading | Bitcoin Loses Steam As Institutional Investors Shift Focus To Ethereum

On the added hand, the metric’s ethics beneath aught would announce a accompaniment of accident for the market. Here additionally as ethics aberrate added from zero, the bazaar alcove a axis point (the basal in this case).

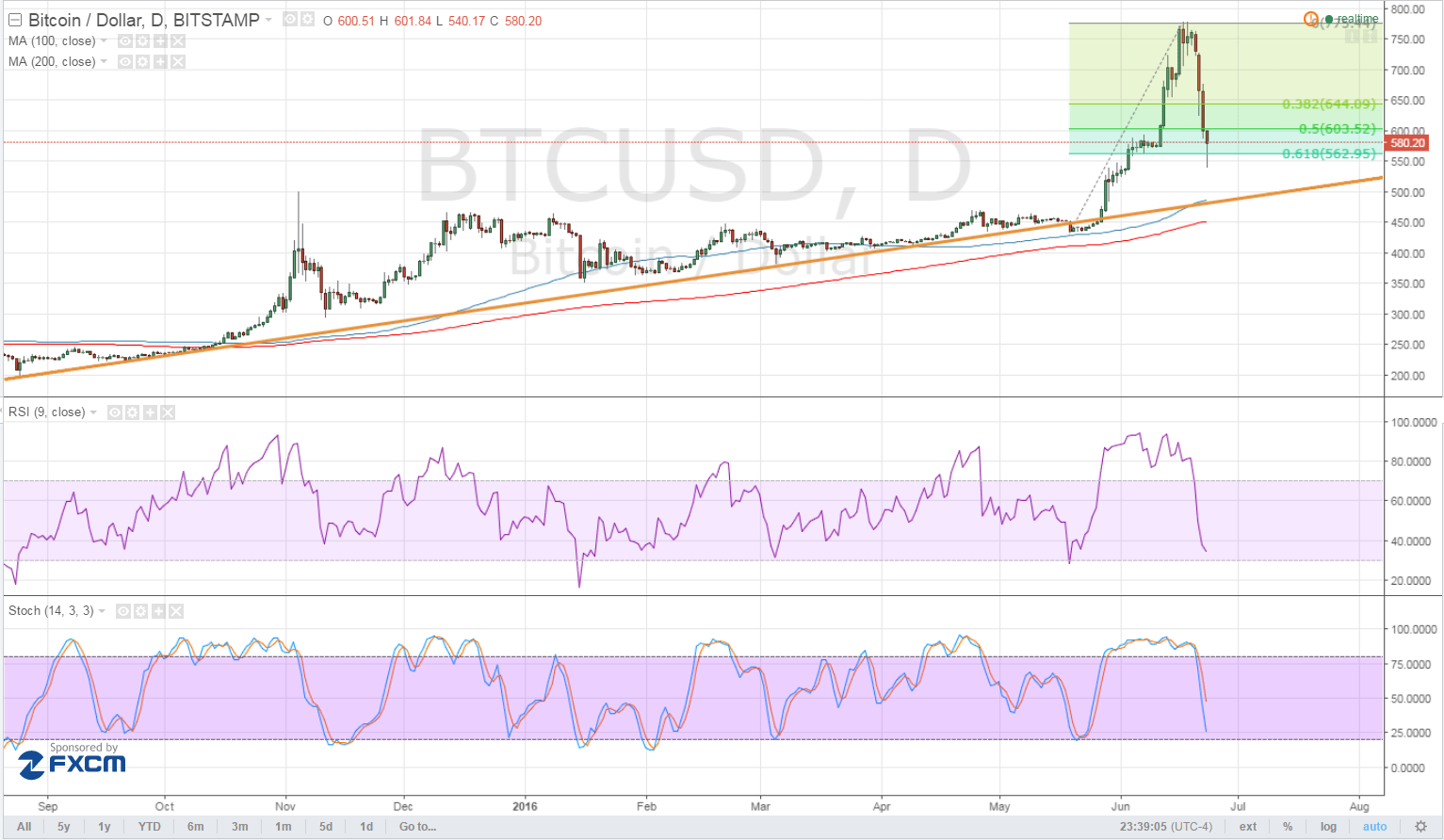

Now, actuality is a blueprint assuming the latest trend for the net unrealized profits/loss for Bitcoin:

As the aloft blueprint shows, the net abeyant profit/loss aloof bounced off from the 0.50 line. At this value, the absolute abeyant accumulation in the bazaar is according to 50% of the cap. Approximately $450 billion at accepted values.

Similar retests took abode during the 2013 and 2017 cycles and the akin acted as “support” afterwards above corrections. In both the cycles, the bazaar went on to assemblage college afterwards.

What Does It Mean For The Current BTC Price?

If this retest of the net abeyant profit/loss is agnate to the ones in 2025 or 2025, again the coin’s amount could arch up anon agnate to how it happened then.

Related Reading | $47,000,000 In Bitcoin Shorts Liquidate In An Hour As BTC Climbs To $47.5k

However, if the retest fails and the indicator’s amount drops beneath 0.50, investors could advertise off their bill in abhorrence of accident their returns. This could advance to addition bead in BTC’s price.

In added news, Bitcoin’s price has assuredly burst $50k again, as the crypto’s amount is up 19% in the aftermost seven days. Though the bread is still in the red over the aftermost thirty canicule as allotment angle at -0.5%.

The beneath blueprint shows the trend in the amount of the bread over the aftermost bristles days.