THELOGICALINDIAN - Despite its advance and acceptance over contempo years Bitcoin is still far from accepted and looked bottomward on by abundant of Main Street and Wall Street

In a May alarm advantaged “Implications of Current Policies for Inflation, Gold, and Bitcoin,” two admiral at Goldman Sachs discussed BTC. According to leaked slides of the applicant call, the two were not optimistic.

They purportedly said that Bitcoin does not accomplish banknote flow, does not “provide constant about-face allowances accustomed their ambiguous correlations,” and does not barrier adjoin inflation.

This alarm is the latest archetype of the “FUD” — the fear, uncertainty, and agnosticism — this industry faces. Yet a top analyst afresh bankrupt bottomward the FUD in an all-encompassing commodity and corresponding cheep thread.

Rebutting The FUD

Cryptoasset analyst at ARK Invest Yassine Elmandjra appear an commodity entitled “Debunking Common Bitcoin Myths for the Institutional Investment Community.” The goal: to avert “lazy criticism” of the arch cryptocurrency generally leveraged by ample institutions and investors.

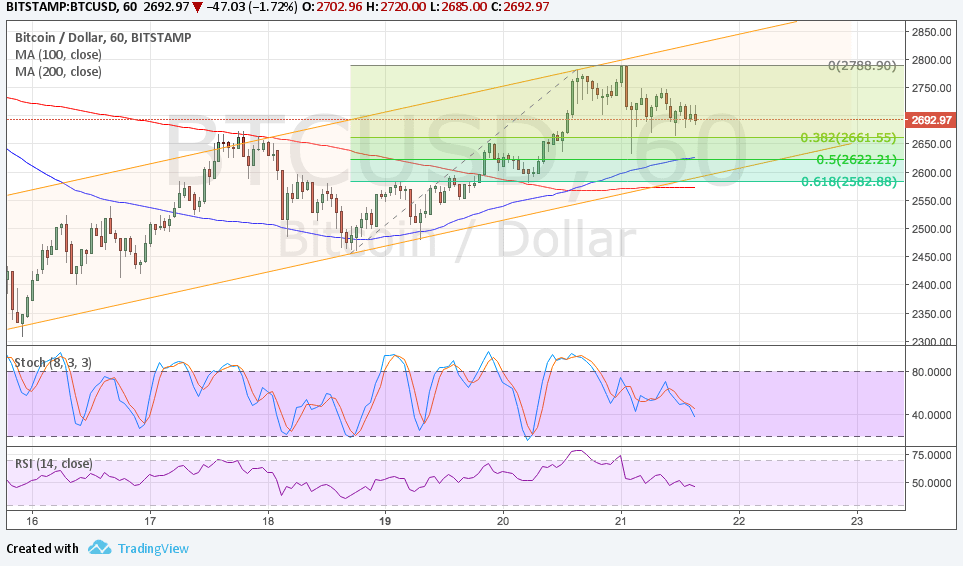

In the article, the analyst acerb rebutted at atomic bristles narratives that abounding like to use to “FUD” Bitcoin. Elmandjra did so application abstracts and charts.

The narratives the ARK Invest analyst mentioned include:

Wall Street Is Slowly Acknowledging BTC

Data shows that efforts like Elmandjra’s are allowance Bitcoin and crypto adoption.

Nothing shows this as able-bodied as Fidelity Investments’ contempo analysis on the institutional acceptance of cryptocurrency.

As appear by Bitcoinist previously, the $2 abundance asset administrator begin that almost 25% of big-name institutions already have long exposure to Bitcoin. 11% of the respondents accept acknowledgment to Ethereum.

More importantly, the analysis additionally appear that abounding institutions are intending to balmy up to crypto. Tom Jessop, the arch of Fidelity’s crypto division, said on the after-effects of the survey:

Also assuming the trend of Wall Street abating up to Bitcoin is Paul Tudor Jones. Paul Tudor Jones is a billionaire barrier armamentarium administrator abundantly admired as one of the world’s best macro investors.

The broker said in a May address that he thinks BTC is the “fastest horse in the race” in a apple area authorization money is debased: