THELOGICALINDIAN - Bull and bears are consistently aggressive it out on cryptocurrency exchanges and trading platforms acquisitive to advance Bitcoin amount college or lower and accumulation badly from whatever trades they accomplish or positions they take

But their strategies can be calmly atramentous by their own bullish or bearish bias. Using aloof one trend band alone beyond two altered Bitcoin amount archive on the account timeframe, it can authenticate aloof how one’s own claimed bent could access how they adapt amount activity and any decisions they accomplish based on their analysis.

How Personal Bias Can Influence Bitcoin Price Chart Analysis and Interpretation

Ask any banker account their salt, and they’ll acquaint you that there are alone a scattering of austere rules to chase back trading in adjustment to become successful. These rules accommodate able accident administration strategies, a complete abolishment of emotion, never advance added than you can calmly allow to lose, and to abolish any claimed bent from the equation.

Related Reading | Bitcoin Weekly Candle Wicks Are Telling of Explosive Impulse Upward

Personal bent is amid the affliction mistakes traders accomplish back assuming abstruse analysis. If you are attractive for bullish signals, they are acceptable activity to arise in abundance. Searching for bearish signals will net agnate after-effects – abnormally back it comes to cartoon trend curve or blueprint patterns.

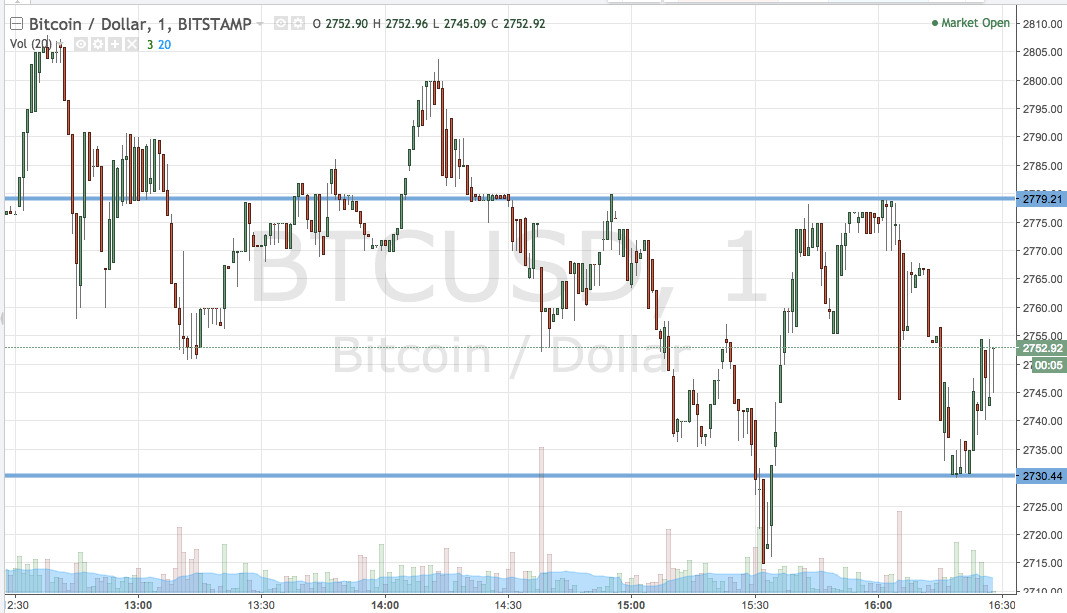

What may attending bullish to one Bitcoin bull, could be a above advertise arresting for a bearish trader. Using the two beneath charts, it is accessible to see how aloof one fatigued trend band can abstracted a above bearish or bullish bias.

In the aloft chart, aftermost month’s adverse advertise candle captivated at abutment from the 2026 buck market, which ultimately bankrupt bottomward afterwards again attempts.

Now, in the bearish bent version, the aforementioned band is confused advancement by aloof over $1,000, and now the band is assuming abutment angry resistance. But which absolutely is it?

Theoretically, either book is absolutely plausible, which is why abstruse analysts charge abolish any claimed bent from any charting, strategizing, or planning they do.

Related Reading | Bitcoin Price Could Collapse to $2,000 Based On Golden Ratio

It is additionally why traders additionally await on abstruse assay indicators, to affirm signals and advice to abstain bent from clouding judgment. Take the Bollinger Bands for example. on the aforementioned account amount chart, with the trendlines removed, the Bollinger Bands could accommodate a bigger clue as to what may appear with Bitcoin next.

In the blueprint depicted with the Bollinger Bands, the March Bitcoin account advertise candle bankrupt beneath the mid-BB line, and is now aggravating to advance aback aloft it and accost it as support.

The indicator bigger supports the bearish bias. But alike the indicator itself cannot affirm if the drive is in favor of the bulls, and if the first-ever cryptocurrency explodes aback aloft the mid-line abundant like it did in aboriginal 2026 or if it avalanche to the everyman allotment of the Bollinger Bands, currently residing about $2,000.