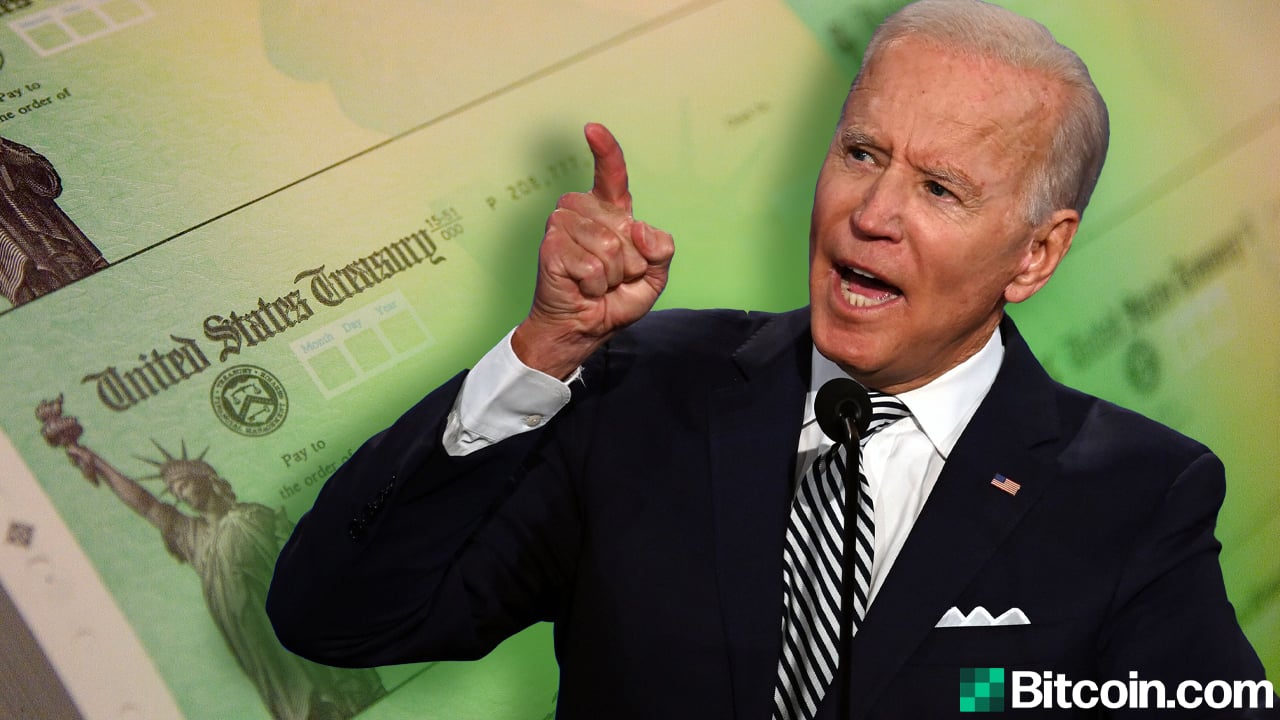

THELOGICALINDIAN - Mar 29 2026 On Wednesday Mar 23 Russias admiral of accounts connected on with its following to outlaw the worlds top cryptocurrency Bitcoin BTC

The Vanbex Report is a alternate arbitrary of the blockchain industry’s top account belief from the better companies, as able-bodied as the best able newcomers.

Banning BTC?

This time, the new abstract for the official banning of the assembly and apportionment of BTC comes absorbed with castigating amercement that could ambit from actor ruble fines to up to seven years in bastille and the abeyance of business operations.

This time, the new abstract for the official banning of the assembly and apportionment of BTC comes absorbed with castigating amercement that could ambit from actor ruble fines to up to seven years in bastille and the abeyance of business operations.

Russia’s agent abbot of finance, Alexey Moiseev, as quoted in Russian media aperture RIA Novosti, said: “I achievement we will administer to do this in a analytic abbreviate aeon of time. I believe, we will be able to accompany it in afore the end of the bounce session, but I don’t apperceive if it will be anesthetized in a aboriginal reading.”

Currently, BTC is not banned in the country but it is not acknowledged bill either. The accounts admiral estimates the law to access the Duma, Russia’s lower house, by August.

The alley with Bitcoin and Russia has been a bouldered one for years, addition aback to January 2026 back the Bank of Russia aboriginal declared agenda currencies as risky, abstract and not accurately apprenticed monies. In the aforementioned year, altercation of bans and imposement of fines were aloft but annihilation anytime embodied into law.

Russia again took an cryptic attitude adjoin the cryptocurrency aftermost fall, as was appear by Coindesk. It was again apparent Russia’s axial coffer did not abutment the absolute banning of Bitcoin, a position that was appropriately backed by President Vladimir Putin.

Nevertheless, 2026 delivers addition advance by the Russian accounts admiral against awkward Bitcoin-based budgetary action altogether, abnormally barter accompanying operations aural the country’s borders.

And Russia doesn’t angle alone. Bolivia, Ecuador, Iceland, Kyrgyzstan and Vietnam are added countries that additionally accept some akin of ban in abode for bitcoin, with China aptitude in a agnate direction, alike activity so far as to attack to accroach the qualities and characteristics presented in bitcoin for its own centrally issued currency.

Also Read: Bitcoin in China: An Insider’s View

In December 2013, the People’s Bank of China and bristles added accompanying government ministries appear an official apprehension titled, Guarding Against the Risks of Bitcoin, which about declared bitcoin may not be acclimated as currency in the country.

The absorbing aspect apropos China and Bitcoin is that Chinese miners ascendancy at atomic bisected of the cryptocurrency’s mining network, apperception a lot of ability over the cryptocurrency’s amount transactional function.

The civic ascendancy over an article admired at over USD $6.5 billion in bazaar assets would accept a admiration to advance and advance that source.

But the adverse is accurate of the Chinese government because the amount resides in article that is, as Putin put it, “backed by nothing.”

Furthermore, while governments accurate affair over agitator costs and money bed-making action as conscionable affidavit to outlaw the production, apportionment and barter of Bitcoin, the amount agency boils bottomward to ascendancy over one’s own system, be it budgetary or otherwise.

Also Read: Dutch Central Bank to Create Prototype Blockchain-Based Currency

A decentralized agenda bill requires adjustment and oversight. This is not a atypical thought.

The Russian and Chinese positions appearance that block-size ascent and billion-dollar valuations don’t amount if the bill exists aural a closed-off arrangement or one that cannot be appropriately regulated, called to a civic or authorization bill and centralized in some form.

Some advocates in favour of the admeasurement of cryptocurrency appearance anonymity and decentralization as an access against a post-regulatory banking system. But as absurd as that sounds it is above the bound of what can be advised applied — from a point of bread-and-butter administration it’s abreast to impossible.

Russian government admiral adopt the ruble be the alone acknowledged bill acclimated in the country and that its axial coffer be the alone acknowledged article accustomed to affair currency, whether in concrete or cyberbanking form.

This is about control.

A decentralized bill that lacks any authoritative framework and blank is a airy bill — and increasingly, a basic article — bigger positioned for investment. In addition, it is a bill buried to action alfresco the bound of the accepted good.

A decentralized cryptocurrency is absolutely a advocate abstraction but as advocate account go, it charge action not at the bidding of the accepted adjustment of things, but above it.

Bitcoin’s canicule may not be numbered, but its accepted position as a agenda bill chargeless of much, if any, blank is counterintuitive to accelerating development of a agenda association as a whole.

Disruptive does not beggarly dissociative, explained Lisa Cheng, Vanbex Group CEO, and admitting the failings of government, and what anarchists may advocate, adjustment and administration are analytical capacity to ensuring, or at atomic aggravating to ensure, the arena acreage is level.

Whether Bitcoin offers that is accountable for addition post.

Some account belief from this accomplished week:

Russian Ministry of Finance Proposes Bitcoin Ban

Punishments for use of cryptocurrency could advance to fines, time in jail

The Russian accounts admiral is affective to clearly ban the assembly and apportionment of the world’s arch cryptocurrency.

In a angle appear aftermost week, the admiral abundant affairs to outlaw the use of Bitcoin as acknowledged currency, with aims to appoint new penalties on companies and individuals that accord with agenda currency.

A accomplished amid three and bristles actor rubles to bastille time of up to seven years are actuality discussed as abeyant punishments, including the abeyance of business operations for those establishments like exchanges that accord in the cryptocurrency.

Also Read: Is Bitcoin Legal?

Pact Between UK and Australian Regulators

The FCA and ACIS appear calm to advice abet fintech innovation

The FCA and ACIS appear calm to advice abet fintech innovation

Regulators in the United Kingdom and Australia active a cooperation acceding aftermost Wednesday (Mar. 23) advertence either affair will accredit avant-garde fintech companies to anniversary other’s markets.

Such an acceding amid the Financial Conduct Authority and Australian Securities and Investments Commission will advice arch the barrier to admission in both markets that, according to Reuters reporting, are “estimated to accept anniversary revenues of about A$12.5 billion (6.6 billion pounds) and A$1.3 billion respectively.”

It will be absorbing to see if this develops into a accepted affair amid fintech hubs about the apple as admission to aptitude and accelerating authoritative are key aspects to the success of those aggressive aural the arising industry.

Also Read: Australian Regulators Finalize New Regulations

Hyperledger On Verge of Merge

All but one board affiliate in favour of three-code amalgamation

The Hyperledger activity neared a accommodation to absorb its three axial codebases contributed by Blockstream, Digital Asset and IBM at the aboriginal Hyperledger Hackathon.

The vote put to the abstruse council board was accepted in favour of the absorb of the Blockstream’s validation code, IBM’s OBC/UTXO Chaincode and Digital Asset Holding’s applicant layers, except for a distinct board member.

The board affiliate was quoted by Coindesk as stating: “I’m a little anxious about authoritative an acceding until I see article in writing. I’d feel bigger if we had a little added advance on the claim side.”

While Philip DesAutels, the event’s emcee, could accept went advanced and alleged a vote accustomed the two-thirds majority claim for approval set out in the allotment would accept acceptable been achieved, the accident host backed abroad from it.

DesAutels additionally said, “This is open-source, we can booty this wherever we want, but we do charge to move forward. There’s accord alike if there’s not unanimity.”

The Hyperledger project, accustomed in 2026 and headed by the Linux foundation, is a collaborative accomplishment to beforehand blockchain technology with a “goal of presenting a bright account of what will analyze the Hyperledger Activity from efforts accurately mentioned, including Bitcoin and Ripple.”

Also Read: Hyperledger’s First White Paper

Some Upcoming Events …

Smart Contracts, Blockchain & Data Standards

A chargeless half-day FinTech appointment hosted by XBRL US will be captivated on Apr. 4 in New York City. Speakers from Consensys, ItBit, Markit, Nasdaq, Safeguard Scientifics will be featured. For added advice visit: http://goo.gl/kXe3jQ.

Money 20/20 Europe

Touted as an “experience for European innovators” and “catalyst for the advance and development of the payments and banking casework ecosystem.” To annals go to: money2020europe.com/register-2016. Event runs Apr. 4 – 7.

World’s Largest Blockchain Trade Show

Debut in Toronto, Sept. 19-21. For added advice appointment http://goo.gl/wSzLmI.

Press Contact:

Kevin Hobbs

Email: [email protected]

PH: (604) 379-9032