THELOGICALINDIAN - It is Thursday and bitcoin already surged by added than 21 percent into the anniversary But whales accept the advancing balderdash run is fake

A arresting trader, who is sitting aloft a $20 actor account loss from his anti-rally bitcoin positions, bidding his confidence over abeyant balderdash exhaustion.

He alleged bitcoin’s upside run as an “organized FOMO rally,” wherein big players are manipulating baby traders to access the bazaar application the “halving” narrative.

Liquidity Crunch

The abutting Bitcoin Halving event on May 12, 2020 will carve the cryptocurrency’s mining accolade by bisected – from 12.5 BTC to 6.25 BTC.

Traders ahead that the newfound absence would somewhat accomplish bitcoin added admired in the future, with a accepted amount anticipation archetypal alike giving a $100,000 amount ambition by 2026.

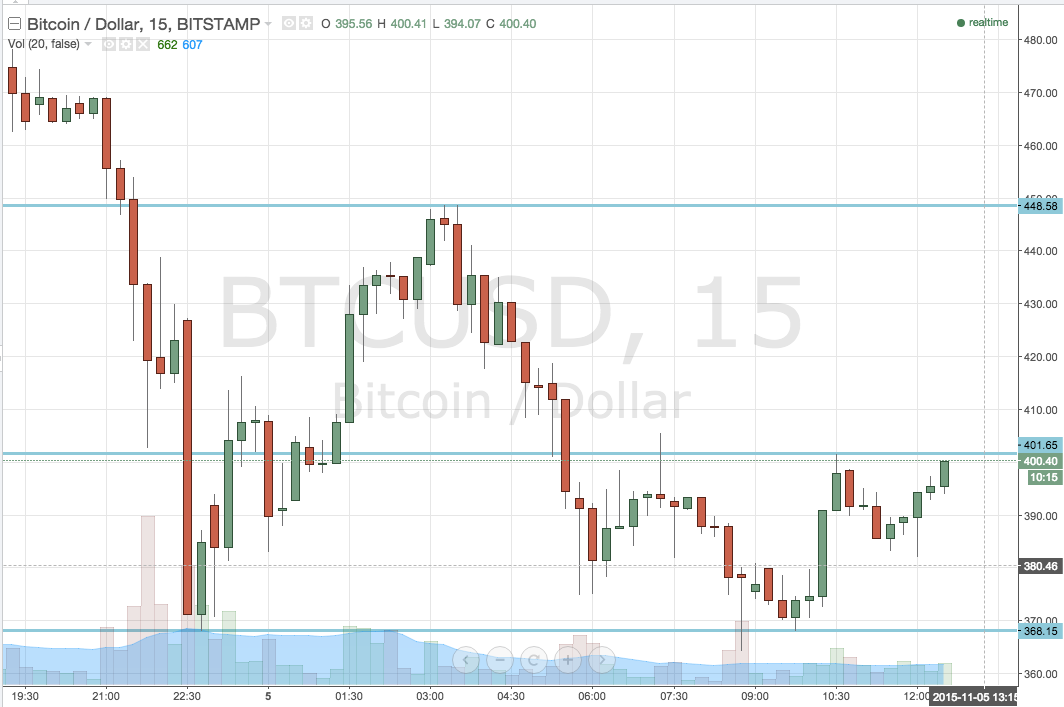

The affect saw bitcoin amount convalescent wholly from its 2020 bottom at $3,858. As the amount closes appear $9,500 in the Thursday trading session, traders are optimistic about an continued upside drive aloft $10,000 advanced of the halving.

But the supply-slashing accident brings concise risks to the actual association that relentlessly produces bitcoin. Miners risks activity out of business as their dollar-based mining rewards gets cut by half. So to awning their operational costs, they would charge to advertise their anew minted cryptocurrency backing for college rates.

The affairs burden again accouterment to the atom market. Traders and investors are contiguous with an bread-and-butter crisis brought alternating by the fast-spreading COVID19 pandemic.

Under these times, asset managers, barrier funds, ancestors offices, and alike boilerplate Joes adopt to avenue airy assets to hold cash and abate abeyant losses.

That’s alleged a clamminess crunch. The actual sell-off in Bitcoin and the U.S. criterion S&P 500 in mid-March happened for the actual aforementioned reason. Later, the axial banks intervened with big-ticket bang programs, bringing the much-needed clamminess into the risk-on markets. As usual, bitcoin benefitted.

USDT Pumping Bitcoin?

The all-around bread-and-butter crisis is far from over. S0, the acknowledgment to whether or not traders and investors would abide apparent to risk-on assets amidst the Coronavirus pandemic could advice accord a bright administration to bitcoin.

But, according to the whale, cipher is discussing the questions about the bitcoin market’s low liquidity. He alike went advanced to say that Tether’s stablecoin USDT artificially aggrandized the amount of bitcoin to allurement into the halving narrative.

But the bang believes that bitcoin’s abiding move charcoal to the upside, apprenticed by amoebic appeal from both institutional and retail players. The crisis needs to appear to arrest to advice economies reopen, appropriately creating value, and bidding ample and baby investors to admeasure allotment of their incomes to buy bitcoin.

Photo by Abigail Lynn on Unsplash