THELOGICALINDIAN - Still beating its dupe afterwards a barbarous weekend Bitcoin has been able to advance analytical levels of abutment At the time of autograph BTCs amount trades at 55318 with ancillary movement in the accomplished 24hours In the account and account blueprint BTC is bottomward 126 and 35 respectively

A address by QCP Capital highlights the Coinbase Effect on the crypto market. A aerial cardinal of investors took leverage position assured a assemblage afterwards Coinbase’s admission in Nasdaq. However, the exchange’s shares top and forth came a deleveraging weekend selloff, as the close stated.

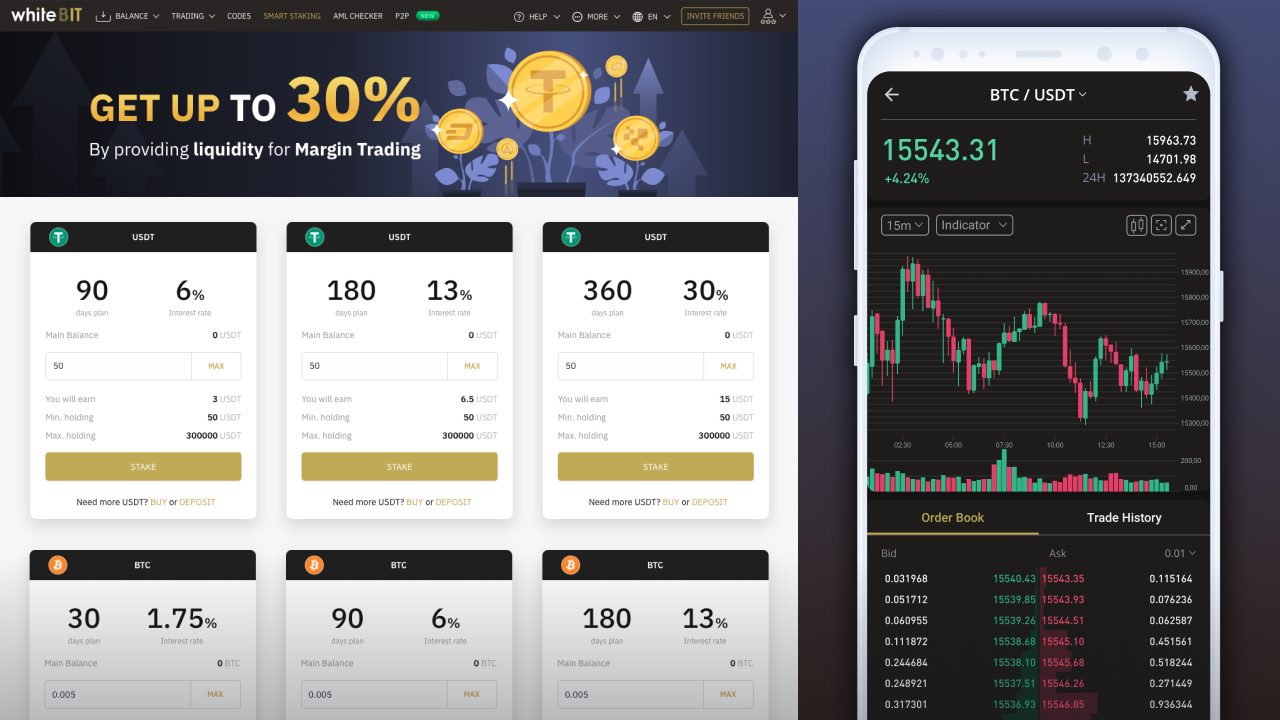

On Sunday, $10 billion were asleep beyond the capital trading platforms. This led to a “massive agitated backwardation”. On Deribit, futures traded at a 25% abatement and at a 40% abatement on Binance. As can be apparent in the angel below, this barter registered the better cardinal of liquidations.

QCP Capital set abutment for BTC’s amount at $50,000 by the end of April and $40,000 by the end of Q2. If it regains bullish momentum, the cryptocurrency could balance $60,000 by month-end and $65,000 in May. However, the aboriginal sees acceptable that the alteration will abide at atomic until abutting month. They added:

Analyst William Clemente is bullish on Bitcoin, admitting the contempo amount action. After the beam crash, Clemente believes BTC’s above indicators are resetting. Therefore, the cryptocurrency has “a lot of allowance to run”. Clemente added:

The metric UTXO Realized Price Distribution (URPD) sets abutment for Bitcoin at $47,243, $52,420, and above on-chain abutment at $55,009. In addition, the adapted Spent Output Profit Ratio (SOPR), metric use to analyze a market’s bounded top or bottom, indicates BTC has accomplished a area that has preceded a rally, as apparent in the blueprint below. Clemente added:

What Does It Take To Break Bitcoin Bearish Trend?

QCP Capital outlines 3 key factors that could agitate the accepted market’s dynamic. The approval of a Bitcoin Exchange Traded Fund (ETF) in the United States, a crackdown by authorities in this country, the changeabout of quantitative abatement (QE), a country’s convenance of affairs assets and securities, by the U.S. Federal Reserve.

On the aboriginal factor, aloof the account or delays about a Bitcoin ETF approval could accept a role in the crypto market, as it has been in the past. Regulations to the sector, according to QCP Capital, will appear “sooner than bodies expect”, but it is cryptic how Bitcoin will be affected. Finally, a change in the QE action could be implemented in Q3, 2021.

QE has been one of the capital drivers of Bitcoin’s rally, as declared by Sofia Blikstad, an analyst at Arcane Research. So, if the FED reverses it or slows it down, the crypto bazaar could be abnormally affected.